How to Begin ACH Payments Market USA Federal Credit Union Form

What is the How To Begin ACH Payments Market USA Federal Credit Union

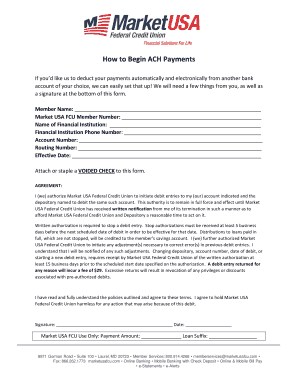

The How To Begin ACH Payments Market USA Federal Credit Union form is a crucial document for individuals and businesses looking to initiate Automated Clearing House (ACH) payments. ACH payments allow for the electronic transfer of funds between banks, streamlining the payment process for various transactions, including payroll, vendor payments, and bill payments. This form is specifically designed to capture the necessary information required by federal credit unions to process ACH transactions efficiently and securely.

Steps to complete the How To Begin ACH Payments Market USA Federal Credit Union

Completing the How To Begin ACH Payments Market USA Federal Credit Union form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information, including your account details and the recipient's information.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through your credit union's secure portal or as directed.

Legal use of the How To Begin ACH Payments Market USA Federal Credit Union

The legal use of the How To Begin ACH Payments Market USA Federal Credit Union form is governed by federal regulations that ensure the security and integrity of electronic transactions. To be considered legally binding, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These regulations establish that electronic signatures and records have the same legal standing as traditional paper documents, provided that the signers consent to use electronic means.

Key elements of the How To Begin ACH Payments Market USA Federal Credit Union

Key elements of the How To Begin ACH Payments Market USA Federal Credit Union form include:

- Account Information: Details about the account holder and their financial institution.

- Transaction Type: Specification of the nature of the payment, such as direct deposit or bill payment.

- Authorization Signature: A signature that confirms the account holder's consent to initiate the ACH transaction.

- Date of Authorization: The date when the authorization is granted, which is essential for record-keeping.

How to use the How To Begin ACH Payments Market USA Federal Credit Union

Using the How To Begin ACH Payments Market USA Federal Credit Union form is straightforward. After completing the form with the required details, you can submit it electronically through your credit union's online platform. Ensure that you have a secure internet connection to protect your personal and financial information. Once submitted, keep a copy of the form for your records, as it serves as proof of authorization for the ACH transaction.

Examples of using the How To Begin ACH Payments Market USA Federal Credit Union

Examples of using the How To Begin ACH Payments Market USA Federal Credit Union form include:

- Setting up direct deposit for payroll, allowing employees to receive their wages directly into their bank accounts.

- Automating monthly bill payments, such as utilities or mortgage payments, to ensure timely payments without manual intervention.

- Facilitating vendor payments, enabling businesses to pay suppliers electronically, improving efficiency and reducing processing time.

Quick guide on how to complete how to begin ach payments market usa federal credit union

Complete How To Begin ACH Payments Market USA Federal Credit Union effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage How To Begin ACH Payments Market USA Federal Credit Union on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to modify and electronically sign How To Begin ACH Payments Market USA Federal Credit Union with ease

- Acquire How To Begin ACH Payments Market USA Federal Credit Union and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight relevant sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign How To Begin ACH Payments Market USA Federal Credit Union and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to begin ach payments market usa federal credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the market for USA federal credit unions?

The market for USA federal credit unions comprises a network of member-owned financial institutions that provide various services, including savings accounts, loans, and e-signature solutions. These credit unions often focus on offering competitive interest rates and low fees, benefiting their members. Understanding the market dynamics is crucial for businesses aiming to serve this sector effectively.

-

How does airSlate SignNow help USA federal credit unions?

airSlate SignNow assists USA federal credit unions by streamlining the document management and e-signing process. With its intuitive interface, organizations can quickly send, sign, and store documents, which enhances operational efficiency. This ease of use helps credit unions serve their members better and reduce turnaround times signNowly.

-

What pricing plans does airSlate SignNow offer for USA federal credit unions?

airSlate SignNow provides a range of pricing plans tailored to fit the needs of USA federal credit unions, ensuring affordability and flexibility. These plans vary based on the number of users and features required, allowing credit unions to select an option that aligns with their budget. Overall, this cost-effective solution helps optimize document workflows without compromising on quality.

-

What features does airSlate SignNow offer for USA federal credit unions?

airSlate SignNow offers a comprehensive set of features specifically designed for USA federal credit unions, including customizable templates, multiple signing options, and audit trails. These tools allow credit unions to manage documents securely and efficiently. The platform's versatility ensures that it can meet the varied needs of different financial institutions.

-

Are there any integrations available for credit unions using airSlate SignNow?

Yes, airSlate SignNow provides seamless integrations with various software and platforms commonly used by USA federal credit unions. These integrations enhance productivity by allowing users to work within their existing systems while leveraging e-signature capabilities. By bridging technology, credit unions can streamline their processes and improve member experiences.

-

What are the benefits of using airSlate SignNow for USA federal credit unions?

Using airSlate SignNow offers numerous benefits for USA federal credit unions, including increased operational efficiency and enhanced member engagement. The platform reduces paperwork hassles and accelerates transaction times, which is crucial in today's fast-paced financial environment. Additionally, it enhances security and compliance, reassuring both institutions and their members.

-

How secure is airSlate SignNow for USA federal credit unions?

airSlate SignNow prioritizes security for USA federal credit unions by utilizing advanced encryption, secure cloud storage, and compliance with industry regulations. These features ensure that all documents and transactions are protected against unauthorized access. Credit unions can trust that their sensitive data is safeguarded throughout the signing process.

Get more for How To Begin ACH Payments Market USA Federal Credit Union

- Laboratory risk assessment example form

- Nyu wagner policy memo amp brief samples docx form

- Culvert inspection form

- Overland track refund application form for help accessing this document please email websiteparks tas gov au

- Cps application form

- Orange county public school orlando florida emergency student information

- Immunity agreement template form

Find out other How To Begin ACH Payments Market USA Federal Credit Union

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form