Form 8316 Rev January Fill in Capable Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wa

Understanding Form 8316

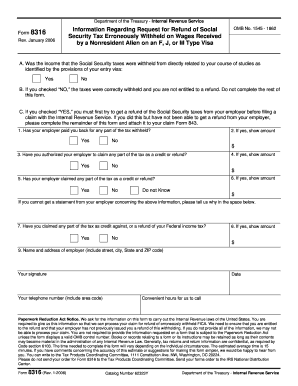

Form 8316, officially titled "Request for Refund of Social Security Tax Erroneously Withheld on Wages Received by a Nonresident Alien on an F, J, or M Type Visa," is a crucial document for nonresident aliens who have had Social Security taxes withheld from their wages in error. This form enables eligible individuals to request a refund of those taxes, ensuring compliance with IRS regulations and protecting their financial interests.

How to Use Form 8316

Using Form 8316 involves several straightforward steps. First, ensure you meet the eligibility criteria, which typically include being a nonresident alien on an F, J, or M visa. Next, gather all necessary documentation, such as your visa information and pay stubs showing the withheld taxes. Complete the form accurately, providing all required details, and submit it to the appropriate IRS office. It is advisable to keep a copy of the completed form for your records.

Steps to Complete Form 8316

Completing Form 8316 requires careful attention to detail. Start by entering your personal information, including your name, address, and taxpayer identification number. Next, indicate the amount of Social Security tax that was erroneously withheld. You will also need to provide a brief explanation of why you believe the withholding was incorrect. After filling out all sections, review the form for accuracy before submitting it to ensure a smooth processing experience.

Required Documents for Form 8316

To successfully submit Form 8316, certain documents are necessary. These include your pay stubs or W-2 forms that reflect the Social Security tax withheld, a copy of your visa, and any correspondence with your employer regarding the withholding. Having these documents ready will help streamline the process and support your refund request.

IRS Guidelines for Form 8316

The IRS provides specific guidelines for completing and submitting Form 8316. It is important to follow these guidelines closely to avoid delays in processing your refund. Ensure that you are using the most current version of the form and that all information is filled out correctly. The IRS also outlines the time frame for processing refunds, which can vary based on the volume of requests they receive.

Eligibility Criteria for Form 8316

Eligibility for filing Form 8316 is primarily based on your nonresident alien status and the type of visa you hold. You must be on an F, J, or M visa and have had Social Security taxes withheld from your wages. Additionally, you should not have been subject to these taxes under U.S. tax treaties. Understanding these criteria is essential to determine if you can file for a refund.

Quick guide on how to complete form 8316 rev january fill in capable information regarding request for refund of social security tax erroneously withheld on

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS, and enhance your document-related processes today.

How to edit and eSign [SKS] smoothly

- Locate [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Choose your preferred method to submit your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8316 Rev January Fill In Capable Information Regarding Request For Refund Of Social Security Tax Erroneously Withheld On Wa

Create this form in 5 minutes!

How to create an eSignature for the form 8316 rev january fill in capable information regarding request for refund of social security tax erroneously withheld on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8316 Rev January?

Form 8316 Rev January is a document designed for nonresident aliens to request a refund of Social Security tax that has been erroneously withheld from wages. It provides fill-in capable information that simplifies the process, specifically for individuals on F, J, or M type visas. Utilizing this form can help eligible nonresident aliens recover funds that should not have been withheld from their wages.

-

How do I fill out Form 8316 Rev January?

To effectively fill out Form 8316 Rev January, you need to gather necessary personal information, including visa details and specifics about the erroneous tax withholding. The form is user-friendly and fill-in capable, ensuring you can complete it accurately. Make sure to review IRS guidelines specific to your visa type to ensure proper submission.

-

Is Form 8316 Rev January applicable for all nonresident aliens?

No, Form 8316 Rev January is specifically applicable to nonresident aliens who have received wages subject to erroneous Social Security tax withholding while on F, J, or M type visas. It is essential to check your visa classification to determine if this form is suitable for your circumstances. When in doubt, consult a tax professional for guidance.

-

What fees are associated with filing Form 8316 Rev January?

There are no direct fees required for filing Form 8316 Rev January with the IRS, but it is recommended to consider any additional costs associated with professional tax consultation. Depending on the complexity of your tax situation, hiring an expert may incur fees. However, filing the form itself is a straightforward process without inherent costs.

-

How does airSlate SignNow assist with Form 8316 Rev January?

airSlate SignNow streamlines the process of completing Form 8316 Rev January by providing an easy-to-use platform for electronic signatures and document management. You can fill out the form digitally and send it securely to the necessary parties. This convenience ensures that you can manage your tax refund requests efficiently without the hassle of paper documentation.

-

Can I integrate airSlate SignNow with other applications for tax management?

Yes, airSlate SignNow offers integrations with various applications that can enhance your tax management experience, including accounting software and document storage solutions. This integration allows for seamless workflows, making it easier to handle Form 8316 Rev January alongside your other financial documentation. Check the integration options available to find the solutions that best fit your needs.

-

What are the benefits of using airSlate SignNow for Form 8316 Rev January?

Using airSlate SignNow for Form 8316 Rev January provides numerous benefits, including time-saving features, secure document sharing, and easy access on multiple devices. The platform's fill-in capable tools ensure that you can complete the form accurately and without the stress of traditional paper methods. Additionally, you can track the document's status and receive confirmations once it's submitted.

Get more for Form 8316 Rev January Fill In Capable Information Regarding Request For Refund Of Social Security Tax Erroneously Withheld On Wa

- Cornell submission form

- Tomorrows scholar forms 5433321

- Switch the complete film viewing questions answer key form

- Condominium resale purchase and sales agreement rhode island rirealtors form

- Ac 3253 s form

- Health care power of attorney wheaton franciscan healthcare form

- Kynect forms khbe i10

- 23rd vis moot claimant memorandum form

Find out other Form 8316 Rev January Fill In Capable Information Regarding Request For Refund Of Social Security Tax Erroneously Withheld On Wa

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement