1545 0074 Department of the Treasury Internal Revenue Service No Lo Env E Al IRS Form

Understanding the Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

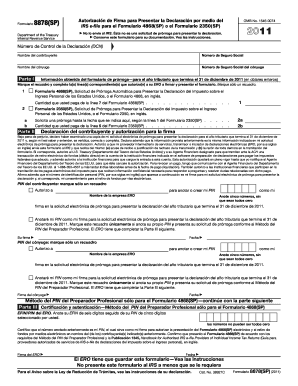

The form, issued by the Department of the Treasury Internal Revenue Service, is a critical document used in various tax-related processes. This form is specifically designed to assist taxpayers in meeting specific reporting requirements. It is essential for individuals and businesses to understand its purpose and implications, as it plays a significant role in ensuring compliance with federal tax laws.

This form may be required for certain tax filings, and understanding its components can aid in accurate completion and submission. It is important to note that this form is not universally applicable; its use is determined by specific circumstances outlined by the IRS.

How to Complete the Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

Filling out the form requires careful attention to detail. Begin by gathering all necessary information, including personal identification details and relevant financial data. The form typically includes sections that require specific entries, such as income information, deductions, and credits.

It is advisable to review the instructions provided by the IRS for this form. These instructions will guide you through each section, ensuring that you provide accurate and complete information. Double-checking entries can help prevent errors that may lead to delays or penalties.

Required Documents for the Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

To successfully complete the form, certain documents may be required. These documents often include:

- Personal identification information, such as your Social Security number.

- Financial statements that reflect your income and expenses.

- Any relevant tax documents, including W-2s or 1099s.

Having these documents ready will streamline the process and ensure that you can provide all necessary information without delay.

Submission Methods for the Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

The form can be submitted through various methods, depending on your preference and the requirements set by the IRS. The primary submission methods include:

- Online submission through the IRS e-filing system, which is often the fastest option.

- Mailing a paper copy of the form to the designated IRS address.

- In-person submission at an IRS office, which may be necessary for certain situations.

Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Legal Considerations for the Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

Using the form correctly is vital for legal compliance. Failure to complete and submit this form as required can result in penalties, including fines or additional scrutiny from the IRS. It is important to understand the legal implications of this form and to ensure that all information provided is truthful and accurate.

Consulting with a tax professional can provide additional guidance on the legal aspects of using this form, particularly if you have unique circumstances or questions regarding your tax situation.

Quick guide on how to complete 1545 0074 department of the treasury internal revenue service no lo env e al irs

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It presents an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct document and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign [SKS] without any hassle

- Acquire [SKS] and click Get Form to begin.

- Use the features we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

Create this form in 5 minutes!

How to create an eSignature for the 1545 0074 department of the treasury internal revenue service no lo env e al irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'?

The number '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS' refers to the IRS requirements for certain tax forms. Understanding this number is essential for compliance when preparing your tax documentation. Using airSlate SignNow makes it easy to handle and eSign related documents securely.

-

How does airSlate SignNow streamline the process for documents related to '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'?

airSlate SignNow simplifies the document signing process necessary for compliance with '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'. Our platform ensures that documents are prepared and signed efficiently, reducing the time spent on administrative tasks.

-

What pricing plans are available for airSlate SignNow regarding IRS-related documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling documents related to '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'. Each plan includes essential features that allow for multiple document transactions, ensuring that you can find a solution that fits your budget.

-

Can airSlate SignNow integrate with other software to manage IRS forms effectively?

Yes, airSlate SignNow can seamlessly integrate with various software applications that may help manage forms subject to '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'. This integration boosts productivity by allowing users to import and export documents with ease.

-

What are the key features of airSlate SignNow that aid in compliant eSignature for IRS forms?

Key features of airSlate SignNow include secure eSigning, form templates for IRS compliance, and automated workflows centered around '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'. These tools have been designed to enhance accuracy and ensure compliance with federal regulations.

-

Is airSlate SignNow suitable for businesses of all sizes working with IRS documents?

Absolutely! airSlate SignNow is designed to be flexible for businesses of all sizes that need to manage documents related to '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS'. Whether you're a small startup or a large corporation, our platform scales to meet your needs.

-

What benefits does airSlate SignNow provide for eSigning IRS necessary documents?

Using airSlate SignNow for eSigning IRS documents tied to '1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS' provides numerous benefits including speed, efficiency, and legal validity of signed documents. This not only saves time but also ensures that your documents are compliant and readily accessible.

Get more for 1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

- Abt 6009 form

- Assured shorthold tenancy agreement docx form

- Bcal 5053 parent notification of the licensing notebook bcal 5053 parent notification of the licensing notebook michigan form

- Hit a thon pledge sheet 347806832 form

- Matka formula in excel

- Fill in dh 4015 08 09 form

- Certificate of medical examination texas form

- Implementing the cycle of success a case study form

Find out other 1545 0074 Department Of The Treasury Internal Revenue Service No Lo Env E Al IRS

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF