by Completing This Form, the Participant Verifies that the Receiving Organization is a Qualified Charity as Defined by the IRS 2023

Understanding the Form

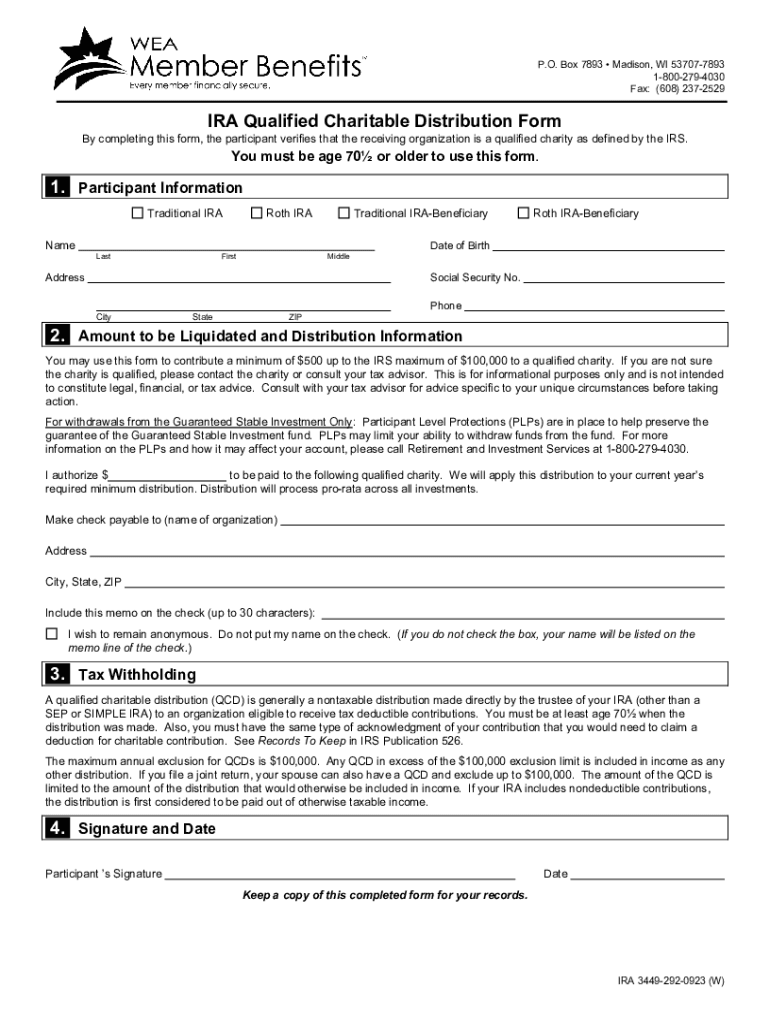

The form titled "By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS" serves as a verification tool for participants to confirm that the organization they are donating to meets the IRS criteria for qualified charities. This verification is vital for ensuring that donations are tax-deductible under U.S. tax law. The IRS defines qualified charities as organizations that are recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. This form is particularly relevant for individuals and businesses looking to make charitable contributions while maximizing their tax benefits.

Steps to Complete the Form

Completing the form involves several straightforward steps to ensure accuracy and compliance. Participants should follow these steps:

- Provide personal information, including name, address, and contact details.

- Clearly identify the receiving organization by including its name and IRS identification number.

- Confirm the organization’s status as a qualified charity by checking the IRS database or obtaining a copy of its IRS determination letter.

- Sign and date the form to validate the information provided.

It is essential to review all entries for accuracy before submission to avoid any potential issues with tax deductions.

Legal Use of the Form

This form is legally significant as it serves as a declaration by the participant regarding the status of the receiving organization. By signing this form, the participant acknowledges that they understand the implications of their contributions and that the organization is eligible to receive tax-deductible donations. This legal affirmation protects both the donor and the charity, ensuring compliance with federal tax regulations.

Key Elements of the Form

Several key elements must be included in the form to ensure its validity:

- Participant Information: Full name and contact information of the donor.

- Charity Details: Name and IRS identification number of the charity.

- Verification Statement: A clear statement confirming the charity's qualified status.

- Signature: The participant's signature and date to validate the form.

Each of these elements plays a crucial role in the form’s purpose and effectiveness.

IRS Guidelines

The IRS provides specific guidelines regarding qualified charities and the documentation required for tax deductions. According to IRS rules, only donations made to eligible organizations can be claimed as tax-deductible. Participants should familiarize themselves with IRS Publication 526, which outlines the types of organizations that qualify and the necessary documentation needed to substantiate charitable contributions. Understanding these guidelines helps ensure compliance and maximizes the benefits of charitable giving.

Form Submission Methods

Participants can submit the completed form through various methods, depending on the preferences of the receiving organization. Common submission methods include:

- Online Submission: Some organizations may allow digital submission through their websites.

- Mail: Participants can send the form via postal mail to the organization’s address.

- In-Person: Delivering the form directly to the organization may also be an option.

It is advisable to confirm the preferred submission method with the charity to ensure proper processing.

Quick guide on how to complete by completing this form the participant verifies that the receiving organization is a qualified charity as defined by the irs

Effortlessly Prepare By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS on Any Device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed documents that require signatures, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly without delays. Manage By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS with Ease

- Find By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive details using tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS and ensure excellent communication at every step of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct by completing this form the participant verifies that the receiving organization is a qualified charity as defined by the irs

Create this form in 5 minutes!

How to create an eSignature for the by completing this form the participant verifies that the receiving organization is a qualified charity as defined by the irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to verify an organization as a qualified charity under IRS guidelines?

By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS. This means the organization meets specific criteria set by the IRS, allowing them to receive tax-deductible contributions. Understanding this helps ensure donations are made responsibly.

-

How does airSlate SignNow simplify the eSigning process for charitable organizations?

airSlate SignNow simplifies the eSigning process by providing a user-friendly platform that allows organizations to easily send and receive signed documents. By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS, ensuring that all necessary legal requirements are met effectively.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet the needs of different users, including nonprofits. By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS, which may grant access to discounted rates for eligible organizations, making it cost-effective for charities.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow can seamlessly integrate with various software tools, including CRMs and cloud storage solutions. This integration enhances efficiency and allows for smoother workflows. By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS, ensuring compliance with necessary documentation processes.

-

What features does airSlate SignNow offer that benefit charitable organizations?

airSlate SignNow offers tailored features such as custom templates, bulk sending, and real-time tracking of document status. These features signNowly enhance document management for charities. By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS, facilitating further transparency and compliance.

-

How secure is the document handling process with airSlate SignNow?

The document handling process with airSlate SignNow is highly secure, incorporating advanced encryption and compliance with industry standards. It ensures that sensitive information remains protected. By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS, reinforcing trust in the electronic signature process.

-

What benefits do organizations gain by using airSlate SignNow?

Organizations benefit from increased efficiency, reduced paperwork, and enhanced accessibility to documents with airSlate SignNow. The ability to eSign documents remotely streamlines operations. By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS, helping secure the organization’s charitable status.

Get more for By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS

- Canada ontario restraining order form

- Kanisa sacco downloads form

- 23rbwm14feb20200026 p bwm14feb20200026 p form

- Form 5541e supplementary form

- 100 114 garry street form

- Sse whe work visa application inz 1153 form

- Bir com hkresourcesdocthe director the immigration department of the republic of form

- Aha transfer request form

Find out other By Completing This Form, The Participant Verifies That The Receiving Organization Is A Qualified Charity As Defined By The IRS

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors