Form 13285 a Rev January Fill in Capable Reducing Tax Burden on American Taxpayers

What is the Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

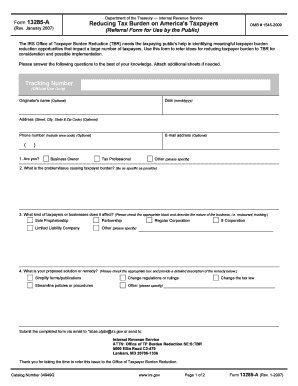

The Form 13285 A Rev January is a tax-related document designed to assist American taxpayers in reducing their tax burden. This form is specifically tailored for individuals and businesses seeking to claim certain deductions or credits that may alleviate their overall tax liabilities. By providing detailed information about income, expenses, and applicable deductions, this form helps taxpayers navigate the complexities of the U.S. tax system effectively.

How to use the Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

Using the Form 13285 A Rev January involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary financial documents, including income statements and receipts for deductible expenses. Once these documents are organized, the form can be filled out by entering the required information in the designated fields. It is crucial to review the completed form for accuracy before submission to avoid delays or penalties.

Steps to complete the Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

To complete the Form 13285 A Rev January, follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Fill in personal information, including name, address, and Social Security number.

- Report income accurately, including wages and other sources of income.

- List all applicable deductions and credits that may apply to your situation.

- Review the form thoroughly for any errors or omissions.

- Submit the completed form according to the instructions provided.

Key elements of the Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

The key elements of the Form 13285 A Rev January include sections for personal identification, income reporting, and deduction claims. Each section is designed to capture specific financial information that is essential for determining tax liability. Additionally, the form may include instructions for claiming various tax credits, which can further reduce the overall tax burden for eligible taxpayers.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 13285 A Rev January, including instructions on which deductions and credits are applicable. Taxpayers should refer to the IRS website or publications for detailed information on eligibility criteria and any updates to the form. Adhering to these guidelines ensures compliance with tax laws and helps avoid potential issues during the filing process.

Required Documents

When completing the Form 13285 A Rev January, taxpayers must have several key documents on hand. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Any relevant tax documents from previous years

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete form 13285 a rev january fill in capable reducing tax burden on american taxpayers

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

Create this form in 5 minutes!

How to create an eSignature for the form 13285 a rev january fill in capable reducing tax burden on american taxpayers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers?

Form 13285 A Rev January is a crucial document designed to help American taxpayers address and reduce their tax burdens. This form provides detailed guidelines on how individuals can fill in relevant information to qualify for various tax relief options. Understanding and properly using this form can signNowly impact your financial situation.

-

How does airSlate SignNow simplify the process of using Form 13285 A Rev January?

airSlate SignNow streamlines the process of filling out Form 13285 A Rev January by providing easy-to-use templates and electronic signature capabilities. You can quickly fill out and send this essential form securely, ensuring compliance and efficiency. This eliminates paperwork issues and speeds up your tax-related resolutions.

-

What are the benefits of using airSlate SignNow for Form 13285 A Rev January?

Using airSlate SignNow for Form 13285 A Rev January comes with numerous benefits, including time savings, reduced errors, and enhanced security. Our platform allows for easy document customization and electronic signing, guiding you through the complexities of tax forms. Ultimately, this helps you focus on reducing your tax burden efficiently.

-

Is airSlate SignNow affordable for businesses needing Form 13285 A Rev January?

Yes, airSlate SignNow offers competitive pricing options tailored for businesses of all sizes looking to handle Form 13285 A Rev January. Our cost-effective solutions ensure that you receive the best value without compromising on features. Compare our plans to find the one that best suits your needs.

-

Can I integrate airSlate SignNow with other software for managing Form 13285 A Rev January?

Absolutely! airSlate SignNow easily integrates with various business applications, allowing for seamless management of Form 13285 A Rev January. This integration capability helps streamline your workflow, ensuring that all your documents and tax forms are interconnected and efficiently managed.

-

What features does airSlate SignNow offer for managing Form 13285 A Rev January?

airSlate SignNow offers a range of features designed specifically for managing Form 13285 A Rev January, including customizable templates, real-time collaboration, and secure eSigning. These tools help simplify the process while maintaining accuracy and compliance with tax regulations. Experience enhanced efficiency in document management.

-

How can Form 13285 A Rev January help reduce my tax burden?

Form 13285 A Rev January provides a structured way to claim eligible deductions and credits that may lower your tax bill. By carefully filling out this form, you can identify tax relief options available specifically to American taxpayers. This proactive approach can lead to substantial savings and improved financial health.

Get more for Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

Find out other Form 13285 A Rev January Fill In Capable Reducing Tax Burden On American Taxpayers

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe