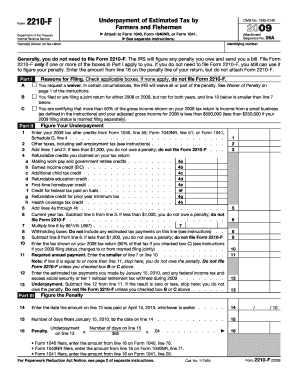

Form 2210 F Underpayment of Estimated Tax by Farmers and Fishermen Attach to Form 1040, Form 1040NR, or Form 1041

Understanding Form 2210 F for Farmers and Fishermen

Form 2210 F is specifically designed for farmers and fishermen to report their underpayment of estimated tax. This form allows these individuals to calculate any penalties for not paying enough tax throughout the year. It is important to attach Form 2210 F to your individual income tax return, which could be Form 1040, Form 1040NR, or Form 1041, depending on your filing status. Farmers and fishermen often have unique income patterns that can affect their tax obligations, making this form essential for accurate reporting.

How to Use Form 2210 F

To use Form 2210 F, begin by gathering your income information for the tax year. This includes all earnings from farming or fishing activities. The form guides you through the process of calculating the required estimated tax payments based on your income. After completing the calculations, you will determine if you owe any penalties for underpayment. Ensure that you attach this form to your main tax return to avoid complications with the IRS.

Steps to Complete Form 2210 F

Completing Form 2210 F involves several key steps:

- Gather your income documentation, including any relevant 1099 forms.

- Calculate your total income from farming or fishing activities.

- Determine your required estimated tax payments based on your income.

- Fill out Form 2210 F, following the instructions carefully to ensure accuracy.

- Attach Form 2210 F to your main tax return, such as Form 1040, Form 1040NR, or Form 1041.

Double-check your calculations to minimize the risk of errors that could lead to penalties.

Key Elements of Form 2210 F

Form 2210 F includes several important sections that are crucial for accurate tax reporting. Key elements include:

- Taxpayer Information: This section requires your name, Social Security number, and other identifying information.

- Income Calculation: Here, you will report your total income from farming and fishing activities.

- Penalty Calculation: This section helps you determine if you owe a penalty for underpayment of estimated taxes.

- Signature: You must sign and date the form to validate your submission.

Filing Deadlines for Form 2210 F

It is essential to be aware of the filing deadlines for Form 2210 F. Typically, the form must be submitted alongside your tax return by the standard tax filing deadline, which is usually April 15 for most taxpayers. However, if you file for an extension, ensure that you still submit Form 2210 F by the extended deadline to avoid penalties.

Obtaining Form 2210 F

You can obtain Form 2210 F through the IRS website, where it is available for download in PDF format. Additionally, you may find printed copies at local IRS offices or request them via mail. Ensure you are using the most current version of the form to comply with IRS regulations.

Quick guide on how to complete form 2210 f underpayment of estimated tax by farmers and fishermen attach to form 1040 form 1040nr or form 1041

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow offers all the resources required to create, edit, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most efficient way to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you’d like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041

Create this form in 5 minutes!

How to create an eSignature for the form 2210 f underpayment of estimated tax by farmers and fishermen attach to form 1040 form 1040nr or form 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen?

The Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen allows eligible individuals to calculate and report any underpaid estimated taxes specifically for farmers and fishermen. This form is essential for those who earn income in these sectors and need to ensure compliance when filing Form 1040, Form 1040NR, or Form 1041.

-

How can airSlate SignNow help me with filing Form 2210 F?

airSlate SignNow simplifies the process of managing your documentation, including the Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041. Our platform ensures you can eSign and send essential tax forms quickly and securely, allowing you to focus more on your farming or fishing operations.

-

Are there any costs associated with using airSlate SignNow for Form 2210 F?

Using airSlate SignNow is a cost-effective solution as it offers various pricing plans that cater to different business needs. You can access features that facilitate the eSigning of Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041 at competitive rates.

-

What features does airSlate SignNow provide for tax form management?

airSlate SignNow offers features such as document templates, real-time tracking, and secure cloud storage, which enhance the management of your tax documents. This includes the ability to efficiently handle the Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen, ensuring that it is easily accessible and ready to attach to different tax forms.

-

Is it secure to use airSlate SignNow for tax documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information. This ensures that when you eSign and manage Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041, your data remains safe and confidential.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow provides integration capabilities with a variety of tax preparation and accounting software. This functionality facilitates the seamless management of Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041, allowing you to streamline your workflow.

-

What are the benefits of using airSlate SignNow for tax submissions?

Using airSlate SignNow for your tax submissions offers numerous benefits, including speed, efficiency, and improved accuracy. By utilizing our platform to manage the Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen, you can ensure timely submissions with less hassle when attaching it to Form 1040, Form 1040NR, or Form 1041.

Get more for Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041

- Interpretation of infrared spectra a practical approach form

- Home contents inventory worksheet nycm com form

- Agrat bat mahlat sigil form

- Prayers of the faithful examples form

- Gregs post form

- Port harcourt electricity distribution company phed form

- Affidavit of residency nevada form

- Black brother black brother pdf form

Find out other Form 2210 F Underpayment Of Estimated Tax By Farmers And Fishermen Attach To Form 1040, Form 1040NR, Or Form 1041

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document