Form 5305 R Rev March Fill in Capable Roth Individual Retirement Trust Account

What is the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

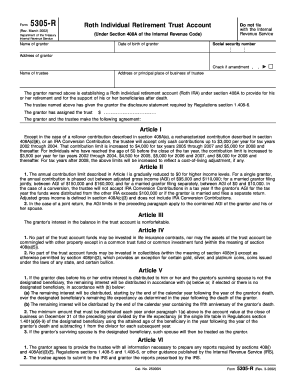

The Form 5305 R Rev March is a crucial document used to establish a Roth Individual Retirement Trust Account (Roth IRA). This form is specifically designed for individuals looking to create a trust account that allows for tax-free growth of their retirement savings. The Roth IRA is notable for its unique tax advantages, where contributions are made with after-tax dollars, and qualified withdrawals are tax-free. This form ensures compliance with IRS regulations while providing a structured approach to retirement planning.

How to use the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

Using the Form 5305 R Rev March involves a straightforward process. First, individuals must accurately fill out the form, providing necessary information such as the account holder's details and the trust's specifics. Once completed, the form must be signed and dated by the account holder and the trustee. It's essential to retain a copy for personal records while submitting the original to the financial institution managing the Roth IRA. This ensures that the account is officially recognized and compliant with IRS requirements.

Steps to complete the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

Completing the Form 5305 R Rev March requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about the trust, including the name of the trust and the trustee's information.

- Specify the contributions to the Roth IRA, ensuring they align with IRS contribution limits.

- Review the form for accuracy and completeness before signing and dating it.

- Submit the signed form to the financial institution managing your Roth IRA.

Key elements of the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

Several key elements are essential to understand when working with the Form 5305 R Rev March. These include:

- Account Holder Information: This section captures the personal details of the individual establishing the account.

- Trustee Information: Identifies the individual or entity responsible for managing the trust.

- Contribution Limits: Outlines the maximum contribution amounts allowed by the IRS for the tax year.

- Signature Requirements: Ensures that both the account holder and trustee sign the form to validate the establishment of the account.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 5305 R Rev March. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. The IRS stipulates that the form must be filled out accurately, and all contributions must meet the established limits. Additionally, the account must be maintained according to IRS rules to retain its tax-advantaged status. Regularly reviewing IRS publications related to Roth IRAs can provide valuable insights into maintaining compliance.

Eligibility Criteria

To establish a Roth IRA using the Form 5305 R Rev March, individuals must meet certain eligibility criteria. Primarily, the account holder must have earned income, as contributions are based on income levels. There are also income limits that determine eligibility for making contributions to a Roth IRA. It is advisable to consult IRS guidelines or a tax professional to ensure that you meet these requirements before completing the form.

Quick guide on how to complete form 5305 r rev march fill in capable roth individual retirement trust account

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to share your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

Create this form in 5 minutes!

How to create an eSignature for the form 5305 r rev march fill in capable roth individual retirement trust account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account?

The Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account is designed to establish a Roth IRA trust account. This account allows individuals to contribute after-tax income for tax-free withdrawals in retirement. By utilizing this form, account holders can maximize their savings and enjoy tax benefits.

-

How can I complete the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account through our user-friendly platform. Our integration allows for real-time editing and signing, making the process efficient and straightforward. You can save your progress and securely store your completed form in one place.

-

What features does airSlate SignNow offer for managing the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account?

airSlate SignNow offers numerous features to streamline the management of the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account. Users benefit from templates, electronic signatures, and document tracking. These features help ensure compliance and secure document handling, thus facilitating a seamless user experience.

-

Is there a cost associated with using airSlate SignNow for the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account?

Yes, airSlate SignNow offers a variety of pricing plans to suit different needs, including options for using the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account. Each plan is designed to provide value, ensuring accessibility to essential features for individuals and businesses alike. Users can select a plan that fits their budget and requirements.

-

Can I integrate airSlate SignNow with other applications when using the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account?

Absolutely! airSlate SignNow offers integrations with numerous applications, enhancing the functionality while working on the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account. You can connect with tools like Google Drive, Dropbox, and various CRM systems for easy document management and collaboration. This integration capability maximizes efficiency.

-

What are the benefits of using airSlate SignNow for the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account?

Using airSlate SignNow for the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account presents numerous benefits. It ensures the document is securely signed and stored, allows for easy collaboration, and helps automate repetitive tasks, saving valuable time. Additionally, its user-friendly interface simplifies the entire process, making it ideal for users of all skill levels.

-

How does airSlate SignNow ensure the security of my Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account?

airSlate SignNow takes security seriously, employing advanced encryption methods to protect your sensitive data, including the Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account. We routinely update our security protocols and conduct audits to maintain the highest standards of data protection. Users can feel confident that their information is safe.

Get more for Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

Find out other Form 5305 R Rev March Fill In Capable Roth Individual Retirement Trust Account

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors