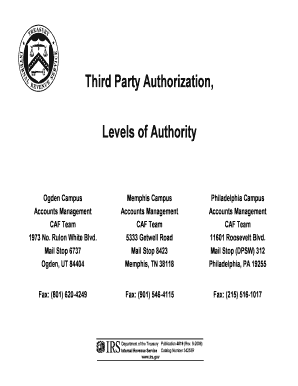

Publication 4019 Rev September Third Party Authorization, Levels of Authority Form

Understanding the Publication 4019 Rev September Third Party Authorization, Levels Of Authority

The Publication 4019 Rev September Third Party Authorization is a crucial document used by taxpayers to authorize a third party to act on their behalf regarding specific tax matters. This publication outlines the levels of authority granted to the third party, allowing them to communicate with the IRS and access certain taxpayer information. It is essential for individuals who may require assistance from tax professionals or representatives, ensuring that the designated third party can perform necessary actions without compromising the taxpayer's privacy.

Steps to Complete the Publication 4019 Rev September Third Party Authorization

Completing the Publication 4019 Rev September Third Party Authorization involves several straightforward steps:

- Gather necessary information, including your personal details and the details of the third party you wish to authorize.

- Clearly specify the levels of authority you are granting. This may include the ability to receive information, make inquiries, or represent you in discussions with the IRS.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays in processing.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the provided instructions, either online, by mail, or in person.

Legal Use of the Publication 4019 Rev September Third Party Authorization

The legal use of the Publication 4019 Rev September Third Party Authorization is vital for compliance with IRS regulations. This document allows taxpayers to designate an authorized representative, ensuring that the representative can legally discuss tax matters with the IRS. It is important to understand that the authorization does not transfer tax liability; the taxpayer remains responsible for all tax obligations. Proper use of this form can facilitate smoother communication with the IRS and help resolve issues more efficiently.

Key Elements of the Publication 4019 Rev September Third Party Authorization

Several key elements define the Publication 4019 Rev September Third Party Authorization:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Third Party Information: Details about the authorized representative, including their name, address, and phone number.

- Levels of Authority: Clearly defined permissions that outline what actions the third party can take on behalf of the taxpayer.

- Signature: The taxpayer must sign the form to validate the authorization.

Examples of Using the Publication 4019 Rev September Third Party Authorization

There are various scenarios where the Publication 4019 Rev September Third Party Authorization can be beneficial:

- A self-employed individual may authorize an accountant to handle their tax filings and inquiries.

- A retired taxpayer might designate a family member to manage tax-related communications on their behalf.

- Business owners can authorize a tax professional to represent their company during IRS audits or disputes.

Filing Deadlines and Important Dates for the Publication 4019 Rev September Third Party Authorization

While the Publication 4019 Rev September Third Party Authorization itself does not have a specific filing deadline, it is advisable to submit the form as soon as the need for third-party representation arises. Timely submission ensures that the authorized representative can act on your behalf without delays in communication with the IRS. Additionally, being aware of tax filing deadlines is crucial to avoid penalties and ensure compliance with tax obligations.

Quick guide on how to complete publication 4019 rev september third party authorization levels of authority

Complete [SKS] easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether it's by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require creating new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Publication 4019 Rev September Third Party Authorization, Levels Of Authority

Create this form in 5 minutes!

How to create an eSignature for the publication 4019 rev september third party authorization levels of authority

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 4019 Rev September Third Party Authorization, Levels Of Authority?

Publication 4019 Rev September Third Party Authorization, Levels Of Authority is a key document that outlines the guidelines for third-party authorization when dealing with tax-related issues. It details the specific levels of authority that individuals or entities can have when representing a taxpayer. This publication ensures that the authorization process is clear, which is beneficial for businesses handling complex transactions.

-

How does airSlate SignNow help with Publication 4019 Rev September Third Party Authorization, Levels Of Authority?

airSlate SignNow provides an efficient solution for managing documents related to Publication 4019 Rev September Third Party Authorization, Levels Of Authority. Our platform allows users to easily send, sign, and store important forms securely. This streamlines the process of obtaining and managing third-party authorizations for tax matters.

-

What are the pricing options for airSlate SignNow regarding Publication 4019 Rev September Third Party Authorization, Levels Of Authority?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes needing to comply with Publication 4019 Rev September Third Party Authorization, Levels Of Authority. You can choose a plan based on your business requirements, ensuring a cost-effective solution for managing document signing and sending. Transparency in pricing means you can predict costs without hidden fees.

-

What features does airSlate SignNow offer for managing third-party authorizations?

airSlate SignNow includes a variety of features tailored for managing third-party authorizations, such as customizable templates, automated workflows, and real-time tracking of document status. These features facilitate compliance with Publication 4019 Rev September Third Party Authorization, Levels Of Authority while enhancing efficiency. Users can streamline the signing process and ensure documents are handled correctly.

-

Are there any integrations available with airSlate SignNow for tax-related needs?

Yes, airSlate SignNow integrates seamlessly with a range of applications that are essential for handling tax-related documentation, including popular accounting software and CRMs. These integrations help streamline processes in line with Publication 4019 Rev September Third Party Authorization, Levels Of Authority. Connecting your tools ensures that all information is synchronized and easily accessible.

-

How secure is airSlate SignNow when handling documents related to Publication 4019 Rev September Third Party Authorization, Levels Of Authority?

airSlate SignNow prioritizes security and ensures that all documents related to Publication 4019 Rev September Third Party Authorization, Levels Of Authority are protected through military-grade encryption. Our compliance with industry standards guarantees that your sensitive data remains confidential and secure during transmission and storage. This provides peace of mind for businesses managing critical documents.

-

Can airSlate SignNow help me speed up the signing process for third-party authorizations?

Absolutely! airSlate SignNow drastically reduces the time needed to complete the signing process for third-party authorizations as outlined in Publication 4019 Rev September Third Party Authorization, Levels Of Authority. With features like in-person signing, reminders, and mobile accessibility, you can ensure that documents are executed promptly and efficiently.

Get more for Publication 4019 Rev September Third Party Authorization, Levels Of Authority

- Lesson 5 homework practice more two step equations form

- City of san jose transient occupancy tax 30 day exemption form www3 csjfinance

- Manufactured structure notice of sale oregon form

- Cc 377 petition for personal protection order nondomestic form

- Kansas cn 51 02 form sos ks

- Personal pre authorized debit pad plan agreement form

- Scholarship terms and conditions template form

- First i want to thank god form

Find out other Publication 4019 Rev September Third Party Authorization, Levels Of Authority

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy