Tax Return for Trustees of Registered Pension Schemes 2023-2026

What is the Tax Return for Trustees of Registered Pension Schemes

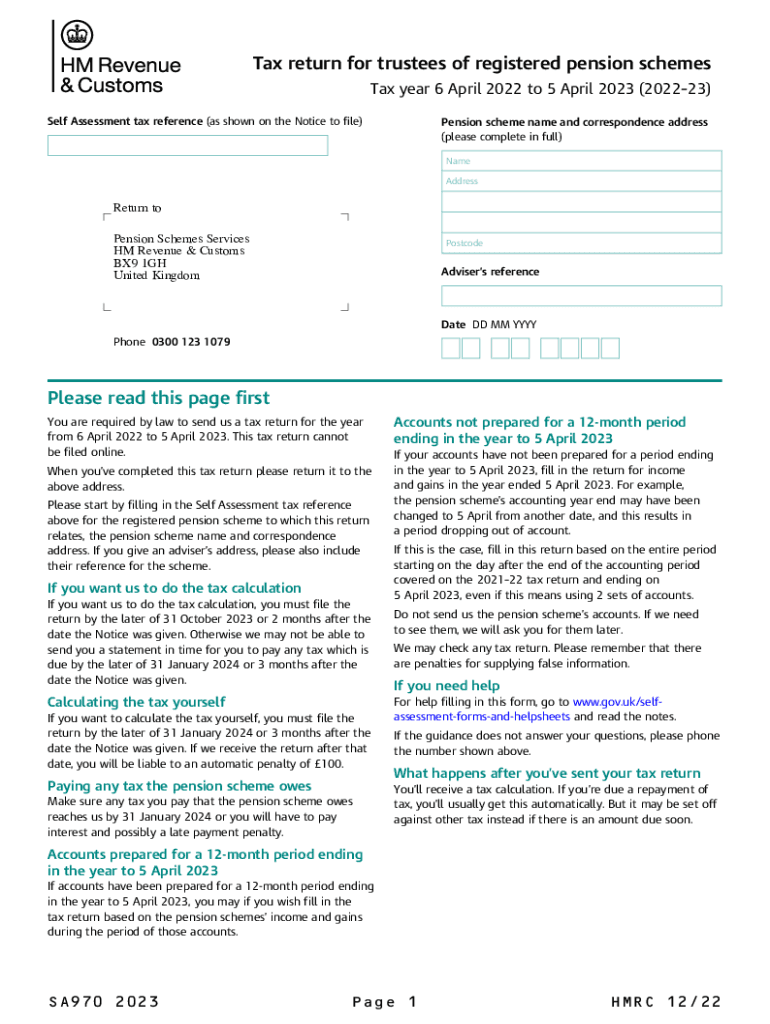

The Tax Return for Trustees of Registered Pension Schemes, commonly referred to as the sa970, is a specific form used by trustees to report income and expenditures related to registered pension schemes in the United States. This form is essential for ensuring compliance with IRS regulations and maintaining the tax-exempt status of the pension scheme. By accurately completing the sa970, trustees provide necessary information about the financial activities of the pension scheme, which helps the IRS assess the scheme's adherence to tax laws.

How to Use the Tax Return for Trustees of Registered Pension Schemes

Using the sa970 involves a systematic approach to ensure all required information is accurately reported. Trustees must gather financial records, including income statements, expense reports, and investment details. Once the necessary documentation is collected, trustees can fill out the form, detailing the scheme's financial activities for the reporting period. It is crucial to review the completed form for accuracy before submission, as errors can lead to penalties or delays in processing.

Steps to Complete the Tax Return for Trustees of Registered Pension Schemes

Completing the sa970 involves several key steps:

- Gather all relevant financial documents, including income and expenditure records.

- Fill out the form with accurate and complete information regarding the pension scheme's financial activities.

- Review the completed form for any errors or omissions to ensure compliance with IRS guidelines.

- Submit the form electronically or via mail, following the specified submission methods.

Legal Use of the Tax Return for Trustees of Registered Pension Schemes

The sa970 form serves a legal purpose by documenting the financial activities of registered pension schemes. Proper completion and submission of this form are vital for maintaining compliance with federal tax laws. The information provided helps the IRS determine whether the pension scheme meets the necessary criteria for tax-exempt status. Failure to file the sa970 or inaccuracies in reporting can result in penalties, loss of tax-exempt status, or other legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the sa970 is crucial to avoid penalties. The IRS typically sets specific deadlines for submitting this form, which may vary based on the fiscal year of the pension scheme. Trustees should be aware of these deadlines to ensure compliance. It is advisable to check the IRS website or consult a tax professional for the most current filing dates and any potential extensions that may apply.

Required Documents

To complete the sa970, trustees must prepare several essential documents, including:

- Income statements detailing all sources of revenue for the pension scheme.

- Expense reports that outline all expenditures incurred during the reporting period.

- Investment records that reflect the scheme's asset management activities.

- Previous tax returns, if applicable, to maintain consistency in reporting.

Form Submission Methods

The sa970 can be submitted through various methods, including electronic filing and traditional mail. Electronic submission is often preferred for its efficiency and faster processing times. Trustees should ensure they follow the IRS guidelines for the chosen submission method to avoid any complications. If submitting by mail, it is recommended to use certified mail for tracking purposes.

Quick guide on how to complete tax return for trustees of registered pension schemes

Manage Tax Return For Trustees Of Registered Pension Schemes effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Tax Return For Trustees Of Registered Pension Schemes on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Tax Return For Trustees Of Registered Pension Schemes with ease

- Obtain Tax Return For Trustees Of Registered Pension Schemes and then click Get Form to commence.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Tax Return For Trustees Of Registered Pension Schemes and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return for trustees of registered pension schemes

Create this form in 5 minutes!

How to create an eSignature for the tax return for trustees of registered pension schemes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA970 and how does it relate to airSlate SignNow?

The SA970 is a powerful feature within airSlate SignNow that streamlines the document signing process. This feature ensures that businesses can easily send and eSign documents, reducing the time and effort typically associated with manual signatures. Leveraging SA970 allows users to implement efficient workflows and enhance their operational efficiency.

-

How much does airSlate SignNow with the SA970 feature cost?

Pricing for airSlate SignNow, which includes the SA970 feature, starts at a competitive rate designed to accommodate various business needs. The cost can vary based on the number of users and specific feature requirements. To get the best value, explore our pricing plans and choose an option that suits your budget.

-

What are the key benefits of using airSlate SignNow’s SA970 feature?

The SA970 feature provides numerous benefits, including improved efficiency in document processing and enhanced security for electronic signatures. By using airSlate SignNow, businesses can signNowly reduce turnaround times and minimize paper usage, contributing to a more sustainable operation. Additionally, the user-friendly interface ensures that all team members can utilize SA970 effectively, regardless of their technical skills.

-

Can SA970 integrate with other software applications?

Yes, the SA970 feature within airSlate SignNow can seamlessly integrate with a variety of applications, including popular CRM and cloud storage platforms. This integration allows for a smoother transition of documents and data across systems, improving overall productivity. Check our integrations page to see a full list of compatible applications.

-

Is training required to use the SA970 feature in airSlate SignNow?

While the SA970 feature is designed to be intuitive and user-friendly, training resources are available to help users fully leverage its capabilities. airSlate SignNow provides tutorials, webinars, and customer support to ensure you can navigate the feature easily. Investing some time in learning about SA970 will enable your team to maximize its potential benefits.

-

What types of businesses can benefit from the SA970 feature?

The SA970 feature is beneficial for a wide range of businesses, from small startups to large enterprises. Any organization that requires the electronic signing of documents, such as contracts or agreements, can streamline operations using airSlate SignNow. Industries like real estate, finance, and healthcare particularly benefit from the efficiency and security that SA970 offers.

-

How does SA970 ensure the security of eSignatures?

airSlate SignNow implements robust security protocols to protect eSignatures processed through the SA970 feature. This includes encryption technology and compliance with legal standards for digital signatures. By using SA970, businesses can rest assured that their documents are securely signed and stored, meeting regulatory requirements.

Get more for Tax Return For Trustees Of Registered Pension Schemes

Find out other Tax Return For Trustees Of Registered Pension Schemes

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT