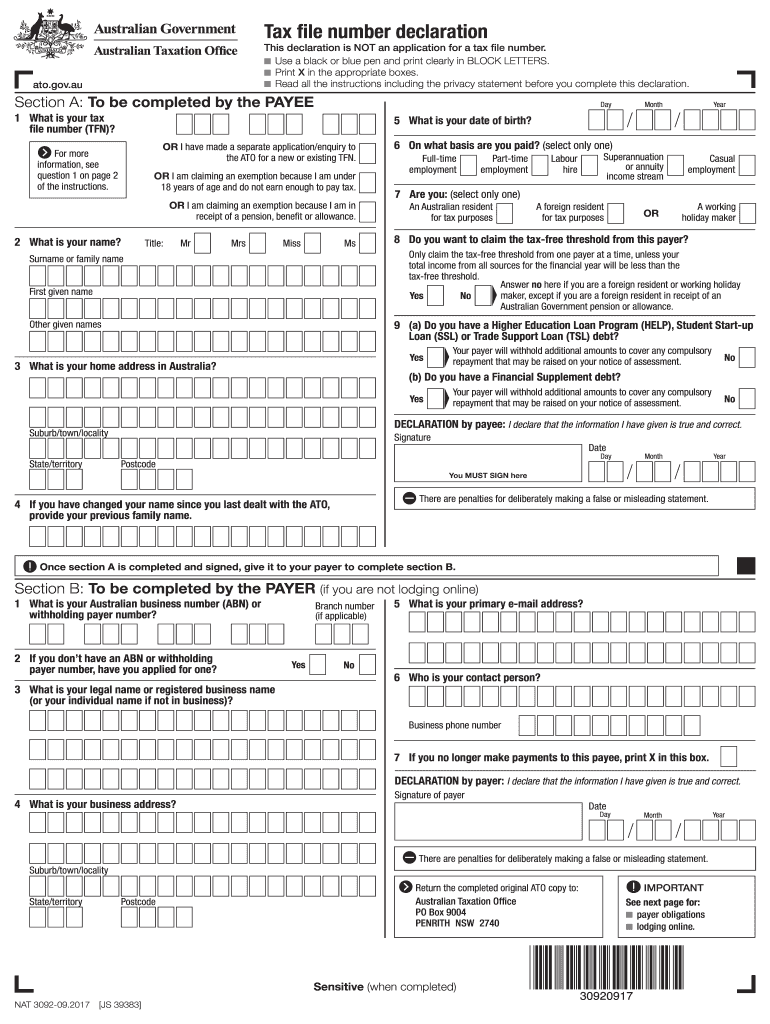

Tax File Declaration Form 2017

What is the Tax File Declaration Form

The Tax File Declaration Form, often referred to as the TFN declaration, is a crucial document used in the United States for tax purposes. This form allows individuals to declare their tax file number (TFN) to their employer or financial institution, ensuring that the correct amount of tax is withheld from their income. It is essential for maintaining compliance with tax regulations and helps streamline the tax filing process. By accurately completing this form, taxpayers can avoid overpayment or underpayment of taxes, which can lead to penalties or unexpected tax bills.

Steps to Complete the Tax File Declaration Form

Completing the Tax File Declaration Form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, address, and TFN. Next, carefully fill out the form, ensuring that all fields are completed correctly. Double-check the information for any errors or omissions, as incomplete forms can lead to delays in processing. Once the form is filled out, sign and date it to validate your declaration. Finally, submit the form to your employer or financial institution as instructed.

How to Obtain the Tax File Declaration Form

The Tax File Declaration Form can be obtained through various channels. Most employers provide the form directly to their employees during the onboarding process. Additionally, the form is available online through the official IRS website or other tax-related resources. If you prefer a physical copy, you can also request one from your local tax office or financial institution. Ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Tax File Declaration Form

The Tax File Declaration Form serves a legal purpose in the United States tax system. It is essential for accurately reporting income and ensuring that the correct amount of tax is withheld from your earnings. By submitting this form, you are legally binding yourself to the information provided, which must be truthful and complete. Misrepresentation or failure to submit the form can result in penalties, including fines or legal action. Therefore, it is crucial to understand the legal implications of the information you provide on the form.

Key Elements of the Tax File Declaration Form

Several key elements are essential to the Tax File Declaration Form. These include personal identification details such as your full name, address, and TFN. Additionally, the form typically requires information about your employment status and any applicable tax exemptions. Understanding these elements is vital for accurately completing the form and ensuring compliance with tax regulations. Each section must be filled out carefully to reflect your current tax situation.

Form Submission Methods (Online / Mail / In-Person)

The Tax File Declaration Form can be submitted through various methods, depending on your preference and the requirements of your employer or financial institution. Many employers allow for online submission through secure portals, making the process quick and efficient. Alternatively, you can mail the completed form to your employer's HR department or submit it in person during your onboarding process. It is important to follow the specific submission guidelines provided by your employer to ensure timely processing.

Penalties for Non-Compliance

Failure to comply with the requirements of the Tax File Declaration Form can lead to significant penalties. If you do not submit the form, your employer may withhold taxes at the highest rate, resulting in overpayment. Additionally, providing false information on the form can lead to legal consequences, including fines or audits by the IRS. It is crucial to understand the importance of completing and submitting the form accurately and on time to avoid these potential penalties.

Quick guide on how to complete tax file declaration form 2017 2019

A concise guide on how to create your Tax File Declaration Form

Locating the appropriate template can prove to be a task when you need to submit official international documents. Even if you possess the necessary form, it may be tedious to swiftly prepare it according to all the specifications if you opt for printed versions instead of handling everything digitally. airSlate SignNow is the web-based electronic signature service that assists you in navigating all of that. It enables you to obtain your Tax File Declaration Form and promptly fill it out and sign it on-site without needing to reprint documents whenever you make an error.

Here are the procedures you should follow to create your Tax File Declaration Form with airSlate SignNow:

- Hit the Get Form button to upload your document to our editor immediately.

- Begin with the first blank space, enter information, and continue with the Next tool.

- Complete the empty fields using the Cross and Check tools from the menu above.

- Select the Highlight or Line features to emphasize the most critical details.

- Click on Image and upload one if your Tax File Declaration Form necessitates it.

- Utilize the right-side menu to add more fields for you or others to fill in as needed.

- Review your inputs and confirm the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete editing by clicking the Done button and choosing your file-sharing options.

Once your Tax File Declaration Form is prepared, you can share it in any way you prefer - dispatch it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your finished paperwork in your account, organized in folders as per your preferences. Don’t spend time on manual form filling; experience airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct tax file declaration form 2017 2019

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How can I file the income tax returns Form 16 for the year of 2017–2018 and 2018–2019? Is there any chance, with a late fee?

No, you can’t file ITR for AY:2017–18 & 2018–19 as the due date for filing ITR is over i.e 31st March 2019.But you can apply for condonation of delay in filing ITR with reasons to CIT. Once the condonation is accepted you can file but it is a complex process.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out the 1080 form when filing taxes?

There is no such form in US taxation. Thus you can not fill it out. If you mean a 1098 T you still do not. The University issues it to you. Please read the answers to the last 4 questions you posted about form 1080. IT DOES NOT EXIST.

Create this form in 5 minutes!

How to create an eSignature for the tax file declaration form 2017 2019

How to make an eSignature for the Tax File Declaration Form 2017 2019 in the online mode

How to generate an eSignature for the Tax File Declaration Form 2017 2019 in Google Chrome

How to generate an eSignature for signing the Tax File Declaration Form 2017 2019 in Gmail

How to make an eSignature for the Tax File Declaration Form 2017 2019 straight from your smartphone

How to generate an eSignature for the Tax File Declaration Form 2017 2019 on iOS devices

How to generate an eSignature for the Tax File Declaration Form 2017 2019 on Android

People also ask

-

What is a Tax File Declaration Form?

A Tax File Declaration Form is a crucial document that employees fill out to declare their tax file number and other relevant tax information to their employer. This form ensures that the correct amount of tax is withheld from your salary. Using airSlate SignNow, you can easily create and eSign a Tax File Declaration Form, streamlining the process and ensuring compliance.

-

How does airSlate SignNow simplify the Tax File Declaration Form process?

airSlate SignNow simplifies the Tax File Declaration Form process by allowing users to create, send, and eSign the document digitally. This eliminates the need for paper forms and in-person meetings, making it faster and more efficient. Additionally, our user-friendly interface ensures that anyone can complete the Tax File Declaration Form with ease.

-

What features does airSlate SignNow offer for managing Tax File Declaration Forms?

airSlate SignNow offers a variety of features for managing Tax File Declaration Forms, including customizable templates, secure data storage, and real-time tracking of document status. These features help businesses streamline their HR processes and ensure that all tax-related documents are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Tax File Declaration Forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans offer various options depending on your needs, including features specifically tailored for managing Tax File Declaration Forms. You can choose a plan that fits your budget while still enjoying the benefits of our powerful eSigning solution.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various software solutions commonly used for tax management and HR processes. This means you can seamlessly connect your existing systems with our platform to enhance the workflow for managing Tax File Declaration Forms and other essential documents.

-

What are the benefits of using airSlate SignNow for Tax File Declaration Forms?

Using airSlate SignNow for Tax File Declaration Forms provides numerous benefits, including improved efficiency, enhanced security, and reduced paperwork. The digital eSigning process ensures that your forms are completed quickly and securely, while also allowing for easy access and storage of important tax documents.

-

Is airSlate SignNow secure for handling sensitive Tax File Declaration Forms?

Yes, airSlate SignNow prioritizes the security of all documents, including Tax File Declaration Forms. Our platform uses advanced encryption and complies with industry standards to protect your sensitive information. You can confidently eSign and store your tax documents knowing they are secure.

Get more for Tax File Declaration Form

- Missouri regional teacher of the year desemogov dese mo form

- Stylist pulling request form

- Uce 1010 2015 form

- Referralauthorization request form uhc military west

- Form no 1118 owner s sale agreement and earnest money

- Change of ownership form slingshotpdf

- 62nd state science engineering fair of florida official abstract and certification form

- Shaving profile form

Find out other Tax File Declaration Form

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe