Chapter 16 Accounting for Income Taxes Form

What is the Chapter 16 Accounting For Income Taxes

Chapter 16 Accounting For Income Taxes provides guidelines and standards for recognizing, measuring, and disclosing income tax obligations and benefits in financial statements. This chapter is part of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) and outlines how businesses should account for current and deferred tax liabilities and assets. The primary goal is to ensure that financial statements reflect the tax implications of business operations accurately, facilitating transparency for stakeholders.

Key elements of the Chapter 16 Accounting For Income Taxes

This chapter includes several critical components that businesses must understand:

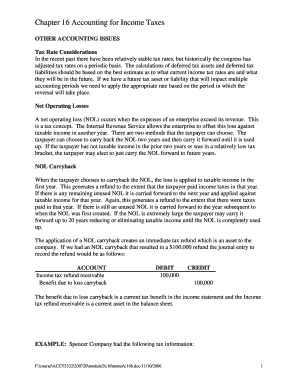

- Current Tax Expense: This is the amount of income tax payable or refundable for the current year.

- Deferred Tax Assets and Liabilities: These arise from temporary differences between the tax base of assets and liabilities and their reported amounts in financial statements.

- Tax Rate Considerations: Businesses must apply the appropriate tax rates when calculating current and deferred tax amounts.

- Uncertain Tax Positions: Companies must evaluate and disclose any tax positions that may be challenged by tax authorities.

Steps to complete the Chapter 16 Accounting For Income Taxes

To effectively apply the guidelines from Chapter 16, businesses should follow these steps:

- Identify the taxable income or loss for the reporting period.

- Calculate the current tax liability based on applicable tax rates.

- Assess any temporary differences that may result in deferred tax assets or liabilities.

- Determine the impact of uncertain tax positions and make necessary disclosures.

- Prepare the financial statements, ensuring that tax-related items are accurately reflected.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines that must be adhered to when accounting for income taxes. These guidelines include rules on how to report income, deductions, and credits. Businesses should regularly review IRS publications and updates to ensure compliance with tax laws and regulations. Understanding these guidelines is essential for accurate reporting and minimizing the risk of penalties.

Filing Deadlines / Important Dates

Businesses must be aware of key deadlines related to filing income tax returns and making payments. Generally, the federal corporate tax return is due on the fifteenth day of the fourth month following the end of the fiscal year. For calendar year corporations, this means April 15. Extensions may be available, but it is crucial to file any necessary forms on time to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the accounting standards outlined in Chapter 16 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal ramifications. It is essential for businesses to maintain accurate records and ensure timely filing to mitigate these risks. Regular audits and reviews can help identify any compliance issues before they escalate.

Quick guide on how to complete chapter 16 accounting for income taxes

Complete Chapter 16 Accounting For Income Taxes effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools essential for creating, editing, and electronically signing your documents swiftly without delays. Manage Chapter 16 Accounting For Income Taxes on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Chapter 16 Accounting For Income Taxes without effort

- Obtain Chapter 16 Accounting For Income Taxes and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Alter and eSign Chapter 16 Accounting For Income Taxes and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chapter 16 accounting for income taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Chapter 16 Accounting For Income Taxes in business finance?

Chapter 16 Accounting For Income Taxes provides crucial guidelines for recognizing income tax liabilities and assets in financial statements. Understanding this chapter helps businesses ensure compliance with regulations and enhances transparency in their financial reporting.

-

How does airSlate SignNow integrate with Chapter 16 Accounting For Income Taxes?

airSlate SignNow streamlines the process of signing and sending documents related to Chapter 16 Accounting For Income Taxes. By using our platform, businesses can efficiently review, eSign, and manage tax-related documents, thus reducing processing time and errors.

-

What features does airSlate SignNow offer for businesses dealing with Chapter 16 Accounting For Income Taxes?

Our platform includes features like customizable templates, automated workflows, and secure storage, specifically designed to handle documents relevant to Chapter 16 Accounting For Income Taxes. These features allow users to process documentation quickly and securely.

-

Is airSlate SignNow a cost-effective solution for managing Chapter 16 Accounting For Income Taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution. By minimizing paperwork and automating the signing process, businesses can save on operational costs associated with managing Chapter 16 Accounting For Income Taxes.

-

How can airSlate SignNow enhance collaboration on Chapter 16 Accounting For Income Taxes documentation?

With airSlate SignNow, teams can collaborate seamlessly on documents related to Chapter 16 Accounting For Income Taxes. The platform allows multiple users to review, comment, and sign, ensuring that all stakeholders are aligned before finalizing tax-related agreements.

-

Does airSlate SignNow offer any support for understanding Chapter 16 Accounting For Income Taxes?

While airSlate SignNow focuses on document management, our customer support team can assist with questions related to using our platform in context with Chapter 16 Accounting For Income Taxes. We also provide resources to help users navigate tax documentation more effectively.

-

What types of documents can be managed through airSlate SignNow in relation to Chapter 16 Accounting For Income Taxes?

Businesses can manage a variety of documents through airSlate SignNow, including tax returns, payment agreements, and compliance statements relevant to Chapter 16 Accounting For Income Taxes. Our platform supports a wide range of document types to ensure comprehensive management.

Get more for Chapter 16 Accounting For Income Taxes

Find out other Chapter 16 Accounting For Income Taxes

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online