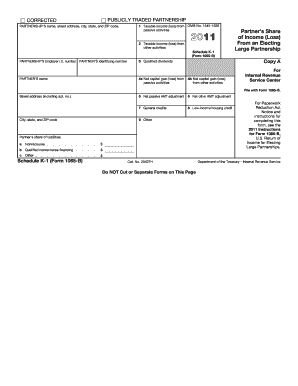

CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income Loss from OMB No Form

What is the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

The CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No is a specific tax form used by publicly traded partnerships in the United States to report income, deductions, and losses to the Internal Revenue Service (IRS). This form is essential for ensuring accurate tax reporting and compliance with federal regulations. It provides a detailed account of the partnership's financial activities and is necessary for partners to correctly report their share of income or losses on their individual tax returns.

How to use the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

To effectively use the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No, partners must first obtain the form from the IRS or their partnership. Once received, partners should carefully review the information reported on the form, ensuring that it aligns with their own records. The data must then be accurately transferred to their personal tax returns, specifically on Schedule E, which is used for reporting income or loss from partnerships. Proper usage of this form is crucial for compliance and to avoid potential penalties.

Steps to complete the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

Completing the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No involves several key steps:

- Obtain the form from the IRS or your partnership.

- Review the partnership's financial information, including income, deductions, and losses.

- Ensure all entries are accurate and complete, reflecting your share of the partnership's financial activities.

- Transfer the relevant information to your individual tax return, typically on Schedule E.

- File your tax return by the applicable deadline.

Key elements of the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

The key elements of the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No include:

- Identification of the partnership and its partners.

- Details of the partnership's income, including ordinary income and capital gains.

- Reported deductions that may reduce taxable income.

- Calculation of losses that partners can claim on their tax returns.

- Specific instructions for reporting and filing the form.

Filing Deadlines / Important Dates

Filing deadlines for the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No are typically aligned with the general tax filing deadlines set by the IRS. For most partnerships, the form must be filed by the fifteenth day of the third month following the close of the tax year. It is essential for partners to be aware of these deadlines to ensure timely filing and to avoid penalties for late submission.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. These guidelines include instructions on how to report income, deductions, and losses accurately. Partners should refer to the IRS instructions for the form to ensure compliance with all federal tax regulations. Adhering to these guidelines helps prevent errors that could lead to audits or penalties.

Quick guide on how to complete corrected publicly traded partnership 1 taxable income loss from omb no

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents efficiently without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

Create this form in 5 minutes!

How to create an eSignature for the corrected publicly traded partnership 1 taxable income loss from omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. form?

The CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. form is a tax document used to report corrected income or loss for publicly traded partnerships. It ensures that taxpayers have accurate information for their tax filings. Utilizing this form is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. documentation?

airSlate SignNow simplifies the process of sending and eSigning your CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. documents. Our platform allows you to create and manage these forms quickly, ensuring timely submissions to tax authorities. This efficiency helps reduce stress during tax season.

-

Is airSlate SignNow cost-effective for managing CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms. With various pricing plans, businesses can choose the option that best fits their budget and document needs. The investment pays off through improved efficiency and accuracy.

-

What features does airSlate SignNow offer for CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms?

AirSlate SignNow provides features like document templates, electronic signatures, and real-time tracking for your CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms. These tools enhance your productivity and ensure that every document is completed accurately and efficiently. Our user-friendly interface simplifies the entire process.

-

Are there integrations available for managing CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms?

Yes, airSlate SignNow integrates with various platforms such as Google Workspace, Microsoft Office, and CRM systems. These integrations streamline the workflow for handling CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms. Effortlessly connect your documents and tools to enhance productivity.

-

What are the benefits of using airSlate SignNow for CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms?

Using airSlate SignNow for your CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms offers numerous benefits, including streamlined processes, enhanced security, and cost savings. By digitizing your documentation, you reduce paper usage and storage needs. Additionally, our platform ensures compliance with legal standards.

-

Can airSlate SignNow help with tracking submissions of CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms?

Absolutely, airSlate SignNow includes real-time tracking features for all your documents, including the CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No. forms. You can see when documents are sent, viewed, and signed, ensuring full transparency throughout the process. This helps ensure that you never miss a filing deadline.

Get more for CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

- Omb 1513 form

- The church historically traced form

- Ngs gps observation log form

- Massachusetts vehicle check inspector license application form

- Affidavit of service by mail new york form

- Beti bachao beti padhao form pdf download in english 26313738

- F248 036 000 form

- Gas 1201q motor fuels claim for refund tax paid form

Find out other CORRECTED PUBLICLY TRADED PARTNERSHIP 1 Taxable Income loss From OMB No

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form