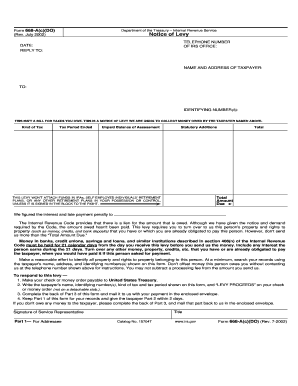

Form 668 AcDO Rev 7 Notice of Levy

What is the Form 668 AcDO Rev 7 Notice Of Levy

The Form 668 AcDO Rev 7 Notice Of Levy is an official document issued by the Internal Revenue Service (IRS) to inform taxpayers that their property or assets are being seized to satisfy a tax debt. This form serves as a legal notification that the IRS is exercising its authority to levy, which means it can take possession of a taxpayer's assets, including bank accounts, wages, and other property, to recover unpaid taxes. Understanding this form is crucial for taxpayers facing IRS collection actions, as it outlines their rights and the steps they can take in response.

How to use the Form 668 AcDO Rev 7 Notice Of Levy

Using the Form 668 AcDO Rev 7 Notice Of Levy involves understanding its implications and responding appropriately. Taxpayers should first carefully review the details provided in the notice, including the amount owed and the specific assets being targeted. If the taxpayer believes the levy is unjust, they can file a request for a hearing with the IRS to contest the levy. It is also advisable to consult with a tax professional to explore options for resolving the tax debt, such as setting up a payment plan or requesting an offer in compromise.

Steps to complete the Form 668 AcDO Rev 7 Notice Of Levy

Completing the Form 668 AcDO Rev 7 Notice Of Levy requires careful attention to detail. Here are the steps involved:

- Review the notice for accuracy, ensuring all information is correct.

- Gather supporting documents that may help contest the levy, such as proof of payment or evidence of financial hardship.

- Fill out any required sections of the form, providing clear and concise information.

- Submit the completed form to the appropriate IRS office as indicated in the notice.

- Keep a copy of the completed form and any supporting documents for your records.

Key elements of the Form 668 AcDO Rev 7 Notice Of Levy

Several key elements define the Form 668 AcDO Rev 7 Notice Of Levy. These include:

- Taxpayer Information: This section includes the name, address, and taxpayer identification number.

- Levy Details: It specifies the type of property being levied and the amount owed.

- Legal Authority: The form cites the legal basis for the levy, referencing applicable tax laws.

- Rights of the Taxpayer: It outlines the taxpayer's rights, including the right to appeal the levy.

- Contact Information: The IRS provides contact details for further inquiries or assistance.

Legal use of the Form 668 AcDO Rev 7 Notice Of Levy

The legal use of the Form 668 AcDO Rev 7 Notice Of Levy is governed by federal tax laws. The IRS must follow specific procedures when issuing a levy, including providing the taxpayer with prior notice of the tax debt and an opportunity to resolve the issue before the levy is enforced. Taxpayers have the right to appeal the levy and seek relief through various means, including requesting a collection due process hearing. Understanding these legal rights is essential for effectively responding to the notice.

IRS Guidelines

The IRS provides guidelines for the issuance and handling of the Form 668 AcDO Rev 7 Notice Of Levy. These guidelines include:

- Ensuring that all levies comply with federal tax regulations.

- Providing taxpayers with clear instructions on how to respond to the notice.

- Offering options for resolving tax debts, including payment plans and appeals.

- Maintaining transparency in the levy process to protect taxpayer rights.

Quick guide on how to complete form 668 acdo rev 7 notice of levy

Effortlessly Prepare Form 668 AcDO Rev 7 Notice Of Levy on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your documents without any hassle. Manage Form 668 AcDO Rev 7 Notice Of Levy on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Form 668 AcDO Rev 7 Notice Of Levy with Ease

- Obtain Form 668 AcDO Rev 7 Notice Of Levy and then click Get Form to begin.

- Make use of the features we provide to fill out your form.

- Emphasize important portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 668 AcDO Rev 7 Notice Of Levy to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 668 acdo rev 7 notice of levy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 668 AcDO Rev 7 Notice Of Levy?

The Form 668 AcDO Rev 7 Notice Of Levy is an official IRS document used to inform individuals or businesses that their assets are being seized to satisfy a tax obligation. This form outlines the legal authority behind the levy and provides details on the taxpayer's rights. Understanding this form is crucial for individuals facing asset seizure.

-

How does airSlate SignNow assist with the Form 668 AcDO Rev 7 Notice Of Levy?

airSlate SignNow simplifies the process of executing and managing the Form 668 AcDO Rev 7 Notice Of Levy. Users can easily send, eSign, and store their IRS documents securely within our platform. Our intuitive interface ensures that users can manage their important documents without hassle.

-

Is there a cost to use airSlate SignNow for Form 668 AcDO Rev 7 Notice Of Levy?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those needing to handle the Form 668 AcDO Rev 7 Notice Of Levy. The cost-effective solution allows you to choose a plan that fits your needs without compromising on features or security. You can find a plan that meets your budget while streamlining your document management.

-

What features does airSlate SignNow offer for managing the Form 668 AcDO Rev 7 Notice Of Levy?

airSlate SignNow offers a range of features designed to streamline the management of the Form 668 AcDO Rev 7 Notice Of Levy, including customizable templates, eSignature capabilities, and secure cloud storage. These features help you prepare and sign your IRS documents quickly and efficiently. Additionally, our platform provides easy tracking and audit trails to ensure compliance.

-

Can I integrate airSlate SignNow with other software to manage the Form 668 AcDO Rev 7 Notice Of Levy?

Absolutely! airSlate SignNow offers integration capabilities with numerous third-party applications. This ensures that you can seamlessly manage the Form 668 AcDO Rev 7 Notice Of Levy alongside your other business tools, enhancing your workflow and improving efficiency.

-

What benefits does airSlate SignNow offer for individuals dealing with the Form 668 AcDO Rev 7 Notice Of Levy?

The primary benefit of using airSlate SignNow for the Form 668 AcDO Rev 7 Notice Of Levy is the ease of eSigning and sharing documents securely. This saves time and reduces the stress involved in handling sensitive IRS documentation. Additionally, our platform helps ensure that you remain compliant while providing peace of mind.

-

How secure is the airSlate SignNow platform for handling the Form 668 AcDO Rev 7 Notice Of Levy?

Security is a top priority at airSlate SignNow. When managing the Form 668 AcDO Rev 7 Notice Of Levy, your documents are protected with advanced encryption and secure access controls. We are committed to maintaining the confidentiality and integrity of your financial and personal information.

Get more for Form 668 AcDO Rev 7 Notice Of Levy

Find out other Form 668 AcDO Rev 7 Notice Of Levy

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement