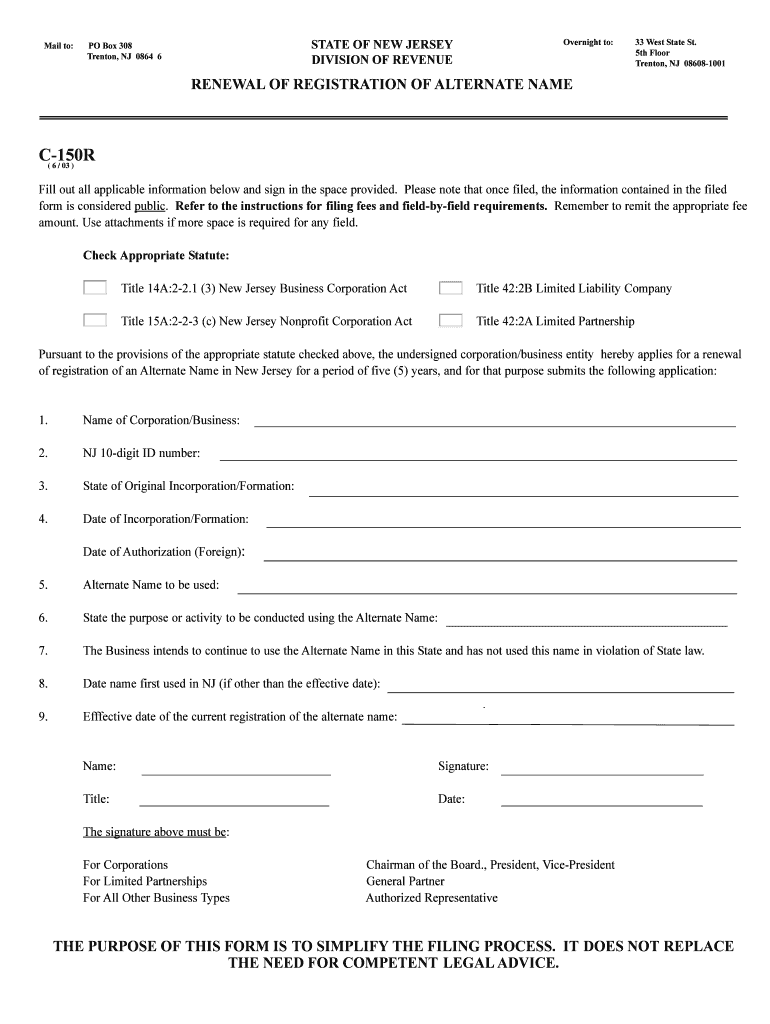

C 150r Form

What is the C 150r Form

The C 150r Form is a specific document used in the United States to report certain information related to tax obligations. This form is essential for individuals and businesses that need to provide accurate financial data to the Internal Revenue Service (IRS). Understanding the purpose of the C 150r Form helps ensure compliance with federal tax regulations.

How to use the C 150r Form

To effectively use the C 150r Form, individuals and businesses should first gather all necessary financial information. This includes income details, deductions, and any relevant tax credits. Once the information is collected, users can fill out the form accurately, ensuring all sections are completed. After filling out the form, it can be submitted to the IRS as part of the tax filing process.

Steps to complete the C 150r Form

Completing the C 150r Form involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, either electronically or by mail.

Legal use of the C 150r Form

The C 150r Form must be used in accordance with IRS regulations. It is important for users to understand the legal implications of submitting this form. Incorrect or fraudulent information can lead to penalties, including fines or audits. Therefore, ensuring the accuracy and honesty of the information provided is crucial for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the C 150r Form vary depending on the taxpayer's situation. Generally, the form must be submitted by April fifteenth for individual taxpayers. However, businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid late penalties.

Required Documents

When completing the C 150r Form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the process of filling out the form and ensure accuracy.

Who Issues the Form

The C 150r Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Users can obtain the form directly from the IRS website or through authorized tax professionals.

Quick guide on how to complete c 150r form

Complete C 150r Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and safely save it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents quickly without interruptions. Manage C 150r Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign C 150r Form with ease

- Locate C 150r Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign C 150r Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c 150r form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the C 150r Form?

The C 150r Form is a specific document often used in business transactions for electronic signatures. It facilitates smooth communication and document management within organizations, allowing users to eSign and send important paperwork securely and efficiently.

-

How can airSlate SignNow help with the C 150r Form?

With airSlate SignNow, businesses can effortlessly manage the C 150r Form by using our intuitive eSignature solution. Our platform streamlines the process, ensuring that all necessary steps are completed quickly and in compliance with legal standards.

-

What are the pricing options for using C 150r Form with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored for various business needs when dealing with the C 150r Form. Users can choose from monthly or annual subscriptions, with options suited for startups to large enterprises, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer for the C 150r Form?

AirSlate SignNow provides several features for handling the C 150r Form, including customizable templates, real-time collaboration, and secure cloud storage. These features enhance the efficiency of document management and ensure that users can easily access and edit their forms.

-

Are there any integrations available for the C 150r Form?

Yes, airSlate SignNow seamlessly integrates with popular platforms such as Google Drive, Salesforce, and Microsoft Office. These integrations allow users to easily import, manage, and send the C 150r Form, streamlining workflow and improving productivity.

-

What are the benefits of using airSlate SignNow for the C 150r Form?

Using airSlate SignNow for the C 150r Form offers numerous benefits, such as enhanced efficiency, reduced turnaround times, and improved security for document handling. The platform simplifies the eSigning process, making it easier for teams to collaborate and finalize documents remotely.

-

Is the C 150r Form legally binding when signed using airSlate SignNow?

Absolutely! The C 150r Form signed using airSlate SignNow is legally binding, as our platform complies with international e-signature laws like ESIGN and UETA. This compliance ensures that all electronic signatures are valid and enforceable in court.

Get more for C 150r Form

- Dd form 2606

- Anti steering disclosure pdf form

- Wire funds transfer request form lek securities

- Credit card application form pdf 100270530

- Cvrp application form pdf

- Tuition assistance agreement template form

- Tuition reimbursement agreement template 787748385 form

- Tuition reimbursement payback agreement template form

Find out other C 150r Form

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed