Earned Income Tax Credit EITC ACCESS NYC 2023

What is the Earned Income Tax Credit EITC ACCESS NYC

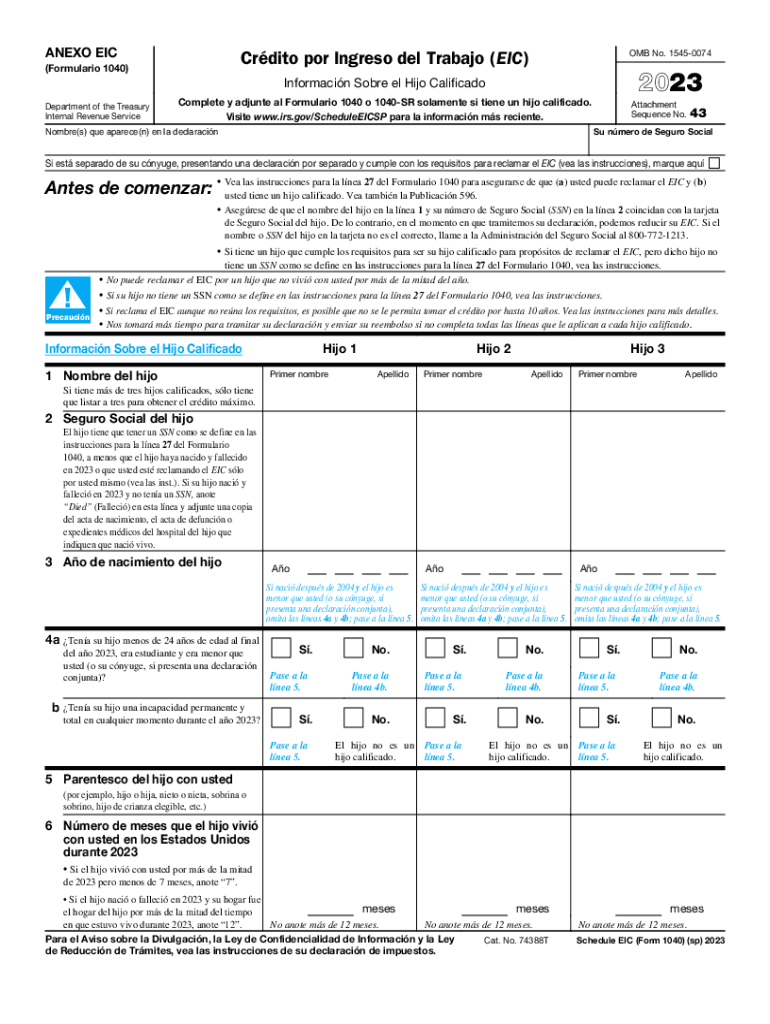

The Earned Income Tax Credit (EITC) is a federal tax benefit designed to assist low- to moderate-income working individuals and families. It aims to reduce poverty and encourage employment by providing a financial boost through tax refunds. ACCESS NYC is a platform that helps residents of New York City determine their eligibility for various public assistance programs, including the EITC. By using this platform, individuals can easily navigate the requirements and apply for the credit, ensuring they receive the financial support they are entitled to.

Eligibility Criteria

To qualify for the Earned Income Tax Credit, applicants must meet specific criteria. These include having earned income from employment or self-employment, being a U.S. citizen or resident alien for the entire year, and having a valid Social Security number. Additionally, the applicant's income must fall below certain thresholds, which vary based on filing status and the number of qualifying children. Individuals without children can also qualify for a smaller credit if they meet the income requirements.

Steps to complete the Earned Income Tax Credit EITC ACCESS NYC

Completing the application for the Earned Income Tax Credit through ACCESS NYC involves several key steps:

- Visit the ACCESS NYC website to access the EITC application.

- Provide personal information, including your name, address, and Social Security number.

- Report your earned income from employment or self-employment for the tax year.

- Indicate your filing status and the number of qualifying children, if applicable.

- Review your information for accuracy before submitting your application.

Required Documents

When applying for the Earned Income Tax Credit, certain documents are necessary to verify eligibility and income. These typically include:

- Proof of income, such as W-2 forms or 1099 forms for self-employed individuals.

- Social Security cards for all family members listed on the application.

- Tax returns from previous years, if applicable.

Having these documents ready can streamline the application process and help ensure a successful claim.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the Earned Income Tax Credit. These guidelines outline eligibility requirements, income limits, and how to properly claim the credit on your tax return. It is essential to review these guidelines to ensure compliance and maximize your potential refund. The IRS updates these guidelines annually, so staying informed about any changes is crucial for applicants.

Application Process & Approval Time

The application process for the Earned Income Tax Credit through ACCESS NYC is designed to be straightforward. After submitting your application, it typically takes the IRS about two to three weeks to process your claim. If additional information is needed, the IRS may contact you directly, which can extend the approval time. Applicants are encouraged to check the status of their application through the IRS website to stay informed about any updates.

Quick guide on how to complete earned income tax credit eitc access nyc

Easily Prepare Earned Income Tax Credit EITC ACCESS NYC on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Earned Income Tax Credit EITC ACCESS NYC on any device with the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to Edit and eSign Earned Income Tax Credit EITC ACCESS NYC Effortlessly

- Locate Earned Income Tax Credit EITC ACCESS NYC and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Earned Income Tax Credit EITC ACCESS NYC to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct earned income tax credit eitc access nyc

Create this form in 5 minutes!

How to create an eSignature for the earned income tax credit eitc access nyc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Earned Income Tax Credit EITC ACCESS NYC?

The Earned Income Tax Credit EITC ACCESS NYC is a tax benefit for low to moderate-income individuals and families, designed to reduce the tax burden and provide additional financial support. By filing for this credit, eligible taxpayers can receive a substantial refund, making it a crucial resource for those in need.

-

How can I apply for the Earned Income Tax Credit EITC ACCESS NYC?

Applying for the Earned Income Tax Credit EITC ACCESS NYC is simple. You can file your tax return using IRS Form 1040 or 1040A, ensuring you check the EITC eligibility requirements. Additionally, various online platforms offer guidance on the application process to help you maximize your potential refund.

-

What are the eligibility requirements for the Earned Income Tax Credit EITC ACCESS NYC?

To qualify for the Earned Income Tax Credit EITC ACCESS NYC, you must have earned income from employment or self-employment, meet specific income limits, and have a valid Social Security number. Additionally, your filing status and the number of eligible children can impact the amount of your credit.

-

How much can I potentially receive from the Earned Income Tax Credit EITC ACCESS NYC?

The amount of the Earned Income Tax Credit EITC ACCESS NYC you can receive varies based on your income, filing status, and the number of qualifying children. For the 2022 tax year, the maximum credit can signNow up to $6,728 for those with three or more qualifying children, providing signNow financial relief.

-

Are there any costs associated with filing for the Earned Income Tax Credit EITC ACCESS NYC?

While the Earned Income Tax Credit EITC ACCESS NYC itself does not cost anything to apply for, you may incur fees if you choose to use a tax preparer or an online filing service. Many taxpayers can take advantage of free filing options, especially if they qualify for the EITC.

-

How will the Earned Income Tax Credit EITC ACCESS NYC benefit me as a small business owner?

As a small business owner, the Earned Income Tax Credit EITC ACCESS NYC can provide a beneficial tax break, increasing your cash flow. This benefit allows you to reinvest savings back into your business, support your employees, or help cover personal expenses.

-

Can I still receive the Earned Income Tax Credit EITC ACCESS NYC if I am self-employed?

Yes, self-employed individuals can qualify for the Earned Income Tax Credit EITC ACCESS NYC if they meet the income and categorization criteria set by the IRS. It's important to accurately report your income and any eligible business expenses to maximize your credit.

Get more for Earned Income Tax Credit EITC ACCESS NYC

- New hire reporting program report form if you use maine gov maine

- Cohabitation agreement 400442438 form

- Vegetable quotation format 355388051

- Vgb 513 form

- Dpwh accreditation 422255460 form

- Penalty cases for failure to disclose form

- Smith cove cruise terminal pier 91 form

- Employee sale commission agreement template form

Find out other Earned Income Tax Credit EITC ACCESS NYC

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later