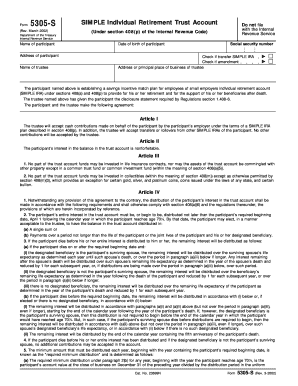

5305 S Form

What is the 5305 S

The 5305 S is a specific form used by the Internal Revenue Service (IRS) for tax-related purposes. This form is primarily utilized for the purpose of establishing a Simplified Employee Pension (SEP) plan, which allows employers to make contributions to their employees' retirement savings. It is essential for businesses looking to provide retirement benefits while enjoying certain tax advantages.

How to use the 5305 S

To effectively use the 5305 S, employers must complete the form accurately and submit it to the IRS. The form serves as a declaration of the employer's intention to establish a SEP plan. Once submitted, the employer can start making contributions on behalf of eligible employees. It is important to ensure that all information is correct to avoid any potential issues with the IRS.

Steps to complete the 5305 S

Completing the 5305 S involves several key steps:

- Gather necessary information about the business and employees.

- Fill out the form with accurate details, including the employer's name, address, and tax identification number.

- Specify the contribution amounts and any other relevant details regarding the SEP plan.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS, ensuring that it is filed by the appropriate deadlines.

Legal use of the 5305 S

The legal use of the 5305 S is governed by IRS regulations. Employers must adhere to the guidelines set forth by the IRS to ensure compliance. This includes maintaining records of contributions and ensuring that the plan meets all legal requirements. Failure to comply with these regulations can result in penalties or disqualification of the SEP plan.

Filing Deadlines / Important Dates

Filing deadlines for the 5305 S are crucial for compliance. Employers should be aware of the following important dates:

- The form must be submitted by the due date of the employer’s tax return, including extensions.

- Contributions to the SEP plan must be made by the tax filing deadline for the year in which they are claimed.

Required Documents

When completing the 5305 S, certain documents may be required to support the information provided. These can include:

- Employer identification number (EIN).

- Records of employee eligibility and contributions.

- Any prior forms related to retirement plans, if applicable.

Quick guide on how to complete 5305 s

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents promptly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 5305 S

Create this form in 5 minutes!

How to create an eSignature for the 5305 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for 5305 S. with airSlate SignNow?

The pricing for 5305 S. varies based on the features you choose. airSlate SignNow offers different plans to accommodate various business sizes and needs. You can select a subscription plan that best suits your budget while getting access to essential eSigning functionalities.

-

What features are included in the 5305 S. plan?

The 5305 S. plan includes a variety of features designed to streamline your document signing process. You can expect functionalities such as unlimited eSignatures, customizable templates, and real-time tracking of documents. These features help enhance productivity and improve the overall user experience.

-

How can 5305 S. benefit my business?

5305 S. offers signNow benefits for businesses looking to simplify their document workflows. With airSlate SignNow, you can reduce turnaround times, increase efficiency, and minimize the risks associated with paper-based processes. This transition can ultimately lead to increased customer satisfaction and improved compliance.

-

Are there any integrations available with 5305 S.?

Yes, 5305 S. provides integrations with a variety of popular business tools and applications. You can easily connect airSlate SignNow with platforms like Google Drive, Salesforce, and Dropbox, among others. These integrations facilitate a seamless flow of documents, enhancing your team’s ability to collaborate effectively.

-

Is there a mobile app for 5305 S.?

Absolutely! airSlate SignNow offers a mobile app compatible with 5305 S., allowing you to manage and sign documents on the go. This mobile functionality ensures that you can access your documents anytime, anywhere, making it convenient for busy professionals who need flexibility in their workflow.

-

What security measures are in place for 5305 S. users?

Security is a top priority with 5305 S. airSlate SignNow employs industry-standard encryption protocols to ensure your documents are protected. Additionally, the platform complies with various regulations, including GDPR and HIPAA, providing peace of mind for businesses that handle sensitive information.

-

Can I customize documents with 5305 S.?

Yes, one of the standout features of 5305 S. is the ability to customize your documents. With airSlate SignNow, you can create templates, add logos, and modify fields to fit your brand’s requirements. This customization enhances your professional image while providing a more tailored experience for your clients.

Get more for 5305 S

- How to fill placement form

- Asthma action planmedication authorization form cms k12 nc

- New mexico office of the state engineer meter reading email form

- No claim certificate 259241165 form

- Practical math for veterinary technicians form

- Firearm statement of ownership texas form

- Wheelchair application form

- Power of attorney affidavit and indemnification form

Find out other 5305 S

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement