Form 5305 a Rev March

What is the Form 5305 A Rev March

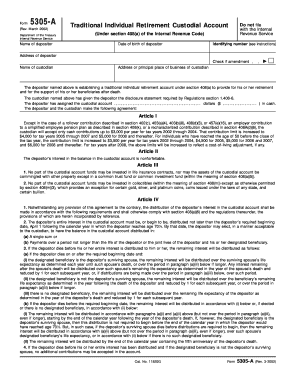

The Form 5305 A Rev March is an IRS document used primarily for establishing a simplified employee pension (SEP) plan. This form allows employers to provide retirement benefits to their employees in a straightforward manner. It is essential for small business owners and self-employed individuals looking to set up a retirement plan that is easy to administer and maintain.

How to use the Form 5305 A Rev March

To use the Form 5305 A Rev March, employers must complete the form accurately and ensure it meets the requirements set by the IRS. The form serves as a written agreement between the employer and employees regarding the SEP plan. Once completed, it must be kept on file, although it does not need to be submitted to the IRS. Employers should also provide employees with information about the SEP plan and their rights under it.

Steps to complete the Form 5305 A Rev March

Completing the Form 5305 A Rev March involves several key steps:

- Gather necessary information about the business and employees.

- Fill out the form, including details about the employer and the plan.

- Ensure compliance with IRS regulations regarding contributions and eligibility.

- Review the completed form for accuracy.

- Store the form in a safe place for record-keeping purposes.

Legal use of the Form 5305 A Rev March

The legal use of the Form 5305 A Rev March is critical for compliance with IRS regulations. Employers must adhere to the guidelines outlined in the form, including contribution limits and eligibility criteria. Failure to comply with these regulations can result in penalties and disqualification of the SEP plan, which may affect the tax benefits associated with it.

Key elements of the Form 5305 A Rev March

Key elements of the Form 5305 A Rev March include:

- Employer information, including name and address.

- Details about the SEP plan, including contribution amounts and eligibility requirements.

- Signatures of the employer and, if applicable, employees.

- Instructions for maintaining the plan and ensuring compliance with IRS rules.

Filing Deadlines / Important Dates

While the Form 5305 A Rev March itself does not need to be filed with the IRS, employers must be aware of important deadlines related to contributions. Contributions to the SEP plan must be made by the employer's tax return due date, including extensions. It is essential to keep track of these dates to ensure compliance and maximize tax benefits.

Eligibility Criteria

Eligibility criteria for the Form 5305 A Rev March include:

- Employees must be at least 21 years old.

- Employees must have worked for the employer for at least three of the last five years.

- Employees must have received at least $650 in compensation during the year.

Employers should review these criteria to determine which employees qualify for participation in the SEP plan.

Quick guide on how to complete form 5305 a rev march

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to alter and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 A Rev March

Create this form in 5 minutes!

How to create an eSignature for the form 5305 a rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 A Rev March used for?

The Form 5305 A Rev March is primarily used to establish a simplified employee pension plan (SEP) for self-employed individuals and small business owners. This form allows you to set up a retirement plan that is easy to maintain and offers tax advantages. By using the airSlate SignNow platform, you can quickly eSign this form and streamline your retirement planning.

-

How does airSlate SignNow facilitate signing the Form 5305 A Rev March?

airSlate SignNow provides an intuitive platform where you can upload, fill out, and eSign the Form 5305 A Rev March easily. With its user-friendly interface, you can ensure that all fields are completed correctly before submitting. This efficiency helps accelerate your SEP setup process.

-

What are the pricing options for using airSlate SignNow to manage documents like the Form 5305 A Rev March?

airSlate SignNow offers flexible pricing plans to cater to different business needs, starting from a budget-friendly option for small teams. For managing essential documents like the Form 5305 A Rev March, our plans include eSigning features and document management tools. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other tools to manage the Form 5305 A Rev March?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRMs and cloud storage solutions. This means you can easily manage documents like the Form 5305 A Rev March in conjunction with your other business processes. Integration boosts productivity by automating workflows.

-

What are the benefits of eSigning the Form 5305 A Rev March with airSlate SignNow?

eSigning the Form 5305 A Rev March with airSlate SignNow offers numerous benefits, including enhanced security, quicker turnaround times, and reduced paper waste. Our platform ensures that your sensitive information is protected while making the signing process more efficient. You can complete necessary paperwork from anywhere at any time.

-

Is airSlate SignNow compliant with legal standards for signing the Form 5305 A Rev March?

Absolutely! airSlate SignNow is fully compliant with federal eSignature laws, ensuring that your Form 5305 A Rev March is legally binding. This compliance guarantees that electronically signed documents hold the same legal validity as traditional paper signatures, giving you confidence in your contract management.

-

How can I track the status of my Form 5305 A Rev March submissions in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Form 5305 A Rev March submissions. Our platform provides real-time updates, allowing you to see when documents are viewed, signed, and completed. This feature keeps you informed throughout the entire signing process.

Get more for Form 5305 A Rev March

- Charmilles machine manuals form

- Spouse consent letter for loan form

- Nfcu delaration of forgery fraud form

- St louis withholding tax forms

- Eagle scout rank bapplicationb intake cover page form

- Omico traffic accident report form old mutual zimbabwe oldmutual co

- Easy crossword 18 by dave fisher puzzles form

- Formsvmp

Find out other Form 5305 A Rev March

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online