Form 8288 Rev November Fill in Uncle Fed's Tax*Board

Understanding Form 8288 Rev November

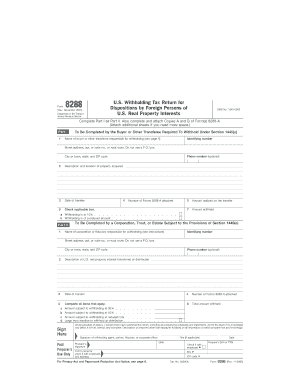

Form 8288 Rev November is a tax form used by the Internal Revenue Service (IRS) for reporting and remitting withholding tax on dispositions of U.S. real property interests by foreign persons. This form is essential for ensuring compliance with U.S. tax laws regarding foreign investments in real estate. It is typically required when a foreign seller disposes of a property located in the United States, and it helps the IRS track tax obligations associated with these transactions.

How to Complete Form 8288 Rev November

Completing Form 8288 Rev November involves several key steps. First, gather all necessary information, including details about the property transaction and the foreign seller. Next, accurately fill out each section of the form, ensuring that all required fields are completed. Pay close attention to the calculations for withholding tax, which are based on the sales price of the property. After completing the form, review it for accuracy before submission to avoid potential penalties.

Obtaining Form 8288 Rev November

Form 8288 Rev November can be obtained directly from the IRS website. It is available as a downloadable PDF file, which can be printed and filled out manually. Alternatively, the form may also be accessed through tax preparation software that supports IRS forms. Ensure that you are using the most current version of the form to comply with IRS regulations.

Filing Deadlines for Form 8288 Rev November

Timely filing of Form 8288 Rev November is crucial to avoid penalties. The form must be submitted to the IRS within twenty days of the date of the property transfer. This deadline ensures that the appropriate withholding tax is remitted promptly. It is advisable to keep track of important dates related to property transactions to ensure compliance with this requirement.

Key Elements of Form 8288 Rev November

Form 8288 Rev November includes several critical components that must be accurately completed. These elements typically consist of the seller’s information, the buyer’s information, details about the property, and the amount of withholding tax calculated based on the sale price. Each section must be filled out carefully to ensure that the IRS receives the correct information for processing.

Penalties for Non-Compliance with Form 8288 Rev November

Failure to file Form 8288 Rev November on time or inaccurately reporting information can result in significant penalties. The IRS may impose fines for late submissions, and the withholding tax may be assessed at a higher rate if not properly reported. It is essential to understand these consequences to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete form 8288 rev november fill in uncle feds taxboard

Easily Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and eSign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all information and click on the Done button to secure your modifications.

- Select your preferred method to send your form, whether via email, text (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8288 Rev November Fill In Uncle Fed's Tax*Board

Create this form in 5 minutes!

How to create an eSignature for the form 8288 rev november fill in uncle feds taxboard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8288 Rev November and how can it benefit my business?

Form 8288 Rev November is a crucial document for tax withholding on sales of U.S. real property by foreign persons. Using airSlate SignNow to fill in this form streamlines the process, ensuring compliance while saving time and reducing errors. The easy-to-use platform empowers your business to manage important documents effectively.

-

How does airSlate SignNow simplify the completion of Form 8288 Rev November?

With airSlate SignNow, completing Form 8288 Rev November is straightforward due to its user-friendly interface. You can fill in fields, add e-signatures, and share documents with stakeholders seamlessly. This results in quicker turnaround times and ensures that your submissions are accurate and compliant.

-

Is there a cost associated with using airSlate SignNow for Form 8288 Rev November?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. These plans are designed to provide cost-effective solutions, especially when handling important documents like Form 8288 Rev November. You can choose a plan that best fits your usage and budget.

-

Can I integrate airSlate SignNow with my existing tools for managing Form 8288 Rev November?

Absolutely! airSlate SignNow offers seamless integrations with numerous third-party applications. This means you can enhance your workflow and manage Form 8288 Rev November alongside other tools, making document management even more efficient.

-

What security measures does airSlate SignNow have for documents like Form 8288 Rev November?

airSlate SignNow provides robust security features to protect your documents, including Form 8288 Rev November. With encryption, secure access, and compliance with industry standards, you can trust that your sensitive information remains confidential and protected.

-

How can I ensure compliance when submitting Form 8288 Rev November through airSlate SignNow?

Using airSlate SignNow ensures compliance by guiding users through the completion of Form 8288 Rev November with clear instructions. Additionally, our platform keeps you updated with any regulatory changes, helping your business stay compliant with tax laws.

-

Is there customer support available for questions related to Form 8288 Rev November?

Yes, airSlate SignNow provides comprehensive customer support for any questions regarding Form 8288 Rev November. Our support team is available to assist you via chat, email, or phone, ensuring you have the help you need to navigate the document process smoothly.

Get more for Form 8288 Rev November Fill In Uncle Fed's Tax*Board

Find out other Form 8288 Rev November Fill In Uncle Fed's Tax*Board

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure