Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund Puerto Rican Version 2022

Understanding the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version

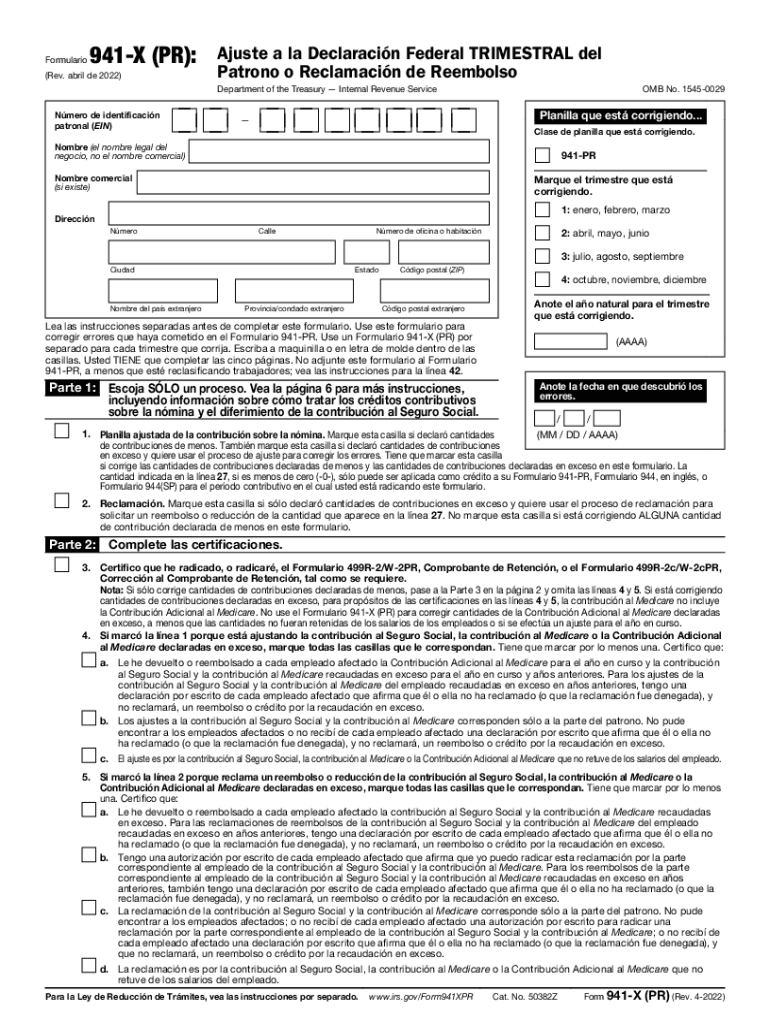

The Form 941 X PR Rev April is a crucial document for employers in Puerto Rico who need to adjust their previously filed Employer's Quarterly Federal Tax Return. This form allows businesses to correct errors or make claims for refunds related to federal tax withholdings. It is specifically tailored for Puerto Rican employers, ensuring compliance with local tax regulations while aligning with federal requirements.

Steps to Complete the Form 941 X PR Rev April

Completing the Form 941 X PR Rev April involves several key steps:

- Begin by gathering all necessary information, including your Employer Identification Number (EIN) and details from your original Form 941.

- Carefully review the sections that require adjustments, ensuring you understand the nature of the corrections needed.

- Fill out the form accurately, providing clear explanations for each adjustment in the designated areas.

- Check your calculations to ensure accuracy before submitting the form.

- Sign and date the form to validate your submission.

Obtaining the Form 941 X PR Rev April

The Form 941 X PR Rev April can be obtained through the Internal Revenue Service (IRS) website or by contacting the IRS directly. It is essential to ensure you have the most current version of the form to avoid any compliance issues. Additionally, many tax preparation software programs may include this form, providing an accessible option for digital completion.

Legal Use of the Form 941 X PR Rev April

Employers must use the Form 941 X PR Rev April in accordance with IRS guidelines. This form is legally binding and should only be submitted when corrections to previously filed returns are necessary. Misuse of the form can lead to penalties or legal complications, so it is vital to adhere to the specific instructions provided by the IRS.

Filing Deadlines for the Form 941 X PR Rev April

Filing deadlines for the Form 941 X PR Rev April align with the quarterly filing schedule for Form 941. Employers should be aware of these deadlines to ensure timely submissions. Late filings may result in penalties, so it is advisable to keep track of these important dates throughout the year.

Form Submission Methods

The Form 941 X PR Rev April can be submitted through various methods, including:

- Mailing the completed form to the designated IRS address.

- Using electronic filing options if available through compatible tax software.

- In-person submission at local IRS offices, if necessary.

Quick guide on how to complete form 941 x pr rev april adjusted employers quarterly federal tax return or claim for refund puerto rican version

Effortlessly prepare Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version on any device

The management of online documents has gained traction among both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and electronically sign Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version with ease

- Find Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version and click Get Form to begin.

- Employ the features we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x pr rev april adjusted employers quarterly federal tax return or claim for refund puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the form 941 x pr rev april adjusted employers quarterly federal tax return or claim for refund puerto rican version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version?

The Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version is a tax form specifically designed for employers in Puerto Rico to adjust previously filed quarterly tax returns. This form allows employers to correct errors related to their employment taxes and claim refunds when necessary, ensuring compliance with federal requirements.

-

How does airSlate SignNow help in filling out the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version?

airSlate SignNow provides an intuitive platform that simplifies the process of completing the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version. With customizable templates and easy-to-use tools, users can efficiently fill out the form, ensuring accuracy and reducing the potential for errors.

-

Is there a cost associated with using airSlate SignNow for the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, starting with affordable options for small enterprises. These plans provide access to all features necessary for managing and eSigning documents, including the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version, with no hidden fees.

-

What features does airSlate SignNow offer for the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version?

AirSlate SignNow offers robust features such as eSignature capabilities, document tracking, and secure storage specifically for the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version. These tools enhance workflow efficiency and ensure that your tax documents are handled securely and promptly.

-

Can I integrate airSlate SignNow with other software to facilitate the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version process?

Absolutely! airSlate SignNow supports integrations with popular software applications, making it easier to manage your Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version across various platforms. This ensures a seamless workflow and enhances overall productivity in your tax processing.

-

What are the benefits of using airSlate SignNow for the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version?

Using airSlate SignNow offers numerous benefits, including increased efficiency, enhanced accuracy, and reduced turnaround times for the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version. Additionally, the platform's user-friendly interface enables even those with little technical expertise to navigate and complete their tax forms with ease.

-

How secure is airSlate SignNow when handling the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version?

AirSlate SignNow prioritizes security, employing advanced encryption and secure storage measures to protect sensitive information related to the Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version. Your data remains confidential and secure throughout the document management process.

Get more for Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version

- Form d 1120ext city of detroit detroitmi

- Standard letter of recommendation georgia state university form

- Loss draft claim forms pdf loss draft claim forms pdf

- Cm22 document form

- Dss 5166 100115077 form

- Scotiabank gic certificate sample form

- Pacific life appointment form

- Nba playoff bracket printable form

Find out other Form 941 X PR Rev April Adjusted Employer's Quarterly Federal Tax Return Or Claim For Refund Puerto Rican Version

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document