Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa Rev

What is the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev

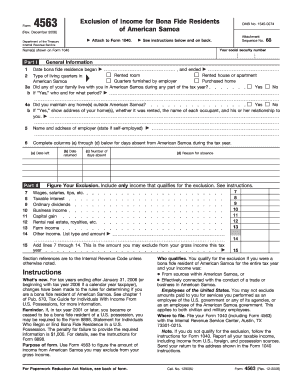

The Form 4563, officially known as the Exclusion of Income for Bona Fide Residents of American Samoa, is a tax form used by individuals who are bona fide residents of American Samoa. This form allows eligible residents to exclude certain types of income from their federal income tax returns. The primary purpose of this form is to provide tax relief to residents who earn income in American Samoa, recognizing their unique status and the specific tax provisions applicable to them. It is essential for residents to understand the criteria for bona fide residency and the types of income that qualify for exclusion to ensure compliance with IRS regulations.

How to use the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev

Using Form 4563 involves several key steps to ensure accurate completion and submission. First, individuals must determine their eligibility as bona fide residents of American Samoa. This includes meeting specific criteria regarding physical presence and intent to remain in the territory. Once eligibility is confirmed, residents should gather necessary documentation, such as income statements and proof of residency. The form itself requires detailed information about the taxpayer, including Social Security numbers and income sources. After filling out the form, it must be submitted alongside the federal tax return to the appropriate IRS address, ensuring that all information is accurate and complete to avoid delays or penalties.

Steps to complete the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev

Completing Form 4563 involves a series of steps to ensure that all required information is accurately reported. Begin by downloading the form from the IRS website or obtaining a physical copy. Next, fill in personal details, including your name, address, and Social Security number. Clearly indicate your status as a bona fide resident of American Samoa by completing the residency section. List all qualifying income that you wish to exclude, ensuring that you adhere to the guidelines provided by the IRS. After reviewing the form for accuracy, sign and date it before submitting it with your federal tax return. Keeping a copy of the completed form for your records is also advisable.

Eligibility Criteria

To qualify for the exclusion of income on Form 4563, individuals must meet specific eligibility criteria set forth by the IRS. First, the taxpayer must be a bona fide resident of American Samoa for the entire tax year. This typically means that the individual has been physically present in American Samoa for at least 183 days during the year and has established a permanent home in the territory. Additionally, the taxpayer must not have a tax home outside of American Samoa during the year. It is important to maintain records that substantiate residency claims, such as utility bills, lease agreements, or other documentation that confirms a physical presence in American Samoa.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the use of Form 4563 and the exclusion of income for bona fide residents of American Samoa. These guidelines outline the eligibility requirements, types of income that can be excluded, and the necessary documentation to support claims. Taxpayers are encouraged to review these guidelines thoroughly to ensure compliance and avoid potential issues during the filing process. The IRS also emphasizes the importance of accurate reporting and timely submission of Form 4563, as failure to comply with these regulations may result in penalties or denial of the exclusion.

Filing Deadlines / Important Dates

Filing deadlines for Form 4563 align with the standard federal tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for bona fide residents of American Samoa to submit Form 4563 along with their federal tax return by this deadline to ensure that they receive the income exclusion. Taxpayers should also be aware of any changes to deadlines that may occur due to extensions or specific circumstances related to American Samoa.

Quick guide on how to complete form 4563 exclusion of income for bona fide residents of american samoa rev

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and safely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without obstacles. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and press Get Form to begin.

- Make use of the tools we supply to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements for document management in just a few clicks from any device you choose. Adjust and electronically sign [SKS] to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev

Create this form in 5 minutes!

How to create an eSignature for the form 4563 exclusion of income for bona fide residents of american samoa rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

The Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. is a tax form used by eligible residents to exclude certain types of income from their federal income tax calculations. This form is essential for those looking to benefit from the special tax rules applicable to bona fide residents. Understanding how to fill out this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

airSlate SignNow provides a streamlined platform to digitalize and securely eSign the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. The user-friendly interface ensures that you can complete and submit this form with ease, ensuring your tax filing process is efficient. Moreover, it helps you keep track of your signed documents and any communication with tax professionals.

-

What features does airSlate SignNow offer for managing Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

With airSlate SignNow, you can enjoy features like customizable templates, automated workflows, and in-app collaboration specifically designed for forms like the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. These features enhance productivity by simplifying document management and reducing turnaround times. Easily track edits and approvals for a smooth workflow.

-

Is there a cost associated with using airSlate SignNow for Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

Yes, there is a subscription fee for using airSlate SignNow, but it is cost-effective compared to traditional paper-based or manual processing methods. The pricing plans cater to different needs, ensuring you only pay for what you need while efficiently managing forms like the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. Consider checking our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software to handle the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

Absolutely! airSlate SignNow offers integrations with various platforms, including CRM, accounting software, and tax tools, which allows for seamless handling of the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. This compatibility saves time and enhances efficiency, as data can be automatically synced across systems.

-

What are the benefits of using airSlate SignNow for Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

Using airSlate SignNow for the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. helps in reducing errors and ensures compliance with tax regulations. The electronic signing capability speeds up the approval process and increases overall productivity. Additionally, document security and audit trails provide peace of mind.

-

How does airSlate SignNow ensure the security of the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev.?

airSlate SignNow prioritizes security with features such as encryption, secure cloud storage, and access controls for documents, including the Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev. These measures comply with industry standards to protect sensitive tax information, ensuring your data remains safe.

Get more for Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev

- Printable parking pass template word form

- Tasks of the 18 national taiwan chemistry olympiad taiwan form

- Calif it22 form

- Illinois appellate court first district appearance form

- Stitch felty ears template form

- What is asir 109r form

- Use this form to confirm payment to carrier carrier rate

- Powerbelt ballistics form

Find out other Form 4563 Exclusion Of Income For Bona Fide Residents Of American Samoa Rev

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer