Do Not File with the Internal Revenue Service Form

Understanding the Do Not File With The Internal Revenue Service

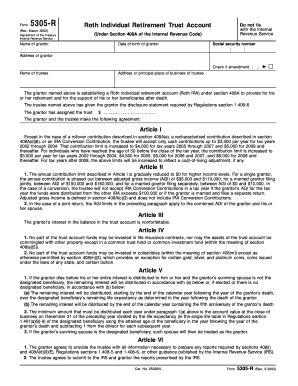

The "Do Not File With The Internal Revenue Service" form is designed to inform taxpayers about specific situations where they should not submit certain documents to the IRS. This can include instances where the form is for informational purposes only or when the taxpayer is not required to file a return based on their income level or filing status. Understanding the purpose of this form is crucial for compliance and to avoid unnecessary complications with tax filings.

Steps to Complete the Do Not File With The Internal Revenue Service

Completing the "Do Not File With The Internal Revenue Service" form involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Identify the specific form you are not required to file and ensure you have the correct version.

- Fill out the form accurately, providing all required information as indicated.

- Review the completed form for any errors or omissions before submission.

- Retain a copy for your records, as this may be needed for future reference.

Legal Use of the Do Not File With The Internal Revenue Service

The legal implications of the "Do Not File With The Internal Revenue Service" form are significant. It serves as a formal declaration that certain documents should not be submitted to the IRS. This can help prevent penalties for non-compliance or misunderstandings regarding a taxpayer's obligations. It is essential to understand the legal context and ensure that the form is used correctly to maintain compliance with federal tax laws.

IRS Guidelines for the Do Not File With The Internal Revenue Service

The IRS provides specific guidelines regarding the use of the "Do Not File With The Internal Revenue Service" form. Taxpayers should refer to the IRS website or official publications to understand the criteria for using this form, including eligibility requirements and any relevant deadlines. Adhering to these guidelines ensures that taxpayers remain compliant and avoid potential issues with their tax filings.

Required Documents for the Do Not File With The Internal Revenue Service

When preparing to use the "Do Not File With The Internal Revenue Service" form, certain documents may be necessary. These can include:

- Identification documents, such as a driver's license or Social Security card.

- Previous tax returns that may provide context for your current filing status.

- Any correspondence from the IRS that relates to your filing requirements.

Having these documents on hand can streamline the process and ensure that all information provided is accurate and complete.

Examples of Using the Do Not File With The Internal Revenue Service

There are various scenarios where the "Do Not File With The Internal Revenue Service" form may be applicable. For instance:

- A taxpayer with income below the minimum threshold may not need to file a return, thus using this form to clarify their status.

- Individuals who receive certain types of income, such as Social Security benefits, may also find this form relevant.

These examples illustrate the practical applications of the form and highlight the importance of understanding when it should be utilized.

Filing Deadlines for the Do Not File With The Internal Revenue Service

While the "Do Not File With The Internal Revenue Service" form itself may not have a specific filing deadline, it is essential to be aware of general tax filing deadlines. Taxpayers should ensure they are familiar with the annual tax return deadlines to avoid any potential penalties. Keeping track of these dates helps maintain compliance and ensures that all necessary forms are submitted in a timely manner.

Quick guide on how to complete do not file with the internal revenue service

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without difficulties. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with the tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Thoroughly review all details and click the Done button to finalize your changes.

- Select your preferred method to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Do Not File With The Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the do not file with the internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Do Not File With The Internal Revenue Service'?

Choosing to 'Do Not File With The Internal Revenue Service' means you are opting out of submitting certain documents to the IRS. This can help streamline your document management and ensure you only send necessary information, minimizing your tax obligations.

-

How can airSlate SignNow assist me in situations where I should 'Do Not File With The Internal Revenue Service'?

airSlate SignNow provides a user-friendly platform for managing and eSigning your documents efficiently. This can be especially useful when you need to securely store documents you choose 'Do Not File With The Internal Revenue Service' for personal or business reasons.

-

Are there any costs associated with using airSlate SignNow if I decide to 'Do Not File With The Internal Revenue Service'?

Using airSlate SignNow comes at a competitive price with various plans to fit your needs, even if you choose to 'Do Not File With The Internal Revenue Service'. The platform offers great value in terms of eSignature capabilities and document workflow management.

-

What features does airSlate SignNow offer for better document management without filing with the IRS?

airSlate SignNow offers features such as secure document storage, customizable templates, and advanced eSigning options. These tools make it easier for you to manage your documents while allowing you to 'Do Not File With The Internal Revenue Service' efficiently.

-

Can I integrate airSlate SignNow with other applications while choosing to 'Do Not File With The Internal Revenue Service'?

Yes, airSlate SignNow offers numerous integrations with popular applications, enhancing your workflow. This functionality is beneficial when you decide 'Do Not File With The Internal Revenue Service', allowing you to optimize your document processes with existing software solutions.

-

What are the benefits of using airSlate SignNow for transactions not filed with the IRS?

Utilizing airSlate SignNow helps you streamline transactions that you choose 'Do Not File With The Internal Revenue Service' while maintaining compliance and ensuring security. The easy-to-use platform allows for quick eSigning, reducing the time and hassle of traditional document handling.

-

Is airSlate SignNow compliant with regulations for documents I 'Do Not File With The Internal Revenue Service'?

Absolutely! airSlate SignNow prioritizes compliance with industry standards, ensuring that even documents you 'Do Not File With The Internal Revenue Service' are handled securely and in alignment with legal requirements for eSignatures and document management.

Get more for Do Not File With The Internal Revenue Service

Find out other Do Not File With The Internal Revenue Service

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter