About Form 941 X PR, Adjusted Employer's Quarterly 2023-2026

What is the About Form 941 X PR, Adjusted Employer's Quarterly

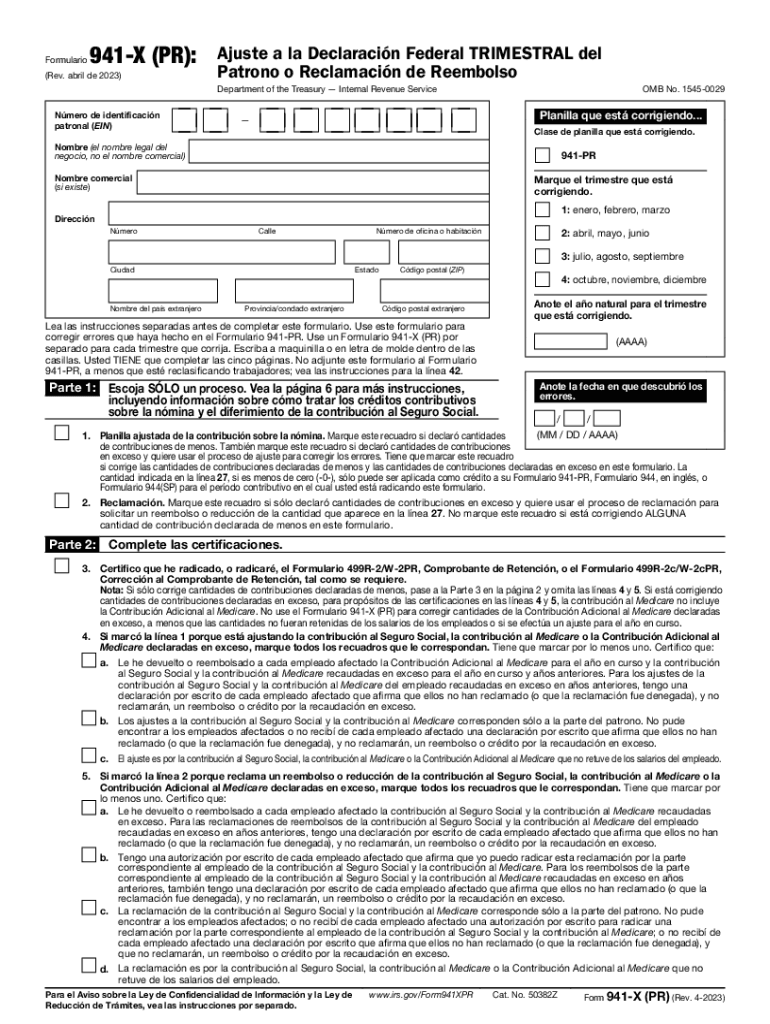

The About Form 941 X PR, Adjusted Employer's Quarterly, is a tax form used by employers in Puerto Rico to amend their previously filed Form 941 PR. This form is essential for correcting errors in reported employment taxes, including adjustments to wages, tips, and other compensation. By using this form, employers can ensure accurate reporting and compliance with federal tax obligations.

How to use the About Form 941 X PR, Adjusted Employer's Quarterly

Employers should use the About Form 941 X PR when they need to correct mistakes made on previous quarterly tax filings. This includes correcting the number of employees, wages reported, or tax amounts withheld. To use the form effectively, employers must provide detailed information about the original entries and the corrected amounts. It is crucial to follow the instructions carefully to ensure that all necessary information is included.

Steps to complete the About Form 941 X PR, Adjusted Employer's Quarterly

Completing the About Form 941 X PR involves several key steps:

- Gather all relevant information from the original Form 941 PR.

- Indicate the tax period being amended.

- Clearly state the corrections being made, including original and adjusted figures.

- Provide any additional explanations or documentation as needed.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the About Form 941 X PR. Generally, the form should be filed as soon as the error is discovered, but it must be submitted within three years from the due date of the original return. Timely filing is essential to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the About Form 941 X PR correctly or on time can result in penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, incorrect reporting can lead to further complications with tax obligations. It is important for employers to stay compliant to avoid these financial repercussions.

Who Issues the Form

The About Form 941 X PR is issued by the Internal Revenue Service (IRS). Employers in Puerto Rico must adhere to the guidelines set forth by the IRS when completing and submitting this form. The IRS provides the necessary forms and instructions to assist employers in fulfilling their tax responsibilities accurately.

Quick guide on how to complete about form 941 x pr adjusted employers quarterly

Complete About Form 941 X PR, Adjusted Employer's Quarterly seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage About Form 941 X PR, Adjusted Employer's Quarterly on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign About Form 941 X PR, Adjusted Employer's Quarterly effortlessly

- Obtain About Form 941 X PR, Adjusted Employer's Quarterly and then click Get Form to begin.

- Make use of the features we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it onto your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign About Form 941 X PR, Adjusted Employer's Quarterly and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 941 x pr adjusted employers quarterly

Create this form in 5 minutes!

How to create an eSignature for the about form 941 x pr adjusted employers quarterly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941 X PR, Adjusted Employer's Quarterly?

Form 941 X PR, Adjusted Employer's Quarterly is a tax form used by employers in Puerto Rico to correct previously filed Form 941. This form allows businesses to amend their quarterly tax filings to ensure accurate reporting of wages, taxes withheld, and other pertinent information.

-

Why should I use airSlate SignNow for Form 941 X PR, Adjusted Employer's Quarterly?

airSlate SignNow provides an efficient, user-friendly platform for managing Form 941 X PR, Adjusted Employer's Quarterly. With our eSignature capabilities, you can easily prepare and send the form for signatures, ensuring compliance and accuracy in your tax submissions.

-

How does pricing work for airSlate SignNow when filing Form 941 X PR, Adjusted Employer's Quarterly?

Pricing for airSlate SignNow is competitive and tailored to suit various business needs. Our flexible plans allow you to choose the package that best fits your usage for filing Form 941 X PR, Adjusted Employer's Quarterly, ensuring you only pay for what you need.

-

Are there any features specifically designed for managing Form 941 X PR, Adjusted Employer's Quarterly?

Yes, airSlate SignNow includes features such as templates and document tracking tailored for Form 941 X PR, Adjusted Employer's Quarterly. These tools streamline the process, making it easier for users to complete and submit their forms accurately.

-

What benefits does airSlate SignNow offer when dealing with Form 941 X PR, Adjusted Employer's Quarterly?

Using airSlate SignNow for Form 941 X PR, Adjusted Employer's Quarterly simplifies the signing and submission process. The platform provides quick access to completed forms, ensures that all necessary signatures are obtained, and reduces the potential for errors.

-

Can airSlate SignNow integrate with other software for Form 941 X PR, Adjusted Employer's Quarterly?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software. This capability is particularly useful for businesses needing to file Form 941 X PR, Adjusted Employer's Quarterly, as it enables streamlined information transfer and management.

-

How secure is airSlate SignNow when handling Form 941 X PR, Adjusted Employer's Quarterly?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and stringent access controls to protect your sensitive information when handling Form 941 X PR, Adjusted Employer's Quarterly and other documents.

Get more for About Form 941 X PR, Adjusted Employer's Quarterly

- The analysis of musical form james mathes pdf

- Firewise home assessment form burnsafetn org burnsafetn

- Citibank account opening form pdf

- Form dhr fia 1130

- Mitosis practice worksheet form

- Mcps form 565 1

- Balancing your checkbook worksheet pdf balancing your checkbook worksheet form

- Bs evaluation form doc

Find out other About Form 941 X PR, Adjusted Employer's Quarterly

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document