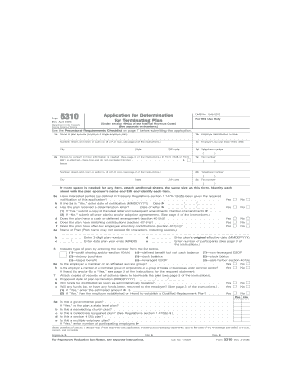

Form 5310 Rev April Application for Determination for Terminating Plan

What is the Form 5310 Rev April Application For Determination For Terminating Plan

The Form 5310 Rev April is an official document utilized by plan sponsors to request a determination from the Internal Revenue Service (IRS) regarding the qualified status of a terminating retirement plan. This form is essential for ensuring that the plan meets all necessary legal requirements before termination. By obtaining a favorable determination letter, plan sponsors can provide assurance to participants and beneficiaries that their accrued benefits will be protected and distributed appropriately.

How to use the Form 5310 Rev April Application For Determination For Terminating Plan

Using the Form 5310 Rev April involves several key steps. First, plan sponsors should gather all relevant information about the retirement plan, including participant data and plan documents. Next, the form must be completed accurately, ensuring that all required sections are filled out. Once completed, the form should be submitted to the IRS along with any necessary supporting documentation. It is important to follow IRS guidelines to avoid delays in processing.

Steps to complete the Form 5310 Rev April Application For Determination For Terminating Plan

Completing the Form 5310 Rev April requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information about the retirement plan, including the plan document and participant records.

- Fill out the form, ensuring that all sections are completed accurately.

- Attach any required supporting documents, such as financial statements and participant data.

- Review the entire application for completeness and accuracy.

- Submit the form to the IRS, either electronically or via mail, depending on the specific filing requirements.

Required Documents

When submitting the Form 5310 Rev April, certain documents must be included to support the application. These typically include:

- The plan document and any amendments.

- Financial statements for the plan.

- Participant census data, detailing the number of participants and their accrued benefits.

- Any prior determination letters from the IRS related to the plan.

Filing Deadlines / Important Dates

It is crucial for plan sponsors to be aware of filing deadlines associated with the Form 5310 Rev April. Generally, the form should be filed within a specific time frame following the plan’s termination date. Failure to submit the form on time may result in penalties or complications in the determination process. Keeping track of these deadlines ensures compliance with IRS regulations and helps facilitate a smooth termination process.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 5310 Rev April. These guidelines outline the necessary information required, the format for submission, and any additional documentation needed. Adhering to these guidelines is essential for obtaining a timely and favorable determination from the IRS. It is advisable for plan sponsors to review these guidelines thoroughly before proceeding with the application.

Quick guide on how to complete form 5310 rev april application for determination for terminating plan

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all information and click on the Done button to save your updates.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Edit and eSign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5310 Rev April Application For Determination For Terminating Plan

Create this form in 5 minutes!

How to create an eSignature for the form 5310 rev april application for determination for terminating plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5310 Rev April Application For Determination For Terminating Plan?

The Form 5310 Rev April Application For Determination For Terminating Plan is a crucial document for businesses looking to terminate their retirement plans. This application seeks a determination from the IRS regarding the tax-qualified status of the plan upon termination. AirSlate SignNow simplifies this process, allowing you to eSign and send these documents seamlessly.

-

How can airSlate SignNow assist with the Form 5310 Rev April Application?

AirSlate SignNow provides an efficient platform for completing and submitting the Form 5310 Rev April Application For Determination For Terminating Plan. Our solution enables you to fill out the form electronically, ensuring accuracy and compliance while allowing for quick eSigning. This streamlines the submission process to the IRS, helping you save time and effort.

-

What pricing options are available for using airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to meet different business needs, including a monthly subscription and annual plans. These plans include features designed to facilitate the completion and submission of important documents like the Form 5310 Rev April Application For Determination For Terminating Plan. With our cost-effective solution, you can choose a plan that best fits your usage requirements.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow offers a range of features designed to enhance document management, including customizable templates, real-time tracking, and secure cloud storage. You can easily manage the Form 5310 Rev April Application For Determination For Terminating Plan along with other essential documents. These features contribute to streamlining the overall process and improving efficiency.

-

Is airSlate SignNow compliant with legal standards for eSigning documents?

Yes, airSlate SignNow is fully compliant with legal standards such as the ESIGN Act and UETA, ensuring that your electronic signatures on documents like the Form 5310 Rev April Application For Determination For Terminating Plan are legally binding. We prioritize security and compliance, giving you peace of mind as you manage your essential documents electronically.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as CRMs, project management tools, and cloud storage services. These integrations enhance your workflow and ensure that the Form 5310 Rev April Application For Determination For Terminating Plan can be easily managed alongside your other business processes.

-

What benefits does airSlate SignNow offer for business efficiency?

Using airSlate SignNow greatly enhances business efficiency by streamlining the document signing process. With features like bulk sending and automated reminders, you can ensure timely completion of documents, such as the Form 5310 Rev April Application For Determination For Terminating Plan. This efficiency ultimately leads to faster decision-making and smooth business operations.

Get more for Form 5310 Rev April Application For Determination For Terminating Plan

Find out other Form 5310 Rev April Application For Determination For Terminating Plan

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form