Publication 4512 C SP Rev 10 Form

Understanding Publication 4512 C SP Rev 10

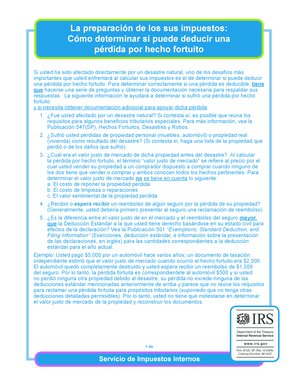

Publication 4512 C SP Rev 10 is an informational document released by the IRS that provides guidance on specific tax-related topics. It is designed to assist taxpayers in understanding their obligations and rights under U.S. tax law. This publication may cover various aspects of tax compliance, including eligibility criteria, disclosure requirements, and the proper use of tax forms. It serves as a reference for individuals and businesses to ensure they are following the correct procedures when filing their taxes.

Steps to Complete Publication 4512 C SP Rev 10

Completing Publication 4512 C SP Rev 10 involves several key steps. First, gather all necessary information and documents that pertain to your tax situation. This may include income statements, previous tax returns, and any relevant financial records. Next, carefully read through the publication to understand the specific instructions and requirements outlined by the IRS. Fill out the form accurately, ensuring that all information is complete and correct. Finally, review your submission before sending it to the IRS, either electronically or via mail, to avoid any potential issues.

Obtaining Publication 4512 C SP Rev 10

Taxpayers can obtain Publication 4512 C SP Rev 10 directly from the IRS website. It is available for download in PDF format, making it easy to access and print. Additionally, some tax professionals may provide copies of this publication as part of their services. It is important to ensure you have the most current version of the publication to comply with any recent changes in tax law.

Legal Use of Publication 4512 C SP Rev 10

Publication 4512 C SP Rev 10 is legally recognized as a valid resource for taxpayers. It outlines the rules and guidelines established by the IRS, and following its instructions can help ensure compliance with federal tax laws. Taxpayers are encouraged to refer to this publication to avoid penalties and to understand their rights and responsibilities when filing taxes.

Key Elements of Publication 4512 C SP Rev 10

Key elements of Publication 4512 C SP Rev 10 include detailed instructions on how to fill out related tax forms, eligibility criteria for various tax benefits, and disclosure requirements. The publication may also provide examples of common taxpayer scenarios, helping individuals understand how the information applies to their specific situations. Understanding these elements is crucial for accurate and compliant tax filing.

IRS Guidelines Related to Publication 4512 C SP Rev 10

The IRS provides specific guidelines regarding the use of Publication 4512 C SP Rev 10. These guidelines outline how and when to use the publication, the importance of adhering to its instructions, and the implications of non-compliance. Taxpayers should familiarize themselves with these guidelines to ensure they are meeting all necessary requirements and deadlines associated with their tax filings.

Quick guide on how to complete publication 4512 c sp rev 10

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS apps and ease any document-related operation today.

How to modify and eSign [SKS] seamlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious document searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Publication 4512 C SP Rev 10

Create this form in 5 minutes!

How to create an eSignature for the publication 4512 c sp rev 10

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 4512 C SP Rev 10?

Publication 4512 C SP Rev 10 is a comprehensive guide provided by the IRS, offering details on specific tax compliance requirements. It addresses various aspects of tax reporting and compliance that are crucial for businesses. Understanding this publication can help ensure that your business meets federal tax obligations.

-

How can airSlate SignNow help with Publication 4512 C SP Rev 10 compliance?

airSlate SignNow offers streamlined eSigning and document management solutions that can enhance your compliance with Publication 4512 C SP Rev 10. By utilizing our platform, businesses can easily prepare, send, and securely sign necessary tax documents. This reduces the risk of non-compliance and ensures that all signatures are legally valid.

-

What features of airSlate SignNow support compliance with Publication 4512 C SP Rev 10?

Key features of airSlate SignNow include secure eSigning, document workflows, and compliance tracking, all of which support adherence to Publication 4512 C SP Rev 10. Our platform allows users to manage documents efficiently while ensuring all required approvals are obtained in a timely manner. This reinforces both process integrity and compliance.

-

Is airSlate SignNow affordable for small businesses needing Publication 4512 C SP Rev 10 services?

Yes, airSlate SignNow offers a cost-effective solution that is particularly beneficial for small businesses managing Publication 4512 C SP Rev 10 requirements. Our pricing plans are designed to fit different budgets while providing the essential features you need for document management and eSigning. This ensures that small businesses can comply without incurring high costs.

-

Are there integrations available with airSlate SignNow for Publication 4512 C SP Rev 10?

AirSlate SignNow seamlessly integrates with various popular applications, enhancing your ability to manage Publication 4512 C SP Rev 10-related tasks. Users can connect our platform with tools like Google Drive, Dropbox, and CRM systems, streamlining the document workflow process. This integration facilitates easy access to documents and promotes better compliance.

-

Can airSlate SignNow assist with remote document signing related to Publication 4512 C SP Rev 10?

Absolutely! airSlate SignNow is designed to support remote document signing, allowing users to comply with Publication 4512 C SP Rev 10 from anywhere. Our platform provides a user-friendly interface that ensures signatures can be obtained quickly and securely, making it convenient for businesses in various locations.

-

What benefits does airSlate SignNow provide for managing Publication 4512 C SP Rev 10 documentation?

By using airSlate SignNow to manage Publication 4512 C SP Rev 10 documentation, businesses benefit from increased efficiency and reduced turnaround times. Our solution facilitates faster document preparation and signatures, ensuring that compliance requirements are met promptly. Additionally, the digital nature of our service minimizes paper use and storage concerns.

Get more for Publication 4512 C SP Rev 10

Find out other Publication 4512 C SP Rev 10

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template