Form W 5 SP Fill in Capable

What is the Form W-5 SP Fill In Capable

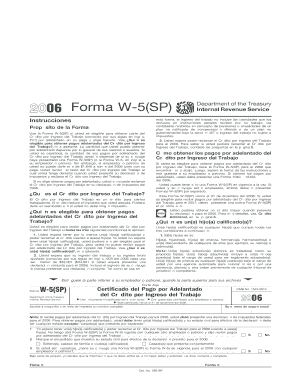

The Form W-5 SP is a tax form used by individuals in the United States to apply for advance payments of the Child Tax Credit and the Additional Child Tax Credit. This form is specifically designed for Spanish-speaking taxpayers, providing a bilingual option to ensure accessibility and understanding. The "Fill In Capable" designation indicates that the form can be completed digitally, allowing users to fill out their information electronically before printing or submitting it. This capability streamlines the process, making it easier for taxpayers to manage their tax credits efficiently.

How to use the Form W-5 SP Fill In Capable

Using the Form W-5 SP Fill In Capable involves a few straightforward steps. First, access the form through a reliable source, ensuring you have the latest version. Once you have the form, you can fill it out digitally, entering your personal information, including your name, address, and details about your qualifying children. After completing the form, review it for accuracy. Finally, submit the form to your employer or the relevant tax authority, depending on your specific situation. This digital approach simplifies the process, reducing the likelihood of errors and enhancing efficiency.

Steps to complete the Form W-5 SP Fill In Capable

Completing the Form W-5 SP Fill In Capable involves several key steps:

- Download the form from a trusted source.

- Open the form in a compatible PDF reader or editor that allows filling in fields.

- Enter your personal information accurately, including your name, Social Security number, and address.

- Provide details about your qualifying children, such as their names and Social Security numbers.

- Review the completed form for any errors or omissions.

- Save the filled form and print it if necessary for submission.

Legal use of the Form W-5 SP Fill In Capable

The legal use of the Form W-5 SP is crucial for ensuring compliance with U.S. tax regulations. This form is specifically intended for individuals who qualify for the Child Tax Credit and the Additional Child Tax Credit. By accurately completing and submitting this form, taxpayers can receive advance payments, which can significantly alleviate financial burdens. It is essential to ensure that all information provided is truthful and accurate to avoid any potential legal repercussions, such as penalties or audits by the Internal Revenue Service (IRS).

Eligibility Criteria

To be eligible to use the Form W-5 SP, taxpayers must meet specific criteria. Primarily, they must have qualifying children under the age of 17 at the end of the tax year. Additionally, the taxpayer's income must fall within the limits set by the IRS to qualify for the Child Tax Credit. It is also necessary for the taxpayer to have a valid Social Security number or Individual Taxpayer Identification Number (ITIN). Understanding these eligibility requirements is vital for ensuring that the form is completed correctly and that the taxpayer can benefit from the credits available.

Form Submission Methods

The Form W-5 SP can be submitted through various methods, depending on individual circumstances. Taxpayers can provide the completed form directly to their employer, who will use the information to adjust withholding amounts for advance payments. Alternatively, the form may be submitted to the IRS by mail if required. It is important to follow the specific submission guidelines provided by the IRS to ensure timely processing and to avoid any delays in receiving benefits.

Quick guide on how to complete form w 5 sp fill in capable

Effortlessly Manage [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the document or obscure sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 5 SP Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form w 5 sp fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can IRS fillable forms be filed electronically?

Yes. You can use Free File Fillable Forms to e-file your federal return. This means you are filing your return electronically over the Internet.

-

What is the income limit for free file fillable forms?

Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return. Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form.

-

How do I create an IRS fillable PDF form?

Visit the Free File Site. Select "Free File Fillable Forms Now” and then hit “Leave IRS Site” after reading the disclaimer. Start the Process. Select “Start Free File Fillable Forms” and hit “Continue.” Get Registered. ... Select Your 1040. ... Fill Out Your Tax Forms. ... E-File Your Tax Form. ... CREATE AN ACCOUNT. ... Complete Your Account.

-

What is a W5 form used for?

The IRS Form W-5 is also known as the Earned Income Credit Advance Payment Certificate. This form was previously used by employees who wanted to get a portion of their Earned Income Credit (EIC) in advance, along with their pay. While IRS Form W-5 was once commonly used, it's no longer in use.

Get more for Form W 5 SP Fill In Capable

Find out other Form W 5 SP Fill In Capable

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free