October Department of the Treasury Internal Revenue Service Request for Student's or Borrower's Taxpayer Identificatio Form

Understanding the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification

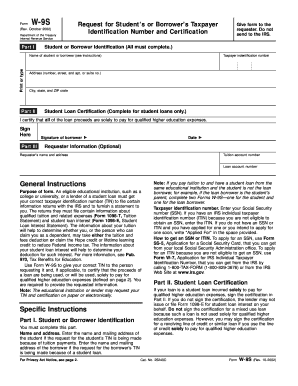

The October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification is a crucial form for students and borrowers who need to provide their taxpayer identification number (TIN) for various financial and tax-related purposes. This form is particularly relevant for those applying for federal student aid or loans, as it certifies the identity and taxpayer status of the individual. It ensures that the IRS has accurate information, which is essential for processing tax returns and verifying eligibility for financial aid.

Steps to Complete the Form

Completing the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number or Individual Taxpayer Identification Number.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Sign and date the form to certify that the information provided is correct.

Obtaining the Form

The October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification can be obtained directly from the IRS website or through educational institutions that require it for financial aid processing. It is important to ensure you have the most current version of the form to avoid any issues during submission.

Legal Use of the Form

This form serves a legal purpose by validating the taxpayer identification number of students or borrowers. It is often required by lenders, educational institutions, and the IRS to ensure compliance with federal regulations regarding tax reporting and financial aid eligibility. Proper completion and submission of this form help prevent delays in processing applications and disbursement of funds.

Key Elements of the Form

Key elements of the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification include:

- Personal identification information of the student or borrower.

- Certification statement confirming the accuracy of the provided information.

- Signature and date line for the individual completing the form.

Form Submission Methods

The completed October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification can be submitted in various ways, depending on the requirements of the requesting institution or lender. Common submission methods include:

- Online submission through secure portals provided by educational institutions or lenders.

- Mailing the completed form to the designated address.

- In-person submission at financial aid offices or lender locations.

Quick guide on how to complete october department of the treasury internal revenue service request for students or borrowers taxpayer identification number

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), or invitation link—or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identificatio

Create this form in 5 minutes!

How to create an eSignature for the october department of the treasury internal revenue service request for students or borrowers taxpayer identification number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

The October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification is a form used to obtain necessary taxpayer information from individuals or organizations applying for financial aid or loans. This form is crucial for ensuring compliance with tax regulations and facilitating smooth processing of applications.

-

How does airSlate SignNow assist with the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

airSlate SignNow simplifies the process of completing the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification by allowing users to eSign and send documents securely. Our platform enhances compliance and accelerates the submission process for stakeholders involved in education financing.

-

What are the pricing options for using airSlate SignNow to manage the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

airSlate SignNow offers flexible pricing plans that cater to various business needs and sizes. With our cost-effective solutions, you can efficiently manage the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification without compromising on quality or features.

-

Can airSlate SignNow integrate with other software for managing forms like the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

Yes, airSlate SignNow can seamlessly integrate with other applications such as CRMs and productivity tools to streamline document workflows. This ensures that managing the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification is not only efficient but also enhances collaboration among team members.

-

What benefits does airSlate SignNow offer for the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

Using airSlate SignNow for the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification provides numerous benefits, including reduced processing time and enhanced compliance. Our solution also fosters better communication between borrowers and organizations, ensuring that all parties have access to necessary taxpayer information securely.

-

Is it easy to use airSlate SignNow for submitting the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

Absolutely! airSlate SignNow is designed to be user-friendly, making it simple for anyone to manage the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification. The intuitive interface allows users to complete and eSign forms quickly without any technical expertise.

-

How secure is airSlate SignNow for handling sensitive information related to the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification?

airSlate SignNow prioritizes security by implementing industry-leading encryption and compliance protocols. When managing the October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identification Number And Certification, you can trust that your sensitive information is handled safely and in accordance with applicable regulations.

Get more for October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identificatio

Find out other October Department Of The Treasury Internal Revenue Service Request For Student's Or Borrower's Taxpayer Identificatio

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement