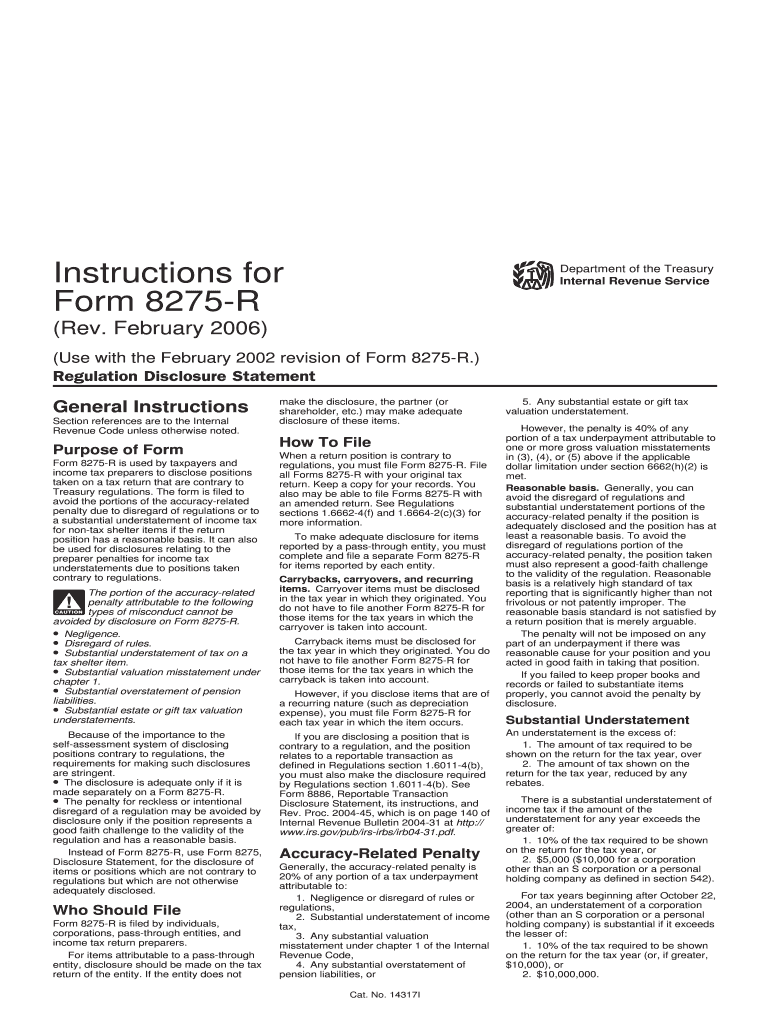

Instructions for Form 8275 R Rev February Instructions for Form 8275 R, Regulation Disclosure Statement

Understanding the Instructions for Form 8275 R

The Instructions for Form 8275 R, also known as the Regulation Disclosure Statement, are essential for taxpayers who wish to disclose positions taken on their tax returns that may be contrary to IRS regulations. This form is particularly relevant for those who want to avoid potential penalties associated with underreporting income or misinterpreting tax laws. By using this form, taxpayers can clarify their positions and provide necessary disclosures to the IRS, ensuring compliance and transparency in their tax filings.

How to Use the Instructions for Form 8275 R

To effectively use the Instructions for Form 8275 R, taxpayers should first review the guidelines provided by the IRS. These instructions outline the specific circumstances under which the form should be filed, detailing the required information and supporting documentation. It is important to accurately complete the form, as any discrepancies may lead to complications during the review process. Taxpayers can refer to the examples provided in the instructions for clarity on how to fill out the form correctly.

Steps to Complete the Instructions for Form 8275 R

Completing the Instructions for Form 8275 R involves several key steps:

- Gather necessary documentation, including any relevant tax returns and supporting materials.

- Carefully read the instructions to understand the specific requirements for disclosure.

- Fill out the form with accurate information, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with your tax return or as a standalone document if required.

Key Elements of the Instructions for Form 8275 R

Several key elements are crucial when working with the Instructions for Form 8275 R:

- Disclosure Requirements: Taxpayers must clearly state the tax positions they are disclosing and the reasons for their positions.

- Supporting Documentation: Any claims made on the form should be backed by appropriate documentation to substantiate the taxpayer's position.

- Filing Instructions: The instructions provide details on how and when to file the form, including any deadlines that must be adhered to.

Legal Use of the Instructions for Form 8275 R

The legal use of the Instructions for Form 8275 R is primarily to provide a safeguard for taxpayers against penalties for underreporting income or misinterpretation of tax laws. By disclosing positions that may be contrary to IRS regulations, taxpayers can demonstrate their intent to comply with tax laws. This proactive approach can be beneficial in case of an audit, as it shows the IRS that the taxpayer is transparent about their tax positions.

Filing Deadlines for Form 8275 R

Filing deadlines for the Instructions for Form 8275 R align with the standard tax return deadlines. Taxpayers should be aware that the form must be submitted by the due date of their tax return, including any extensions. It is essential to keep track of these deadlines to avoid late penalties and ensure compliance with IRS regulations.

Quick guide on how to complete instructions for form 8275 r rev february instructions for form 8275 r regulation disclosure statement

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS apps and streamline any document-related procedure today.

The Simplest Way to Alter and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Verify all the information and then click the Done button to save your changes.

- Choose your preferred delivery method for your form: by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8275 r rev february instructions for form 8275 r regulation disclosure statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement?

The Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement, includes crucial details for taxpayers to disclose positions taken on their tax returns. This tool ensures that taxpayers can effectively communicate their tax positions and help avoid penalties. With comprehensive guidelines, it simplifies compliance with IRS regulations.

-

How can I access the Instructions For Form 8275 R Rev February Instructions For Form 8275 R?

You can easily access the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement through the IRS website or directly via the airSlate SignNow platform. Our user-friendly solution allows you to view and download the required forms effortlessly, making the process seamless for your convenience.

-

Are there any costs associated with using the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement?

Using the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement itself from the IRS is free. However, if you choose to use airSlate SignNow for sending and signing documents, we offer affordable pricing plans so that you can choose the option that best fits your business needs.

-

What benefits does airSlate SignNow offer for documents related to the Instructions For Form 8275 R Rev February Instructions For Form 8275 R?

airSlate SignNow provides numerous benefits for handling documents related to the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement. With eSignature capabilities, secure document storage, and real-time tracking, you can streamline the tax compliance process and ensure that your submissions are accurate and timely.

-

Can I integrate airSlate SignNow with other software for managing the Instructions For Form 8275 R Rev February Instructions For Form 8275 R?

Yes, airSlate SignNow easily integrates with various software applications to enhance your workflow for the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement. Whether you use accounting software or project management tools, our integrations can help you centralize document management and improve efficiency.

-

Is there customer support available for using the Instructions For Form 8275 R Rev February Instructions For Form 8275 R with airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support to assist you with any questions or issues regarding the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement. Our knowledgeable team is ready to provide guidance, ensuring you have a smooth experience with our platform.

-

What should I do if I need help completing the Instructions For Form 8275 R Rev February Instructions For Form 8275 R?

If you need help completing the Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement, consider signNowing out to a tax professional for personalized advice. Additionally, airSlate SignNow provides useful resources that can help guide you through the process, ensuring accurate and compliant submissions.

Get more for Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement

Find out other Instructions For Form 8275 R Rev February Instructions For Form 8275 R, Regulation Disclosure Statement

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now