Application for an Identity Protection Personal IRS PDF Form

What is the Application for an Identity Protection Personal IRS PDF Form

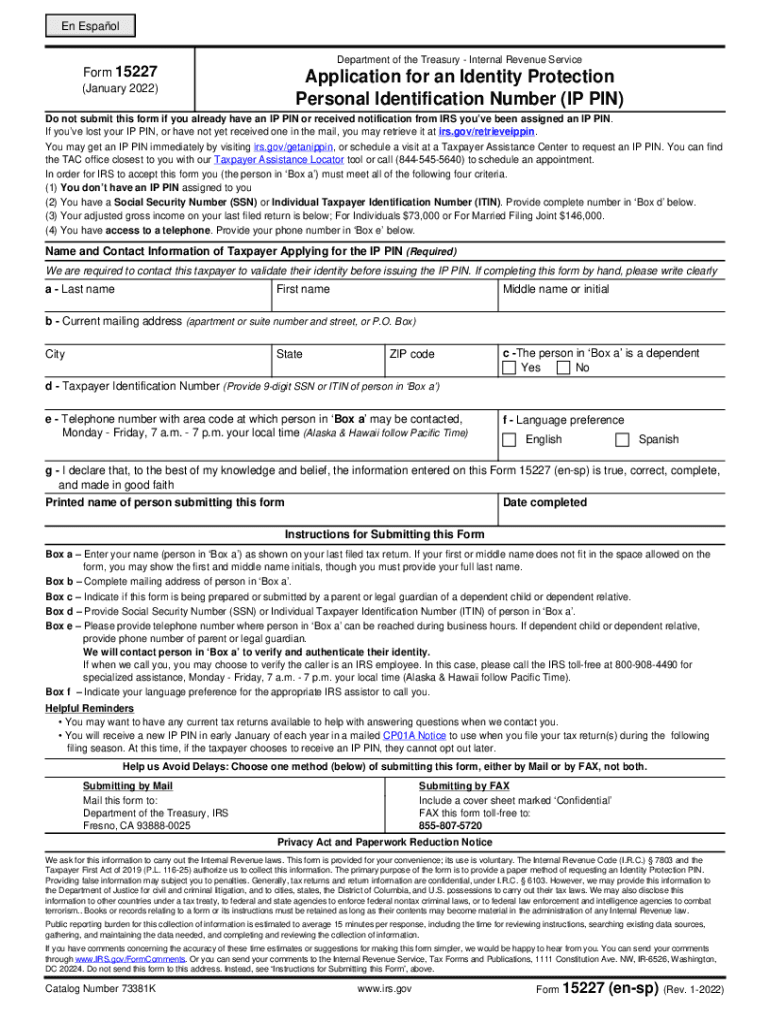

The IRS Form 15227 is specifically designed for individuals seeking an Identity Protection Personal Identification Number (IP PIN). This form allows taxpayers who have been victims of identity theft to apply for an IP PIN, which helps protect their tax filings from fraudulent claims. The IP PIN serves as an additional layer of security, ensuring that only the rightful taxpayer can file their tax return, thus preventing unauthorized access to sensitive personal information.

Steps to Complete the Application for an Identity Protection Personal IRS PDF Form

Completing the IRS Form 15227 involves several key steps to ensure accuracy and compliance. Begin by downloading the form from the IRS website or accessing it through a trusted digital platform. Fill out the required personal information, including your name, address, and Social Security number. It is important to provide accurate details to avoid delays in processing. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the instructions provided, either electronically or via mail.

Legal Use of the Application for an Identity Protection Personal IRS PDF Form

The IRS Form 15227 is legally recognized as a valid method for requesting an IP PIN. To ensure its legal standing, it is essential to comply with all IRS guidelines and requirements when filling out the form. This includes providing truthful information and submitting the form within the specified time frames. The form is designed to protect taxpayers from identity theft, and its proper use is crucial for maintaining the integrity of the tax filing process.

How to Obtain the Application for an Identity Protection Personal IRS PDF Form

The IRS Form 15227 can be obtained directly from the IRS website. It is available in a downloadable PDF format, allowing taxpayers to fill it out electronically or print it for manual completion. Additionally, many tax preparation services and software platforms may provide access to this form as part of their offerings. Ensure that you are using the most current version of the form to avoid any issues with your application.

Filing Deadlines / Important Dates

When applying for an IP PIN using the IRS Form 15227, it is important to be aware of relevant deadlines. Generally, the application must be submitted before the tax filing season begins to ensure that you receive your IP PIN in time for filing your return. The IRS typically provides specific dates each year, so it is advisable to check the IRS website for the most current information regarding deadlines and any changes to the application process.

Eligibility Criteria

To be eligible to use the IRS Form 15227, applicants must have been victims of identity theft and should have a valid Social Security number. The IRS requires documentation to support claims of identity theft, which may include police reports or other relevant information. Understanding these eligibility criteria is essential for a successful application and to ensure that you can obtain the necessary IP PIN for secure tax filing.

Quick guide on how to complete application for an identity protection personal irs pdf form

Complete Application For An Identity Protection Personal IRS PDF Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and secure it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Application For An Identity Protection Personal IRS PDF Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Application For An Identity Protection Personal IRS PDF Form with ease

- Locate Application For An Identity Protection Personal IRS PDF Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Set aside concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that require new document printouts. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Application For An Identity Protection Personal IRS PDF Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for an identity protection personal irs pdf form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 15227 and how can it benefit my business?

Form 15227 is a crucial document that can streamline your business processes. By utilizing airSlate SignNow, you can easily create and manage this form, ensuring that all necessary signatures are collected efficiently. This not only saves time but also enhances compliance and record-keeping for your organization.

-

How much does it cost to use airSlate SignNow for form 15227?

The pricing for using airSlate SignNow to manage form 15227 is competitive and designed to meet the needs of businesses of all sizes. Various plans are available, and you can choose one that best fits your requirements. By opting for SignNow, you will gain access to advanced features that justify the cost.

-

Can I integrate other applications with airSlate SignNow when handling form 15227?

Yes, airSlate SignNow offers seamless integrations with many popular applications, which allows you to manage form 15227 more effectively. You can connect it with CRM systems, cloud storage services, and other tools to streamline your workflows. This integration enhances productivity and reduces manual data entry.

-

What features does airSlate SignNow offer for managing form 15227?

airSlate SignNow provides a range of features for effectively handling form 15227, including customizable templates, automated reminders, and secure eSignature options. These features help ensure that your document processing is efficient and secure. You can track the status of your form in real time, providing peace of mind.

-

Is it easy to use airSlate SignNow for form 15227?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to manage form 15227. The intuitive interface allows you to create, send, and sign documents quickly. You don’t need extensive training to get started, which makes it ideal for businesses looking to simplify their processes.

-

What support is available when using airSlate SignNow for form 15227?

When using airSlate SignNow to manage form 15227, you have access to comprehensive support. The customer support team is available to assist you through various channels, including live chat and email. Additionally, there are numerous online resources, such as tutorials and FAQs, to help you navigate any challenges.

-

Can I track the status of form 15227 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 15227 in real time. You will receive notifications when the document is viewed, signed, or completed. This feature ensures that you are always informed and can follow up if necessary.

Get more for Application For An Identity Protection Personal IRS PDF Form

- Po box 830 canal street station form

- Visa application form 48491612

- Waitbutwhy career form

- Fr den kufer form

- Post surgical home care instructions form

- Duserdata rueformsgbrsites 9 ichardharvardaverealty

- Lipo lab consent form 303550696

- Application for beauty culture professional license by reciprocity form

Find out other Application For An Identity Protection Personal IRS PDF Form

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online