Nevada Modified Tax Return Form 2009

What is the Nevada Modified Tax Return Form

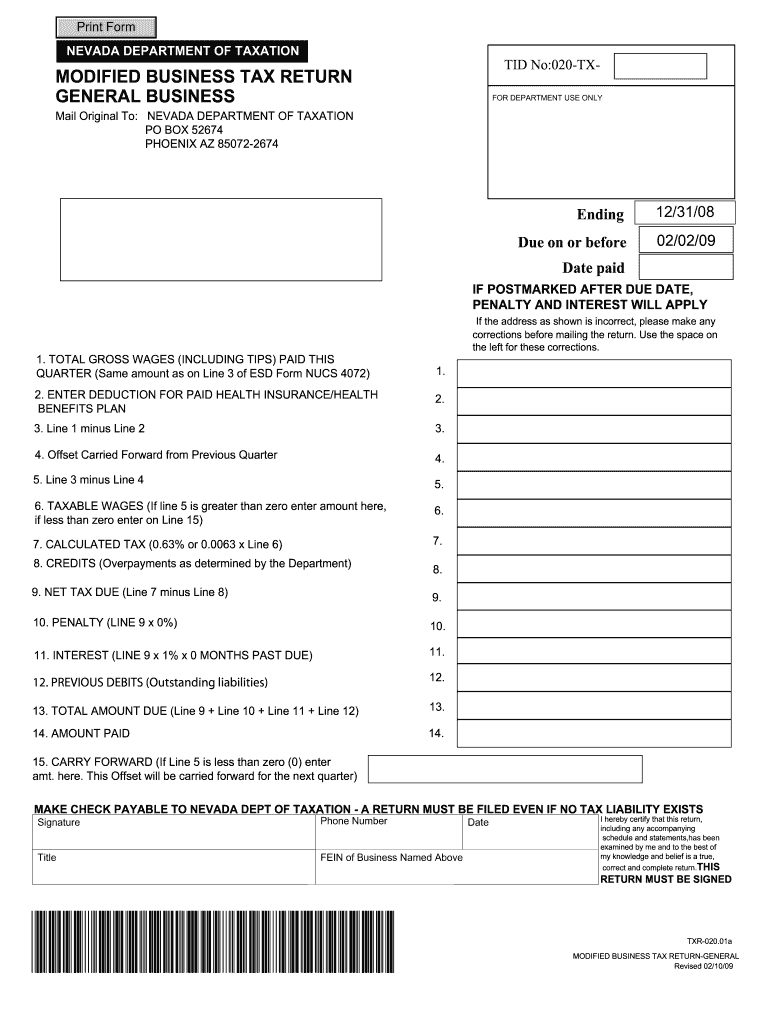

The Nevada Modified Tax Return Form is a specific document used by taxpayers in Nevada to report income and calculate tax obligations. This form is essential for individuals who need to amend their tax returns or correct previously submitted information. It is designed to ensure compliance with state tax regulations and to facilitate accurate tax reporting. The form includes various sections where taxpayers can input their financial details, including income sources, deductions, and credits applicable to their situation.

How to use the Nevada Modified Tax Return Form

Using the Nevada Modified Tax Return Form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including previous tax returns, W-2 forms, and any relevant receipts or statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing and dating it. This form can be submitted electronically or via mail, depending on the taxpayer's preference and the specific requirements for submission.

Steps to complete the Nevada Modified Tax Return Form

Completing the Nevada Modified Tax Return Form involves a systematic approach:

- Gather Documentation: Collect all relevant financial documents, including income statements and previous tax returns.

- Fill Out Personal Information: Enter your name, address, and Social Security number accurately at the top of the form.

- Report Income: Input all sources of income, including wages, dividends, and any other earnings.

- Claim Deductions and Credits: Identify and list any deductions or credits you are eligible for to reduce your taxable income.

- Review and Sign: Thoroughly review the completed form for any mistakes, then sign and date it to validate your submission.

- Submit the Form: Choose your preferred method of submission, whether online or by mail, and ensure it is sent to the correct address.

Legal use of the Nevada Modified Tax Return Form

The legal use of the Nevada Modified Tax Return Form is governed by state tax laws and regulations. Taxpayers must ensure that the form is completed accurately to avoid penalties or legal issues. The form serves as an official document submitted to the Nevada Department of Taxation, and any discrepancies or false information can lead to audits or fines. It is important to understand the legal implications of filing this form and to keep copies of all submitted documents for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Modified Tax Return Form are crucial for compliance. Typically, the form must be submitted by the annual tax deadline, which is usually April 15 for most taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines, especially during tax season, to avoid late fees or penalties. Taxpayers should also be aware of any specific deadlines related to amendments or corrections to previously filed returns.

Form Submission Methods

The Nevada Modified Tax Return Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically, which is often faster and more efficient. Alternatively, the form can be printed and mailed to the appropriate tax authority. In-person submission is also an option for those who prefer direct interaction with tax officials. Regardless of the method chosen, it is important to follow the submission guidelines provided by the Nevada Department of Taxation.

Quick guide on how to complete nevada modified tax return 2009 form

Your assistance manual on how to prepare your Nevada Modified Tax Return Form

If you are curious about how to generate and transmit your Nevada Modified Tax Return Form, here are some straightforward instructions on how to simplify tax filing.

To initiate, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to edit, create, and finalize your income tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to amend details as necessary. Optimize your tax organization with advanced PDF editing, eSigning, and seamless sharing.

Follow the directions below to complete your Nevada Modified Tax Return Form in just a few minutes:

- Create your account and start editing PDFs in moments.

- Browse our catalog to locate any IRS tax form; examine various versions and schedules.

- Click Obtain form to access your Nevada Modified Tax Return Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to include your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Please be aware that submitting via paper can lead to increased errors and delayed refunds. It goes without saying, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nevada modified tax return 2009 form

FAQs

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How do I fill an income tax return with the 16A form in India?

The applicable Form for filing of your income tax return shall need to examine nature of your income.If you are receiving Form 16A only, then it means you are earning income other than salaries, and therefore possibly you shall need to file Income Tax Return in Form ITR 3 or ITR 4 (depends over the nature of income as already said in above para).You shall need to register your PAN on the website of income tax efiling, thereafter you shall need to link your PAN if you are a resident of India.After successful registration, you may file your income tax return through applicable form. Show your income as being appearing in Form 16A, your bank interest and any other income if you do have.For any assistance/queries related to taxation, you may contact me on pkush39@gmail.com

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the nevada modified tax return 2009 form

How to make an electronic signature for the Nevada Modified Tax Return 2009 Form online

How to create an electronic signature for your Nevada Modified Tax Return 2009 Form in Chrome

How to generate an electronic signature for signing the Nevada Modified Tax Return 2009 Form in Gmail

How to generate an eSignature for the Nevada Modified Tax Return 2009 Form from your mobile device

How to create an eSignature for the Nevada Modified Tax Return 2009 Form on iOS

How to generate an eSignature for the Nevada Modified Tax Return 2009 Form on Android devices

People also ask

-

What is a Nevada Modified Tax Return Form?

The Nevada Modified Tax Return Form is a specific document used by businesses and individuals to amend previously filed tax returns in Nevada. This form allows taxpayers to correct errors, claim overlooked credits, or adjust their income for accurate tax reporting. Understanding how to properly fill out this form can ensure compliance and potentially improve your tax situation.

-

How can airSlate SignNow help me with my Nevada Modified Tax Return Form?

airSlate SignNow streamlines the process of creating, signing, and sending your Nevada Modified Tax Return Form. With our user-friendly platform, you can easily upload your document, add necessary signatures, and securely share it with the tax authorities. This ensures that your forms are submitted correctly and on time.

-

Is there a cost associated with using airSlate SignNow for my Nevada Modified Tax Return Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to different needs. Whether you are a small business or an individual, you can find a plan that provides ample features for managing your Nevada Modified Tax Return Form. The cost-effective solutions ensure you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for managing Nevada Modified Tax Return Forms?

airSlate SignNow provides a variety of features to assist with your Nevada Modified Tax Return Forms, including customizable templates, multi-user capabilities, and secure cloud storage. Additionally, our platform allows for real-time updates and notifications, ensuring you and your clients stay informed throughout the signing process.

-

Can I integrate airSlate SignNow with other software for my Nevada Modified Tax Return Form?

Certainly! airSlate SignNow offers seamless integrations with various popular software solutions, including accounting and tax preparation software. This enables you to efficiently manage your Nevada Modified Tax Return Form workflow and enhances your overall productivity by connecting all your essential tools in one place.

-

Are there any benefits to eSigning my Nevada Modified Tax Return Form?

Yes, eSigning your Nevada Modified Tax Return Form offers several advantages, including faster processing times and the ability to sign documents from anywhere. Using airSlate SignNow also provides enhanced security, reducing the risk of lost or misplaced forms. Plus, it's environmentally friendly as it eliminates the need for paper.

-

How do I ensure my Nevada Modified Tax Return Form is compliant?

To ensure compliance when using your Nevada Modified Tax Return Form, it’s vital to stay updated on current tax laws and regulations. airSlate SignNow simplifies this process, allowing you to access the latest templates and guidelines. Our platform also offers customer support to help clarify any compliance-related questions you may have.

Get more for Nevada Modified Tax Return Form

- Chapter section quiz native american societies around 1492 form

- Standardized form aam consent form for permanent cosmetics

- Kansas 4h record form

- Load tender and rate confirmation form

- Njcaa hardship request 1 hocking college hocking form

- Njcaa hardship form

- Automobile insurance motor vehicle inspection report completecar form

- Ssi awards letterpdffillercom form

Find out other Nevada Modified Tax Return Form

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast