Schedule D Form 1065 Fill in Capable

What is the Schedule D Form 1065 Fill In Capable

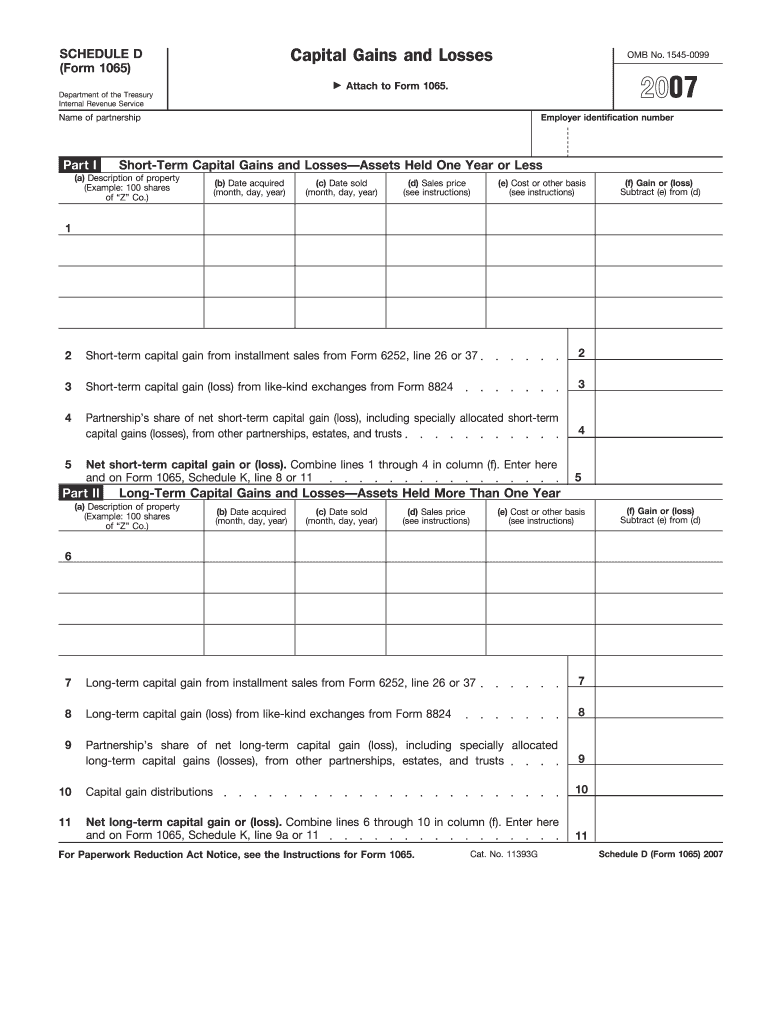

The Schedule D Form 1065 is a tax form used by partnerships to report capital gains and losses. This form is crucial for determining the tax implications of asset sales or exchanges within a partnership. It provides a detailed account of the partnership's capital transactions, allowing the Internal Revenue Service (IRS) to assess the tax liability accurately. The "Fill In Capable" aspect indicates that the form can be completed digitally, making it easier for users to input their information without the need for paper forms.

How to use the Schedule D Form 1065 Fill In Capable

Using the Schedule D Form 1065 Fill In Capable involves several straightforward steps. First, access the form through a digital platform that supports electronic filling. Begin by entering the partnership's identifying information, including the name, address, and Employer Identification Number (EIN). Next, input the details of each capital asset transaction, including the date acquired, date sold, sales price, and cost basis. After completing all sections, review the form for accuracy before submitting it electronically or printing it for mailing.

Steps to complete the Schedule D Form 1065 Fill In Capable

Completing the Schedule D Form 1065 Fill In Capable requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as previous tax returns and records of asset transactions.

- Open the digital form and input the partnership's basic information.

- List each capital asset transaction, ensuring to include all required details like acquisition and sale dates.

- Calculate the total capital gains and losses by following the provided instructions on the form.

- Review the completed form for any errors or missing information.

- Submit the form electronically or print it for mailing to the IRS.

Key elements of the Schedule D Form 1065 Fill In Capable

The Schedule D Form 1065 includes several key elements essential for accurate reporting. These elements consist of:

- Part I: This section summarizes short-term capital gains and losses.

- Part II: This section details long-term capital gains and losses.

- Part III: This section reconciles the total capital gains and losses with the partnership's overall income.

- Supporting documentation: Any additional schedules or statements that provide further details about transactions.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1065 are crucial to avoid penalties. Generally, partnerships must file their tax returns, including this form, by the fifteenth day of the third month after the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can file for an extension, which typically grants an additional six months.

Penalties for Non-Compliance

Failure to file the Schedule D Form 1065 accurately and on time can result in significant penalties. The IRS may impose fines for late filing, which can accumulate daily. Additionally, incorrect reporting of capital gains and losses may lead to further scrutiny and potential audits. It is essential for partnerships to ensure compliance to avoid these financial repercussions.

Quick guide on how to complete schedule d form 1065 fill in capable

Manage [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential parts of your documents or obscure sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule D Form 1065 Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1065 fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule D Form 1065 Fill In Capable feature?

The Schedule D Form 1065 Fill In Capable feature allows users to easily complete and eSign the Schedule D form required for partnership tax filings. It simplifies tax reporting by offering a user-friendly interface that ensures accurate data entry and compliance. With this feature, businesses can streamline their tax preparation processes efficiently.

-

How can I access the Schedule D Form 1065 Fill In Capable feature?

To access the Schedule D Form 1065 Fill In Capable feature, you need to sign up for an account with airSlate SignNow. Once registered, you can navigate to the tax forms section and select the Schedule D Form 1065 to start filling it out. The platform provides intuitive guidance for all users.

-

Is there a cost associated with using the Schedule D Form 1065 Fill In Capable feature?

Yes, the Schedule D Form 1065 Fill In Capable feature is included in our subscription plans for airSlate SignNow. We offer various pricing tiers to suit different business needs. You can choose a plan that best fits your usage, ensuring access to this essential feature without hidden fees.

-

What are the benefits of using the Schedule D Form 1065 Fill In Capable feature?

The Schedule D Form 1065 Fill In Capable feature offers many benefits including increased accuracy and efficiency in tax filing. It also reduces the risk of errors and omissions that can lead to costly penalties. Additionally, it saves time with automated data entry and seamless eSigning processes.

-

Can I integrate the Schedule D Form 1065 Fill In Capable feature with other software?

Absolutely! The Schedule D Form 1065 Fill In Capable feature integrates smoothly with popular accounting and tax preparation software. This allows for easy data transfer, helping you maintain consistent records across your financial platforms. Check our integrations page for a complete list of compatible software.

-

How does airSlate SignNow ensure the security of the Schedule D Form 1065 Fill In Capable feature?

AirSlate SignNow prioritizes security by implementing industry-standard encryption and compliance practices when you use the Schedule D Form 1065 Fill In Capable feature. Your sensitive tax information is protected at all times during data transmission and storage. We adhere to strict security protocols to ensure your peace of mind.

-

What support options are available for users of the Schedule D Form 1065 Fill In Capable feature?

Users of the Schedule D Form 1065 Fill In Capable feature have access to comprehensive support options including live chat, email assistance, and a detailed knowledge base. Our support team is dedicated to helping you navigate any questions or issues you may encounter. You're never alone when using our platform.

Get more for Schedule D Form 1065 Fill In Capable

Find out other Schedule D Form 1065 Fill In Capable

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order