Form 1040 Schedule EIC Sp

What is the Form 1040 Schedule EIC sp

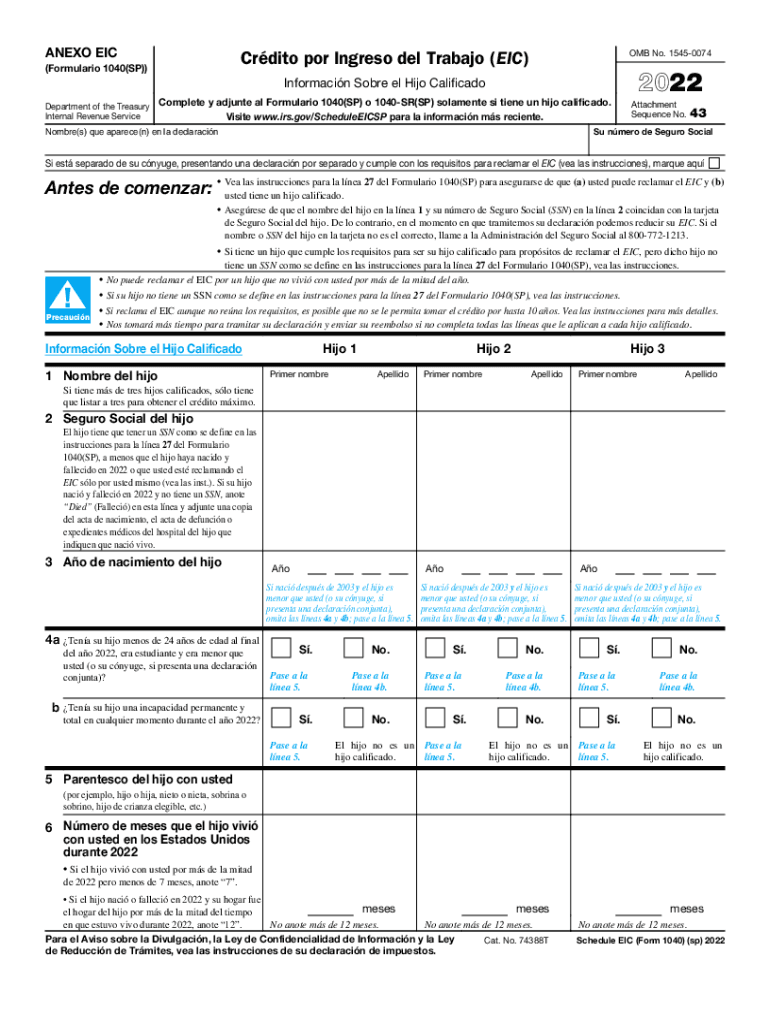

The Form 1040 Schedule EIC sp is a tax form used by eligible taxpayers in the United States to claim the Earned Income Tax Credit (EITC) for specific qualifying children. This form is particularly relevant for those who are filing their taxes and wish to take advantage of the credit, which is designed to reduce the tax burden on low to moderate-income working individuals and families. The Schedule EIC sp is specifically tailored for taxpayers who have a qualifying child and meet certain income thresholds.

How to use the Form 1040 Schedule EIC sp

To use the Form 1040 Schedule EIC sp, taxpayers must first determine their eligibility for the Earned Income Tax Credit. This involves assessing their income level, filing status, and the number of qualifying children they have. Once eligibility is confirmed, the taxpayer should complete the form by providing necessary details about their income, filing status, and information regarding their qualifying children. The completed Schedule EIC sp should then be attached to the Form 1040 when filing taxes.

Steps to complete the Form 1040 Schedule EIC sp

Completing the Form 1040 Schedule EIC sp involves several key steps:

- Gather all necessary documents, including W-2 forms and any other income statements.

- Determine your eligibility for the EITC by reviewing the IRS guidelines.

- Fill out the personal information section, including your name, Social Security number, and filing status.

- List your qualifying children, providing their names, Social Security numbers, and relationship to you.

- Calculate your earned income and adjusted gross income to ensure you meet the income limits.

- Review the completed form for accuracy before attaching it to your Form 1040.

Eligibility Criteria

To qualify for the Earned Income Tax Credit using the Form 1040 Schedule EIC sp, taxpayers must meet specific eligibility criteria. These include:

- Filing a federal tax return, either jointly or separately, with a valid Social Security number.

- Having earned income from employment or self-employment.

- Meeting specific income limits based on filing status and the number of qualifying children.

- Having a qualifying child who meets age, relationship, and residency requirements.

Required Documents

When filling out the Form 1040 Schedule EIC sp, taxpayers should have several documents ready to ensure accurate reporting. These documents typically include:

- W-2 forms from employers to report wages and salaries.

- 1099 forms for any additional income, such as self-employment earnings.

- Proof of residency for qualifying children, such as school records or medical records.

- Any other documentation that supports claims of income and eligibility for the credit.

IRS Guidelines

The IRS provides detailed guidelines on how to properly complete the Form 1040 Schedule EIC sp. It is essential for taxpayers to refer to these guidelines to ensure compliance and to maximize their potential refund. The guidelines cover aspects such as:

- Income limits for claiming the EITC.

- Definitions of qualifying children and their requirements.

- Instructions on how to report income accurately.

Quick guide on how to complete form 1040 schedule eic sp

Complete Form 1040 Schedule EIC sp effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage Form 1040 Schedule EIC sp on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 1040 Schedule EIC sp with ease

- Obtain Form 1040 Schedule EIC sp and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or censor sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or unorganized files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign Form 1040 Schedule EIC sp and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule eic sp

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule eic sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 Schedule EIC sp, and who should use it?

Form 1040 Schedule EIC sp is used to claim the Earned Income Credit (EIC) for eligible families and individuals in the United States. It is specifically designed for those who meet certain income thresholds and have qualifying children. Utilizing this form can maximize your tax benefits, making it essential for low to moderate-income families.

-

How does airSlate SignNow facilitate the submission of Form 1040 Schedule EIC sp?

airSlate SignNow empowers users to easily prepare, eSign, and submit Form 1040 Schedule EIC sp through a streamlined digital process. The platform ensures secure document handling while simplifying the eSignature experience. This efficiency allows you to focus on maximizing your tax credits rather than getting bogged down in paperwork.

-

What are the pricing options for using airSlate SignNow for Form 1040 Schedule EIC sp?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs, starting with a free trial. Subscriptions include various features such as unlimited eSigning and document sharing, making it cost-effective for businesses preparing Form 1040 Schedule EIC sp. You can easily select a plan that fits your budget and requirements.

-

Is airSlate SignNow secure for handling sensitive documents like Form 1040 Schedule EIC sp?

Absolutely! airSlate SignNow prioritizes security, employing encryption and secure server technologies to protect sensitive documents like Form 1040 Schedule EIC sp. With features such as two-factor authentication and audit trails, users can have peace of mind knowing their data is safeguarded throughout the signing process.

-

What benefits does using airSlate SignNow provide for filing Form 1040 Schedule EIC sp?

Using airSlate SignNow to file Form 1040 Schedule EIC sp offers several benefits, including faster processing times and reduced error rates. The intuitive platform minimizes manual entry and provides templates to streamline the process. This means you can save time and ensure a higher accuracy in your submissions.

-

Can I integrate airSlate SignNow with other software for managing Form 1040 Schedule EIC sp?

Yes, airSlate SignNow seamlessly integrates with various third-party software, enhancing your ability to manage Form 1040 Schedule EIC sp alongside your existing tools. Whether you’re using accounting software or customer relationship management systems, the integrations ensure data consistency and minimize duplication of efforts.

-

What features should I look for in airSlate SignNow to assist with Form 1040 Schedule EIC sp?

Key features to look for in airSlate SignNow when dealing with Form 1040 Schedule EIC sp include customizable templates, document tracking, and automated reminders for signer actions. These elements enhance productivity and ensure timely completion of your tax forms, making the eSignature experience smooth and efficient.

Get more for Form 1040 Schedule EIC sp

- Crba casablanca form

- Statement of medical necessity for the tslim vitality medical form

- Underage permission form new mexico state department of

- Hazmat employee training workbook answers form

- Nova online lifes greatest miracle answers form

- Ky form 001 fy instructions

- Date of assessmentsurvey assessment completed by form

- Form 4868 dialysis

Find out other Form 1040 Schedule EIC sp

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online