Form 5305 EA Rev October Coverdell Education Savings Custodial Account

What is the Form 5305 EA Rev October Coverdell Education Savings Custodial Account

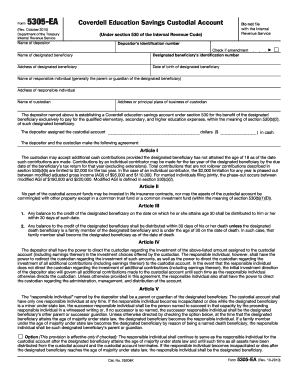

The Form 5305 EA Rev October is a tax form used to establish a Coverdell Education Savings Custodial Account (ESA). This account allows individuals to save for qualified education expenses for designated beneficiaries, typically children. The funds in a Coverdell ESA can be used for various educational costs, including tuition, fees, books, and certain room and board expenses. The form outlines the responsibilities of the custodian and the rights of the account holder, ensuring compliance with IRS regulations.

Steps to Complete the Form 5305 EA Rev October Coverdell Education Savings Custodial Account

Completing the Form 5305 EA Rev October involves several key steps. First, gather necessary information about the beneficiary, including their name, Social Security number, and date of birth. Next, provide details about the custodian, who manages the account. Fill in the required sections of the form, ensuring accuracy to avoid delays. After completing the form, review it for any errors, then sign and date it. Finally, submit the form to the financial institution that will be managing the custodial account.

Legal Use of the Form 5305 EA Rev October Coverdell Education Savings Custodial Account

The Form 5305 EA Rev October is legally binding and must be used in accordance with IRS guidelines. It establishes the terms under which the Coverdell ESA operates, including contribution limits and withdrawal rules. The custodian is responsible for maintaining accurate records and ensuring that distributions are used for qualified educational expenses. Failure to comply with these regulations can result in penalties, including taxes on non-qualified withdrawals.

Eligibility Criteria for the Form 5305 EA Rev October Coverdell Education Savings Custodial Account

To establish a Coverdell Education Savings Custodial Account using Form 5305 EA Rev October, certain eligibility criteria must be met. The beneficiary must be under the age of 18 or a special needs beneficiary. Additionally, the account holder must meet income limits set by the IRS, which determine the maximum contribution allowed. These criteria ensure that the benefits of the account are directed towards those who need them most, promoting educational savings for families.

IRS Guidelines for the Form 5305 EA Rev October Coverdell Education Savings Custodial Account

The IRS provides specific guidelines for the use of Form 5305 EA Rev October. These guidelines cover various aspects, including contribution limits, qualified expenses, and tax implications. For the tax year, the maximum contribution to a Coverdell ESA is two thousand dollars per beneficiary. The IRS also stipulates that funds must be used for qualified education expenses to avoid penalties. Understanding these guidelines is essential for account holders to maximize the benefits of their Coverdell ESA.

How to Obtain the Form 5305 EA Rev October Coverdell Education Savings Custodial Account

The Form 5305 EA Rev October can be obtained directly from the IRS website or through financial institutions that offer Coverdell Education Savings Accounts. Many banks and credit unions provide the form as part of their account opening process. It is important to ensure that the most current version of the form is used to comply with IRS requirements. Additionally, some financial institutions may offer online resources to assist with the completion of the form.

Quick guide on how to complete form 5305 ea rev october coverdell education savings custodial account

Prepare [SKS] effortlessly on any device

Online document administration has become increasingly favored by enterprises and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents rapidly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to amend and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form—via email, SMS, an invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5305 ea rev october coverdell education savings custodial account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 EA Rev October Coverdell Education Savings Custodial Account?

The Form 5305 EA Rev October Coverdell Education Savings Custodial Account is a tax-advantaged savings vehicle designed to help families save for education expenses. This account allows for tax-free growth and tax-free withdrawals when the funds are used for qualified education expenses. By utilizing airSlate SignNow, you can easily manage and eSign the necessary documents for setting up this custodial account.

-

How can I set up a Form 5305 EA Rev October Coverdell Education Savings Custodial Account using airSlate SignNow?

Setting up a Form 5305 EA Rev October Coverdell Education Savings Custodial Account with airSlate SignNow is straightforward. Our platform allows you to upload, edit, and eSign the required documents securely and efficiently. With user-friendly features, you can complete your custodial account setup in no time.

-

What are the benefits of using a Coverdell Education Savings Custodial Account?

A Coverdell Education Savings Custodial Account, like the one detailed in Form 5305 EA Rev October, offers signNow tax benefits. Contributions grow tax-free, and withdrawals for qualified education expenses are also tax-free. This makes it an excellent option for families looking to maximize their education savings.

-

Is there a fee associated with using airSlate SignNow for the Form 5305 EA Rev October Coverdell Education Savings Custodial Account?

airSlate SignNow provides a cost-effective solution for managing the Form 5305 EA Rev October Coverdell Education Savings Custodial Account. While our services come with a subscription fee, we offer various pricing plans to suit different needs, ensuring that you get excellent value for your money while handling important documents.

-

What features does airSlate SignNow offer for the Form 5305 EA Rev October Coverdell Education Savings Custodial Account?

airSlate SignNow offers a range of features designed to streamline the process of managing the Form 5305 EA Rev October Coverdell Education Savings Custodial Account. These include customizable templates, real-time collaboration, secure eSigning, and document tracking. With these tools, you can manage all your education savings documents with ease.

-

Can I integrate airSlate SignNow with other applications for my Coverdell Education Savings Custodial Account?

Yes, airSlate SignNow offers integrations with various applications to enhance your experience when managing the Form 5305 EA Rev October Coverdell Education Savings Custodial Account. You can seamlessly connect with popular tools like Google Drive, Dropbox, and numerous CRM systems to streamline your workflow.

-

What age limits apply to the beneficiary of a Coverdell Education Savings Custodial Account?

The Form 5305 EA Rev October Coverdell Education Savings Custodial Account allows contributions until the beneficiary turns 18 years old. However, the funds must be used by age 30, or they will incur penalties and taxes. This account is specifically designed to encourage education savings, making it essential to adhere to these age restrictions.

Get more for Form 5305 EA Rev October Coverdell Education Savings Custodial Account

Find out other Form 5305 EA Rev October Coverdell Education Savings Custodial Account

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors