Employer's Withholding of State Income Tax Hawaii Tax 2022-2026

Understanding the California DE 4 Form

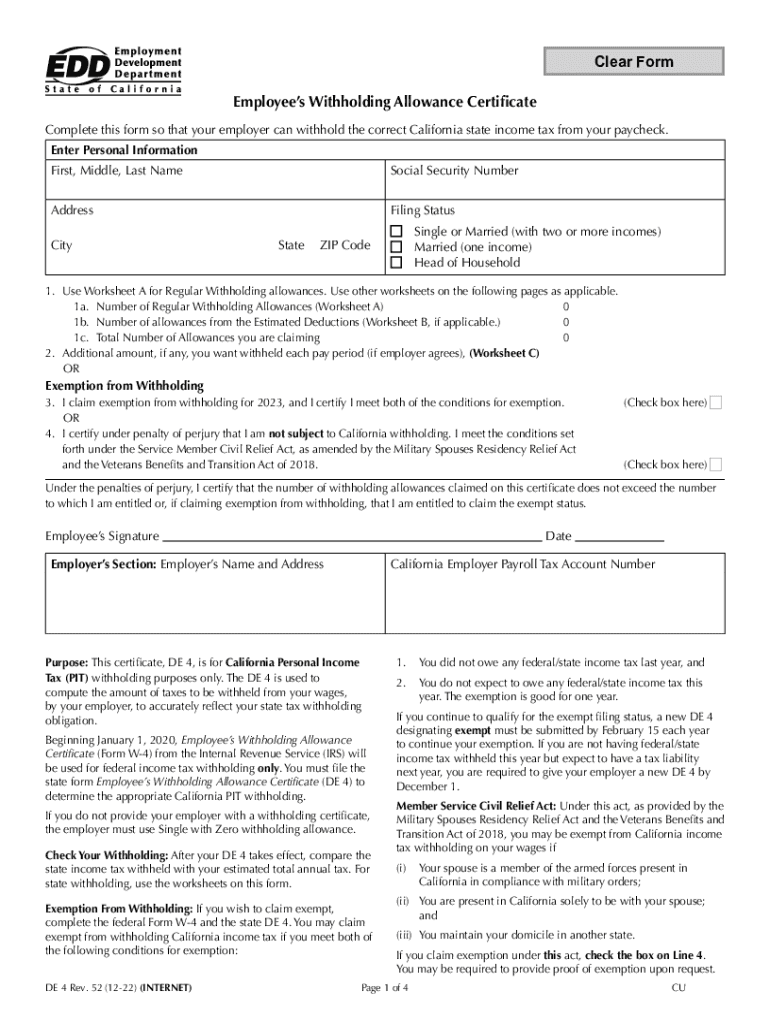

The California DE 4 form, also known as the California Withholding Allowance Certificate, is essential for employees in the state to determine the amount of state income tax withheld from their paychecks. This form allows individuals to claim allowances based on their personal circumstances, such as dependents and other tax credits. Accurately completing the DE 4 form ensures that the correct amount of tax is withheld, helping to avoid underpayment or overpayment issues when filing state income tax returns.

Steps to Complete the California DE 4 Form

Filling out the California DE 4 form involves several straightforward steps:

- Personal Information: Begin by entering your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate the number of allowances you are entitled to claim. This includes personal allowances for yourself and your dependents.

- Additional Withholding: If you wish to have extra amounts withheld from your paycheck, specify that amount in the appropriate section.

- Signature: Sign and date the form to validate your information.

Legal Use of the California DE 4 Form

The DE 4 form is legally recognized by the California Employment Development Department (EDD) as a valid document for determining state income tax withholding. It is crucial for employees to submit this form to their employers to ensure compliance with state tax laws. Failure to provide accurate information can lead to incorrect withholding amounts, which may result in penalties or tax liabilities.

Key Elements of the California DE 4 Form

Several key elements must be understood when working with the DE 4 form:

- Allowances: Each allowance claimed reduces the amount of income subject to withholding.

- Additional Withholding: This option allows employees to request more tax to be withheld if they expect to owe taxes at the end of the year.

- Updates: Employees should update their DE 4 form whenever there are significant changes in their financial situation, such as marriage or the birth of a child.

Filing Deadlines and Important Dates

It is important to be aware of deadlines related to the DE 4 form. Employees should submit their completed forms to their employers as soon as they start a new job or experience changes in their tax situation. Employers are required to implement the withholding adjustments based on the DE 4 form promptly. Additionally, understanding the tax filing deadlines for California can help ensure that individuals are prepared for their tax obligations.

Penalties for Non-Compliance

Failure to complete and submit the California DE 4 form accurately can lead to penalties. If an employee does not provide the correct withholding information, they may face under-withholding, resulting in a tax bill at the end of the year. Additionally, employers who fail to withhold the correct amount may also incur penalties from the state. Therefore, it is essential to ensure that the DE 4 form is completed correctly and submitted on time.

Quick guide on how to complete employers withholding of state income tax hawaii tax

Effortlessly Prepare Employer's Withholding Of State Income Tax Hawaii Tax on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Employer's Withholding Of State Income Tax Hawaii Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and electronically sign Employer's Withholding Of State Income Tax Hawaii Tax seamlessly

- Locate Employer's Withholding Of State Income Tax Hawaii Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to preserve your modifications.

- Choose how you'd like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Employer's Withholding Of State Income Tax Hawaii Tax and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employers withholding of state income tax hawaii tax

Create this form in 5 minutes!

How to create an eSignature for the employers withholding of state income tax hawaii tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DE4 allowance form, and why is it important?

The DE4 allowance form is a crucial document used for declaring withholding allowances for state income tax. By accurately filling out the DE4 allowance form, employees can ensure that the correct amount of taxes is withheld from their paychecks, helping to avoid underpayment or overpayment issues.

-

How can airSlate SignNow help with the DE4 allowance form?

airSlate SignNow offers a seamless platform to create, send, and eSign the DE4 allowance form digitally. This simplifies the process and ensures that your documents are securely stored and easily accessible, reducing the hassle associated with paperwork.

-

Is there a cost associated with using airSlate SignNow for the DE4 allowance form?

airSlate SignNow offers flexible pricing plans suited for businesses of all sizes, making it a cost-effective solution for managing the DE4 allowance form. You can choose a plan that fits your needs, and there is often a free trial available to assess its features.

-

What features does airSlate SignNow provide for the DE4 allowance form?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the DE4 allowance form. These features enhance efficiency and help ensure compliance with tax regulations seamlessly.

-

Can I integrate airSlate SignNow with my existing HR software for the DE4 allowance form?

Yes, airSlate SignNow integrates smoothly with various HR and accounting software, making it easy to incorporate the DE4 allowance form into your existing workflows. This ensures that data flows seamlessly between platforms, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for the DE4 allowance form?

Using airSlate SignNow for the DE4 allowance form offers numerous benefits, including reduced processing time, increased accuracy, and enhanced security. It allows your business to maintain compliance and streamlines document management, ultimately improving overall productivity.

-

Is it safe to send the DE4 allowance form through airSlate SignNow?

Absolutely! airSlate SignNow employs top-notch security protocols to ensure that the DE4 allowance form and all other documents are transmitted and stored securely. Your sensitive information is protected with encryption and complies with regulatory standards.

Get more for Employer's Withholding Of State Income Tax Hawaii Tax

- Cg2024 form

- Asid agreement form

- Gcb foreign exchange transaction form

- Unitedhealthcare claim submission withdrawal request form

- Lesson 4 skills practice solve equations with variables on each side form

- Affidavit consent for minor to drive form

- Moneypayment between two parties agreement template form

- Montana buy sell agreement template form

Find out other Employer's Withholding Of State Income Tax Hawaii Tax

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP