F248 036 000 2016

What is the F248 036 000

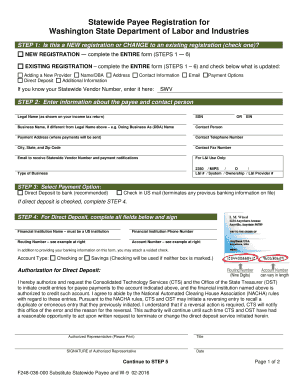

The F248 036 000 form is a specific document utilized for various administrative purposes within the United States. It is essential for individuals and businesses to understand the nature of this form, as it often pertains to compliance with federal regulations. The F248 036 000 serves as a formal request or declaration that may be required in different contexts, such as tax reporting or regulatory compliance.

How to use the F248 036 000

Using the F248 036 000 form involves several key steps to ensure proper completion and submission. First, gather all necessary information that pertains to the requirements of the form. This may include personal identification details, financial data, or specific declarations relevant to the purpose of the form. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors before submission.

Steps to complete the F248 036 000

Completing the F248 036 000 form requires careful attention to detail. Follow these steps for a successful submission:

- Read the instructions provided with the form to understand its requirements.

- Collect all necessary documents and information needed for completion.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any mistakes or missing information.

- Submit the form according to the specified submission methods.

Legal use of the F248 036 000

The legal use of the F248 036 000 form is governed by specific regulations that dictate its validity and acceptance. To ensure that the form is legally binding, it must be filled out in compliance with applicable laws. This includes adhering to any relevant federal or state guidelines that may pertain to the information being submitted. Proper execution of the form is crucial, as failure to follow legal requirements can lead to complications or invalidation of the submission.

Form Submission Methods

The F248 036 000 form can be submitted through various methods, depending on the specific requirements outlined for its use. Common submission methods include:

- Online submission through authorized platforms, ensuring a secure and efficient process.

- Mailing the completed form to the designated address, allowing for traditional processing.

- In-person submission at specified offices or agencies, providing an opportunity for immediate confirmation.

Required Documents

When completing the F248 036 000 form, certain documents may be required to support the information provided. These documents can include:

- Identification documents, such as a driver's license or social security card.

- Financial statements or records relevant to the form's purpose.

- Any additional forms or documentation that may be specified in the instructions accompanying the F248 036 000.

Eligibility Criteria

Eligibility to use the F248 036 000 form is determined by specific criteria that must be met. These criteria can vary based on the context in which the form is used. Generally, individuals or entities must demonstrate compliance with the relevant regulations and provide accurate information as required by the form. It is important to review the eligibility requirements carefully to ensure that the form is applicable to your situation.

Quick guide on how to complete f248 036 000

Effortlessly Prepare F248 036 000 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage F248 036 000 on any device using the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

How to Change and eSign F248 036 000 with Ease

- Locate F248 036 000 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether it be via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Alter and eSign F248 036 000 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f248 036 000

Create this form in 5 minutes!

How to create an eSignature for the f248 036 000

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f248 036 000 solution offered by airSlate SignNow?

The f248 036 000 solution from airSlate SignNow simplifies the process of sending and eSigning documents. With its user-friendly interface, businesses can easily manage their document workflows and ensure secure electronic signatures, making it an ideal choice for various organizational needs.

-

How much does the f248 036 000 service cost?

airSlate SignNow offers competitive pricing for the f248 036 000 service, providing various plans to suit different business sizes and requirements. By investing in this cost-effective solution, organizations can enhance their document management processes without breaking the bank.

-

What features are included in the f248 036 000 package?

The f248 036 000 package includes essential features such as template creation, secure cloud storage, and advanced eSignature capabilities. These features enable users to streamline their document workflows and increase efficiency across their organizations.

-

How can the f248 036 000 benefit my business?

By utilizing the f248 036 000 solution, businesses can save time and reduce errors associated with traditional document signing methods. The quick turnaround and enhanced security provided by airSlate SignNow lead to improved customer satisfaction and operational effectiveness.

-

Can I integrate f248 036 000 with other applications?

Yes, airSlate SignNow's f248 036 000 solution offers seamless integration with various applications and platforms, such as CRM and project management tools. This flexibility allows businesses to streamline their document processes and maintain a cohesive workflow across different systems.

-

Is the f248 036 000 solution secure for sensitive documents?

Absolutely, the f248 036 000 solution prioritizes security, employing robust encryption methods to protect sensitive documents. With airSlate SignNow, businesses can confidently handle their documentation without compromising on security.

-

What types of documents can be signed using f248 036 000?

The f248 036 000 solution allows users to sign various document types, including contracts, agreements, and forms. This versatility makes it suitable for multiple industries and business functions, enhancing overall productivity.

Get more for F248 036 000

Find out other F248 036 000

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy