Form 8849 Schedule 2 Rev December Fill in Capable Sales by Registered Ultimate Vendors

What is the Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

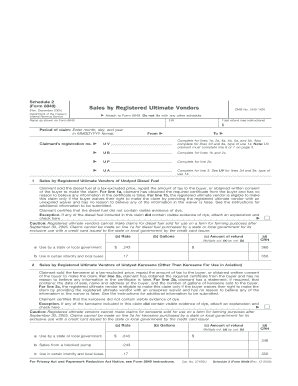

The Form 8849 Schedule 2 is a tax form used by registered ultimate vendors in the United States to claim refunds for excise taxes paid on fuel. This form specifically addresses sales made by vendors who are registered with the Internal Revenue Service (IRS) and allows them to recover certain taxes that may have been overpaid or incorrectly assessed. The form is essential for businesses that deal with fuel sales and need to ensure compliance with federal tax regulations.

How to use the Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

To effectively use the Form 8849 Schedule 2, registered ultimate vendors must fill out the form accurately, providing detailed information about the fuel sold and the taxes paid. This includes entering the correct identification details, the amount of fuel sold, and the corresponding tax amounts. Vendors should ensure that all information is complete and accurate to avoid delays in processing the refund request. After completing the form, vendors can submit it to the IRS for review and processing.

Steps to complete the Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

Completing the Form 8849 Schedule 2 involves several key steps:

- Gather necessary documentation, including sales records and tax payment receipts.

- Fill in the vendor's identifying information, such as name, address, and taxpayer identification number.

- Detail the sales information, including the type and amount of fuel sold, and the excise taxes paid.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS, either electronically or via mail, ensuring to keep a copy for your records.

Key elements of the Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

Important elements of the Form 8849 Schedule 2 include:

- Vendor Information: This section requires the vendor's name, address, and taxpayer identification number.

- Sales Details: Vendors must provide detailed information about fuel sales, including quantities and types of fuel.

- Tax Amounts: Accurate reporting of the excise taxes paid is crucial for refund claims.

- Signature: The form must be signed by an authorized representative of the vendor to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8849 Schedule 2 are crucial for vendors to ensure timely processing of their refund claims. Typically, vendors must submit the form within three years from the date the tax was paid. It is advisable to keep track of all relevant dates and ensure that submissions are made well in advance of any deadlines to avoid penalties or delays in processing.

Form Submission Methods (Online / Mail / In-Person)

The Form 8849 Schedule 2 can be submitted to the IRS through various methods. Vendors have the option to file the form electronically, which is often faster and allows for quicker processing of refunds. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submissions are generally not recommended for this form, as the IRS does not accept walk-in filings for tax refund requests. Vendors should choose the method that best suits their needs while ensuring compliance with IRS guidelines.

Quick guide on how to complete form 8849 schedule 2 rev december fill in capable sales by registered ultimate vendors

Complete [SKS] seamlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS apps and enhance any document-driven operation today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

Create this form in 5 minutes!

How to create an eSignature for the form 8849 schedule 2 rev december fill in capable sales by registered ultimate vendors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors is a tax form used to report specific sales by registered ultimate vendors to ensure compliance with tax regulations. Using this form correctly helps businesses manage their tax obligations smoothly. airSlate SignNow offers features that simplify the e-signing process for such forms.

-

How can airSlate SignNow help with Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

airSlate SignNow provides a user-friendly platform for electronically signing Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors. Our solution ensures that your documents are signed securely and quickly, making it easier to adhere to deadlines and compliance requirements.

-

Is there a cost associated with using airSlate SignNow for Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Depending on the features and volume of usage, pricing can vary, but it remains cost-effective for businesses looking to manage Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors efficiently.

-

What features does airSlate SignNow offer for managing Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

airSlate SignNow includes a variety of features such as document templates, automatic reminders, and secure sharing options to effectively manage Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors. These features enhance the signing workflow and help maintain compliance effortlessly.

-

Can I integrate airSlate SignNow with other software for handling Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

Absolutely! airSlate SignNow offers integrations with popular software solutions. This allows for seamless handling of Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors alongside your existing business tools, streamlining your document processes even further.

-

What are the benefits of using airSlate SignNow for Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

Using airSlate SignNow for Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors saves time and improves accuracy in your document management. The platform ensures compliance, enhances collaboration, and offers a secure way to handle sensitive information.

-

How secure is airSlate SignNow for signing Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When signing Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors, you can trust that your documents and data are well protected.

Get more for Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

Find out other Form 8849 Schedule 2 Rev December Fill In Capable Sales By Registered Ultimate Vendors

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online