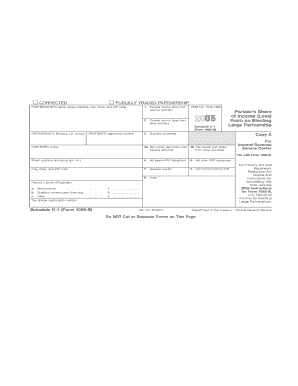

Form 1065 B Schedule K 1 Fill in Capable Partner's Share of Income Loss from an Electing Large Partnership

Understanding Form 1065 B Schedule K-1

Form 1065 B Schedule K-1 is a tax document used by electing large partnerships to report each partner's share of income, deductions, and credits. This form is essential for partners to accurately report their share of the partnership’s financial activities on their individual tax returns. The information provided on the K-1 helps partners understand their tax obligations and ensures compliance with IRS regulations.

Steps to Complete Form 1065 B Schedule K-1

Completing Form 1065 B Schedule K-1 involves several key steps:

- Gather necessary financial information from the partnership’s records.

- Fill in the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, loss, deductions, and credits as provided by the partnership.

- Ensure accuracy by double-checking all figures against partnership records.

- Distribute copies of the completed K-1 to each partner for their tax filings.

Obtaining Form 1065 B Schedule K-1

Form 1065 B Schedule K-1 can be obtained directly from the IRS website or through tax preparation software that supports partnership tax filings. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. Partners should also consult their partnership for any specific instructions regarding the form.

Key Elements of Form 1065 B Schedule K-1

Several key elements are included in Form 1065 B Schedule K-1:

- Partner’s name and address

- Partner’s taxpayer identification number

- Partnership’s identifying information

- Partner’s share of income, losses, deductions, and credits

- Any special allocations or adjustments relevant to the partner

Legal Use of Form 1065 B Schedule K-1

The legal use of Form 1065 B Schedule K-1 is critical for compliance with U.S. tax laws. Each partner must report the information from the K-1 on their individual tax returns. Failure to accurately report this information can lead to penalties or audits by the IRS. It is essential for partners to retain copies of the K-1 for their records and to ensure proper filing with the IRS.

Filing Deadlines for Form 1065 B Schedule K-1

Filing deadlines for Form 1065 B Schedule K-1 typically align with the partnership's tax return deadlines. Generally, partnerships must file Form 1065 by the fifteenth day of the third month following the end of their tax year. Partners should receive their K-1 forms in a timely manner to ensure they can meet their individual tax filing deadlines. It is advisable to consult the IRS guidelines for specific dates and any potential extensions.

Quick guide on how to complete form 1065 b schedule k 1 fill in capable partners share of income loss from an electing large partnership

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Annotate important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B Schedule K 1 Fill In Capable Partner's Share Of Income Loss From An Electing Large Partnership

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b schedule k 1 fill in capable partners share of income loss from an electing large partnership

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 B Schedule K 1 and why is it important?

Form 1065 B Schedule K 1 is a tax document that reports each partner's share of income, deductions, credits, and other items from an electing large partnership. It is crucial because it ensures accurate tax reporting for partners involved, allowing them to understand their tax obligations. Using airSlate SignNow helps streamline the process of filling in this form, making it quicker and more efficient.

-

How can airSlate SignNow assist with filling out Form 1065 B Schedule K 1?

airSlate SignNow provides intuitive tools that simplify the process of filling in Form 1065 B Schedule K 1. With customizable templates and a user-friendly interface, you can easily enter the capable partner's share of income and loss data. Our solution eliminates manual errors and saves time during tax preparation.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to suit various business needs, starting with a free trial. Each plan includes access to features specifically designed for filling out documents like Form 1065 B Schedule K 1. Contact our sales team to discuss the best option for your business and budget.

-

Are there specific features in airSlate SignNow that cater to accountants?

Yes, airSlate SignNow includes features that are particularly beneficial for accountants, such as collaborative tools, secure document sharing, and eSignature options. These features make it easier to manage multiple Form 1065 B Schedule K 1 submissions efficiently while ensuring compliance and accuracy.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting and financial software, enhancing your overall workflow. This means you can easily fill in and send Form 1065 B Schedule K 1 and other documents directly from your preferred applications, streamlining your financial processes.

-

What benefits does airSlate SignNow provide for businesses handling Form 1065 B Schedule K 1?

Using airSlate SignNow, businesses can benefit from time-saving automation, improved accuracy, and secure document management when handling Form 1065 B Schedule K 1. The platform simplifies collaboration among partners and accountants, leading to faster tax season turnaround times and reduced stress.

-

Is airSlate SignNow compliant with tax regulations when completing Form 1065 B Schedule K 1?

Yes, airSlate SignNow is built to comply with relevant tax regulations and guidelines, ensuring that your Form 1065 B Schedule K 1 is completed accurately. We continuously update our templates to reflect the latest changes in tax laws, helping you stay compliant while filling out your documents.

Get more for Form 1065 B Schedule K 1 Fill In Capable Partner's Share Of Income Loss From An Electing Large Partnership

Find out other Form 1065 B Schedule K 1 Fill In Capable Partner's Share Of Income Loss From An Electing Large Partnership

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile