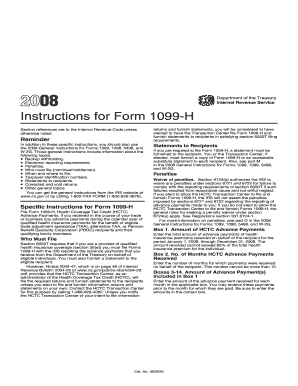

Instructions for Form 1099 H Instructions for Form 1099 H, Health Coverage Tax Credit HCTC Advance Payments

Understanding Form 1099-H and Its Purpose

The Instructions for Form 1099-H pertain to the Health Coverage Tax Credit (HCTC) and its advance payments. This form is specifically designed for individuals who are eligible for the HCTC, allowing them to receive advance payments for health insurance premiums. The HCTC is a federal tax credit that assists certain individuals in covering their health insurance costs, particularly those who have lost their jobs due to trade-related issues or who are receiving pension benefits from the Pension Benefit Guaranty Corporation. Understanding the purpose of Form 1099-H is essential for eligible taxpayers to ensure they correctly report their advance payments on their tax returns.

Steps to Complete Form 1099-H

Completing Form 1099-H involves several specific steps to ensure accuracy. First, gather all necessary information, including your personal details and the amounts of advance payments received. Next, fill out the form by providing your name, address, and taxpayer identification number. You will also need to report the total advance payments received during the tax year. Once completed, review the form for any errors before submitting it to the appropriate tax authorities. It is important to keep a copy of the form for your records, as you will need it when filing your tax return.

Eligibility Criteria for HCTC

To qualify for the Health Coverage Tax Credit and use Form 1099-H, individuals must meet specific eligibility criteria. Generally, you must be receiving benefits from the Pension Benefit Guaranty Corporation or have been adversely affected by international trade. Additionally, you must be enrolled in qualified health insurance coverage. It is crucial to verify your eligibility before applying for the HCTC to avoid complications during the tax filing process.

Filing Deadlines for Form 1099-H

Filing deadlines for Form 1099-H are critical to ensure compliance with IRS regulations. Typically, the form must be submitted to the IRS by January 31 of the year following the tax year for which the advance payments were made. If you are providing copies to recipients, those should also be distributed by the same deadline. Staying aware of these deadlines helps avoid potential penalties and ensures that you receive any tax credits you are entitled to.

Required Documents for Completing Form 1099-H

When completing Form 1099-H, certain documents are necessary to provide accurate information. You will need your Social Security number or taxpayer identification number, documentation of the advance payments received, and records of your health insurance coverage. Having these documents readily available simplifies the process and ensures that all information reported on the form is correct.

Form Submission Methods

Form 1099-H can be submitted through various methods, including online filing, mailing, or in-person submission. For online filing, many taxpayers choose to use tax preparation software that supports Form 1099-H. Alternatively, you can mail the completed form to the IRS or deliver it in person at a local IRS office. Each method has its own advantages, so it is important to choose the one that best fits your needs and ensures timely submission.

Potential Penalties for Non-Compliance

Failure to comply with the requirements for Form 1099-H can result in penalties imposed by the IRS. These penalties may include fines for late filing or failure to file altogether. Additionally, if incorrect information is reported, you may face further penalties. It is essential to understand the implications of non-compliance and to ensure that all forms are completed accurately and submitted on time to avoid unnecessary financial repercussions.

Quick guide on how to complete instructions for form 1099 h instructions for form 1099 h health coverage tax credit hctc advance payments

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance every document-based process today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure confidential information with tools specifically designed for that function by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure seamless communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1099 h instructions for form 1099 h health coverage tax credit hctc advance payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 1099 H, Health Coverage Tax Credit HCTC Advance Payments?

The Instructions For Form 1099 H provide guidance on claiming the Health Coverage Tax Credit for those eligible for HCTC advance payments. This form assists taxpayers in reporting their health coverage costs accurately and understanding eligibility criteria for the credit.

-

How can airSlate SignNow help me complete my Instructions For Form 1099 H?

airSlate SignNow offers an easy-to-use platform to manage and eSign documents digitally. By utilizing our service, you can securely complete the Instructions For Form 1099 H and ensure all information is correctly filled and submitted, simplifying your tax process.

-

Is airSlate SignNow cost-effective for handling tax-related documents?

Yes, airSlate SignNow provides a cost-effective solution for managing tax documents. Our pricing plans are designed to suit various business needs, making it affordable to easily process Instructions For Form 1099 H and other tax-related forms.

-

What features does airSlate SignNow offer to assist with tax documentation?

airSlate SignNow offers features like custom templates, secure cloud storage, and real-time tracking of documents. These features enhance your ability to efficiently manage Instructions For Form 1099 H and ensure timely submission of Health Coverage Tax Credit HCTC Advance Payments.

-

Are there integrations available with airSlate SignNow for financial software?

Absolutely! airSlate SignNow integrates seamlessly with various financial software, allowing for efficient document processing. This makes it easy to incorporate Instructions For Form 1099 H with your existing HCTC management tools.

-

How secure is the information shared while using airSlate SignNow for tax forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that all information, including Instructions For Form 1099 H, is kept secure while you manage your Health Coverage Tax Credit HCTC Advance Payments.

-

Can I track the progress of my documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents. Whether it's the Instructions For Form 1099 H or any other tax-related documents, you can easily monitor their status and ensure everything is on track for your Health Coverage Tax Credit HCTC Advance Payments.

Get more for Instructions For Form 1099 H Instructions For Form 1099 H, Health Coverage Tax Credit HCTC Advance Payments

Find out other Instructions For Form 1099 H Instructions For Form 1099 H, Health Coverage Tax Credit HCTC Advance Payments

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement