Give from Your IRAUniversity of Wisconsin Foundation 2023

What is the Give From Your IRAUniversity Of Wisconsin Foundation

The Give From Your IRA program allows individuals to make charitable contributions directly from their Individual Retirement Accounts (IRAs) to the University of Wisconsin Foundation. This initiative is particularly beneficial for those aged seventy and older, as it enables them to support the university while potentially reducing their taxable income. By donating directly from an IRA, individuals can avoid the income tax that would typically apply to withdrawals, making it a tax-efficient way to contribute to the foundation's mission.

How to use the Give From Your IRAUniversity Of Wisconsin Foundation

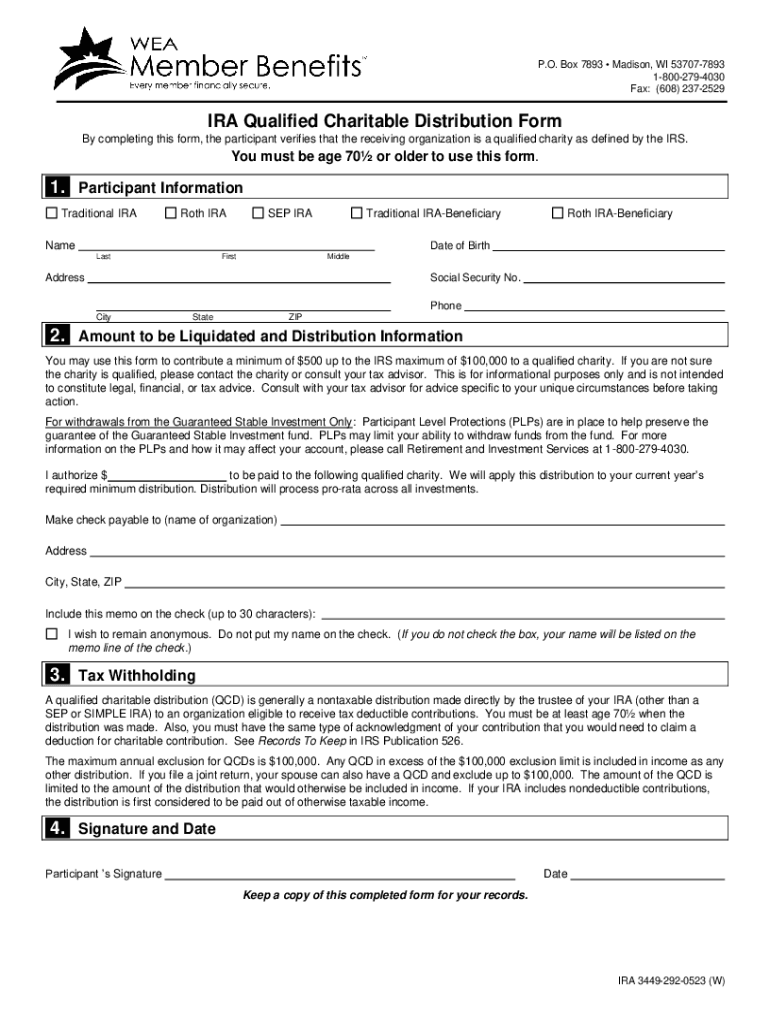

To utilize the Give From Your IRA program, individuals must first confirm their eligibility based on age and account type. Once confirmed, they can contact their IRA custodian to initiate the transfer process. It is essential to specify that the funds are to be sent directly to the University of Wisconsin Foundation. Donors should also ensure that the donation meets the required minimum distribution amount to qualify for tax benefits. Proper documentation should be requested to maintain accurate records for tax purposes.

Steps to complete the Give From Your IRAUniversity Of Wisconsin Foundation

Completing a donation from your IRA to the University of Wisconsin Foundation involves several key steps:

- Verify eligibility: Ensure you are at least seventy years old and that your IRA qualifies for direct charitable distributions.

- Contact your IRA custodian: Request the necessary forms to initiate a transfer.

- Specify the donation details: Clearly indicate the amount and the recipient, the University of Wisconsin Foundation.

- Submit the transfer request: Follow your custodian's procedures to complete the transaction.

- Keep records: Obtain confirmation of the transfer for your tax records.

IRS Guidelines

The IRS has specific guidelines regarding charitable distributions from IRAs. Contributions must be made directly from the IRA to a qualified charity, such as the University of Wisconsin Foundation, to avoid taxation. The maximum annual contribution limit is one hundred thousand dollars per individual. It is important to adhere to these guidelines to ensure that the donation is tax-deductible and complies with federal regulations. Donors should consult the IRS website or a tax professional for the most current information and to clarify any questions regarding eligibility and tax implications.

