Get the Facts Earned Income Tax Credit EITC NJ Gov 2024-2026

What is the Get The Facts Earned Income Tax Credit EITC NJ gov

The Get The Facts Earned Income Tax Credit (EITC) is a federal tax benefit designed to assist low- to moderate-income working individuals and families. In New Jersey, the state government provides additional information and resources to help residents understand and access this credit. The EITC reduces the amount of tax owed and may result in a refund, making it a crucial financial resource for eligible taxpayers. The credit is based on income, filing status, and the number of qualifying children, encouraging work and reducing poverty.

Eligibility Criteria

To qualify for the Earned Income Tax Credit in New Jersey, individuals must meet specific criteria, including:

- Having earned income from employment or self-employment.

- Meeting income limits that vary based on filing status and the number of qualifying children.

- Filing a federal tax return, even if no tax is owed.

- Being a U.S. citizen or a resident alien for the entire tax year.

- Not being claimed as a dependent on someone else's tax return.

Steps to complete the Get The Facts Earned Income Tax Credit EITC NJ gov

Completing the process for the Earned Income Tax Credit involves several key steps:

- Determine your eligibility based on income and family size.

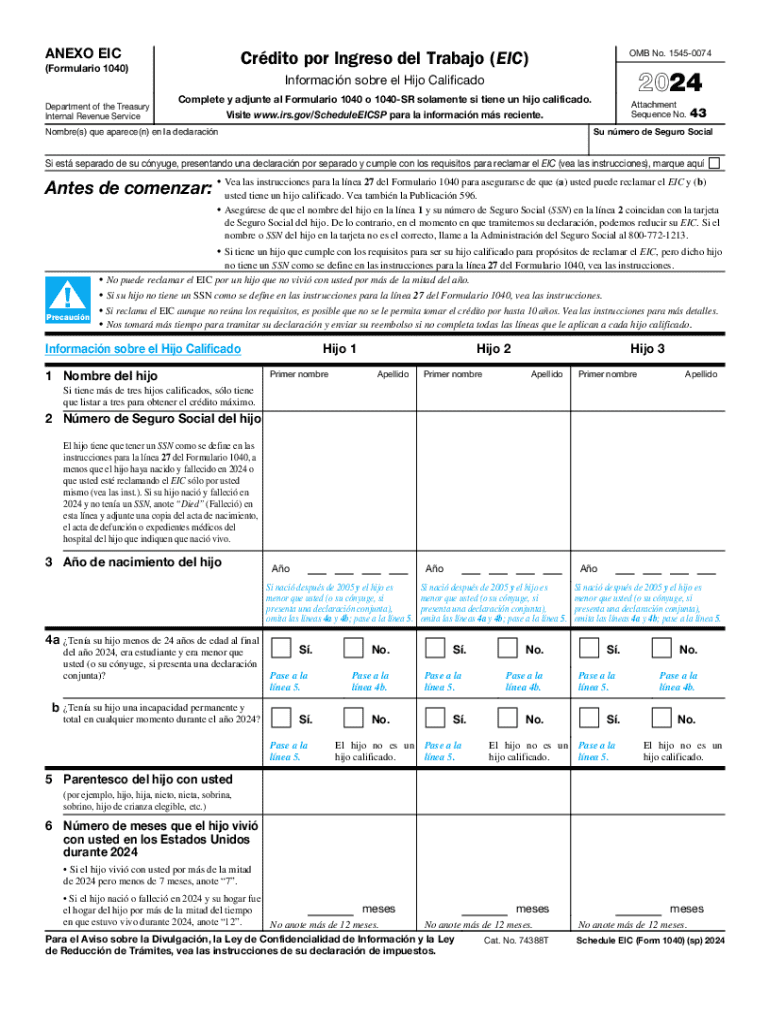

- Gather necessary documentation, including proof of income and Social Security numbers for all family members.

- Complete the federal tax return using Form 1040 or 1040-SR, ensuring to include the EITC section.

- Submit your tax return electronically or by mail, ensuring to follow the guidelines provided by the IRS and New Jersey state tax authorities.

- Keep copies of all documents for your records and potential future audits.

Required Documents

When applying for the Earned Income Tax Credit, it is essential to have the following documents ready:

- W-2 forms from employers.

- 1099 forms for any self-employment income.

- Proof of any other income, such as unemployment benefits or Social Security.

- Social Security cards for yourself and any qualifying children.

- Documentation of any child care expenses, if applicable.

Form Submission Methods

Taxpayers can submit their applications for the Earned Income Tax Credit through various methods:

- Online filing through tax preparation software, which often includes EITC calculations.

- Mailing a paper tax return to the appropriate IRS address.

- In-person filing at designated tax assistance centers or with a tax professional.

IRS Guidelines

The IRS provides comprehensive guidelines for the Earned Income Tax Credit, including:

- Detailed eligibility requirements and income limits.

- Instructions for completing the relevant tax forms.

- Information on how to claim the credit, including the necessary calculations.

- Resources for taxpayers who need assistance or have questions regarding their claims.

Create this form in 5 minutes or less

Find and fill out the correct get the facts earned income tax credit eitc nj gov

Create this form in 5 minutes!

How to create an eSignature for the get the facts earned income tax credit eitc nj gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Earned Income Tax Credit (EITC) and how can I Get The Facts Earned Income Tax Credit EITC NJ gov?

The Earned Income Tax Credit (EITC) is a federal tax credit designed to benefit low to moderate-income working individuals and families. To Get The Facts Earned Income Tax Credit EITC NJ gov, you can visit the official New Jersey government website, which provides comprehensive information on eligibility, application processes, and potential benefits.

-

How do I apply for the EITC in New Jersey?

To apply for the EITC in New Jersey, you must file your state tax return and claim the credit on your tax form. For detailed guidance, you can Get The Facts Earned Income Tax Credit EITC NJ gov by visiting the New Jersey Division of Taxation website, which outlines the necessary steps and documentation required for your application.

-

What are the eligibility requirements for the EITC in NJ?

Eligibility for the EITC in New Jersey depends on your income level, filing status, and number of qualifying children. To Get The Facts Earned Income Tax Credit EITC NJ gov, check the New Jersey government resources that provide specific income thresholds and criteria to determine if you qualify for this beneficial tax credit.

-

What benefits does the EITC provide to taxpayers?

The EITC can signNowly reduce the amount of tax you owe and may even result in a refund. By claiming this credit, you can increase your financial stability and support your family. To Get The Facts Earned Income Tax Credit EITC NJ gov, explore the benefits outlined on the New Jersey government website for more insights.

-

Are there any costs associated with applying for the EITC?

Applying for the EITC itself does not incur any costs, as it is a tax credit available to eligible taxpayers. However, if you choose to use a tax preparation service, there may be fees involved. To Get The Facts Earned Income Tax Credit EITC NJ gov, refer to the official resources that explain the application process and any potential costs associated with tax preparation.

-

Can I receive assistance with my EITC application?

Yes, there are various resources available to assist you with your EITC application, including community organizations and tax assistance programs. To Get The Facts Earned Income Tax Credit EITC NJ gov, you can find local help through the New Jersey government website, which lists certified tax preparers and assistance programs.

-

How does the EITC impact my overall tax return?

The EITC can have a positive impact on your overall tax return by reducing your taxable income and potentially increasing your refund. This credit is designed to support working families, making it an essential aspect of your tax planning. To Get The Facts Earned Income Tax Credit EITC NJ gov, review the information provided by the New Jersey Division of Taxation for detailed insights.

Get more for Get The Facts Earned Income Tax Credit EITC NJ gov

- Cairn university transcript request form

- Fall investigation form

- Statement of fact to correct error on title form

- The child ptsd symptom scale cpss part i form

- Composition marking scheme form

- Tr 999 emt competency verification guidance revised 1 28 21 docx form

- Worksite heat illness prevention plan form

- Maine quit claim deed form eforms

Find out other Get The Facts Earned Income Tax Credit EITC NJ gov

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template