Required Documents

When participating in the Give From Your IRA program, certain documents are necessary to ensure a smooth donation process. Key documents include:

- Proof of age: Documentation confirming that the donor is at least seventy years old.

- Transfer request form: A completed form from the IRA custodian authorizing the transfer of funds.

- Confirmation of donation: A receipt or acknowledgment from the University of Wisconsin Foundation confirming the donation amount and date.

Maintaining these documents is essential for tax reporting and compliance purposes.

Eligibility Criteria

To be eligible for the Give From Your IRA program, individuals must meet specific criteria. The primary requirements include:

- Age: Donors must be at least seventy years old at the time of the donation.

- Account type: The donation must come from a traditional IRA or a Roth IRA that allows for qualified charitable distributions.

- Qualified charities: The recipient must be a qualified 501(c)(3) organization, such as the University of Wisconsin Foundation.

Meeting these criteria is crucial to ensure that the donation qualifies for tax benefits.

Quick guide on how to complete give from your irauniversity of wisconsin foundation

Complete Give From Your IRAUniversity Of Wisconsin Foundation effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Give From Your IRAUniversity Of Wisconsin Foundation on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Give From Your IRAUniversity Of Wisconsin Foundation without hassle

- Obtain Give From Your IRAUniversity Of Wisconsin Foundation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of your documents or redact sensitive information using tools provided by airSlate SignNow designed specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Give From Your IRAUniversity Of Wisconsin Foundation to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct give from your irauniversity of wisconsin foundation

Create this form in 5 minutes!

How to create an eSignature for the give from your irauniversity of wisconsin foundation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Give From Your IRAUniversity Of Wisconsin Foundation?

To Give From Your IRAUniversity Of Wisconsin Foundation, you need to initiate a transfer from your Individual Retirement Account (IRA) directly to the foundation. This process usually involves filling out a form provided by your IRA custodian and specifying the University of Wisconsin Foundation as the recipient. Make sure to consult with a financial advisor to understand any tax implications.

-

Are there any tax benefits associated with Giving From Your IRAUniversity Of Wisconsin Foundation?

Yes, Giving From Your IRAUniversity Of Wisconsin Foundation can offer signNow tax benefits. Contributions made directly from your IRA to the foundation are often excluded from your taxable income, making it a strategic way to support the university while reducing your tax burden. Always consider consulting a tax professional for personalized advice.

-

What are the minimum and maximum amounts to Give From Your IRAUniversity Of Wisconsin Foundation?

The minimum amount you can give from your IRA to the University of Wisconsin Foundation varies by custodian, but it's typically around $100. There is generally no maximum limit, but it's advisable to check with your IRA custodian for specific rules and limits that may apply.

-

Can I Give From My IRAUniversity Of Wisconsin Foundation if I am not a current student or alumni?

Absolutely! Anyone can Give From Your IRAUniversity Of Wisconsin Foundation, regardless of whether they are a current student or alumni. Your support helps further the mission of the university and positively impacts future generations of students.

-

Does the University of Wisconsin Foundation accept gifts from retirement plans other than IRAs?

Yes, the University of Wisconsin Foundation does accept gifts from various retirement plans, including 401(k)s and 403(b)s. It's important to check with your retirement plan administrator to understand the specific steps needed to facilitate your gift. Giving From Your IRAUniversity Of Wisconsin Foundation is just one option to support the university.

-

What information do I need to provide to Give From My IRAUniversity Of Wisconsin Foundation?

To Give From Your IRAUniversity Of Wisconsin Foundation, you'll typically need to provide details such as the foundation's legal name, tax identification number, and possibly a confirmation of the transfer request. Ensure you have your IRA account information ready, along with any forms your custodian may require.

-

How long does it take for my IRA contribution to signNow the University of Wisconsin Foundation?

The time it takes for your IRA contribution to signNow the University of Wisconsin Foundation can vary. Generally, it may take anywhere from a few days to several weeks, depending on processing times with your IRA custodian and the method used for the transfer. To ensure a smooth process, communicate with both your custodian and the foundation.

Get more for Give From Your IRAUniversity Of Wisconsin Foundation

- Ssm doctors note form

- Illinois mutual life insurance company forms

- Visual eyes optometric eye clinic elite eye care form

- Aqua park waiver wake island waterpark form

- St martin east elementary pre registration form

- Dog walking agreement template form

- Dog training agreement template form

- Dog training service agreement template form

Find out other Give From Your IRAUniversity Of Wisconsin Foundation

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe