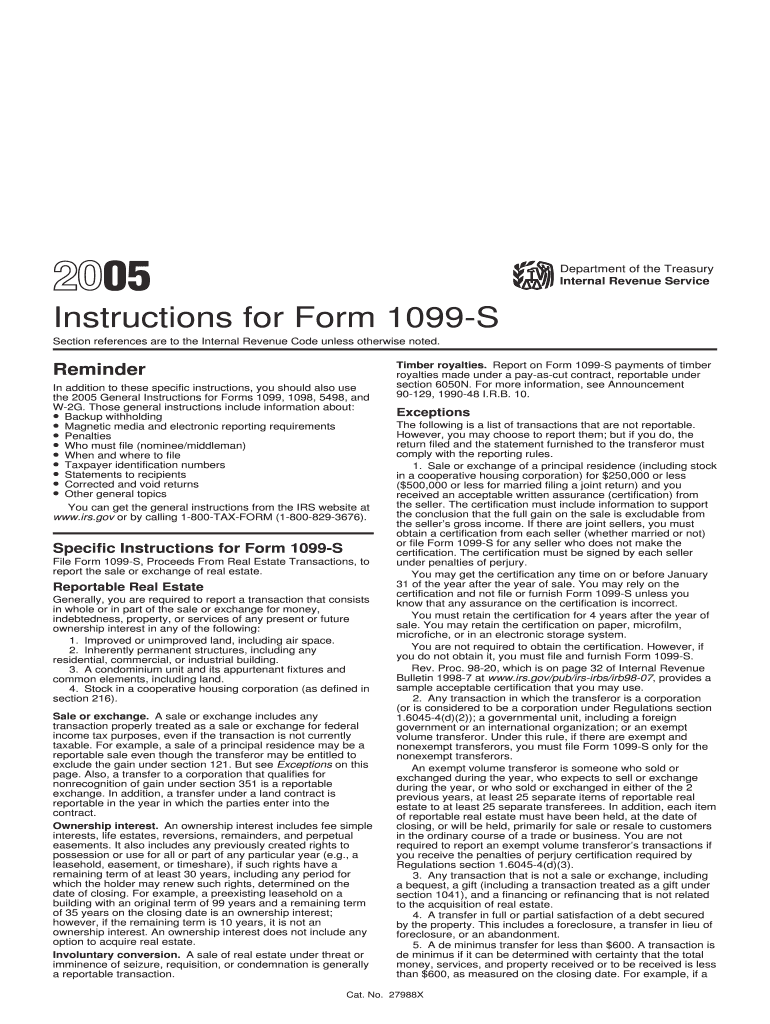

Instructions for Form 1099 S Instructions for Form 1099 S, Proceeds from Real Estate Transactions

Understanding Form 1099-S and Its Instructions

Form 1099-S, titled "Proceeds From Real Estate Transactions," is a tax document used in the United States to report the sale or exchange of real estate. This form is essential for both the seller and the buyer, as it ensures that the Internal Revenue Service (IRS) is informed about the transaction, which may have tax implications. The form captures details such as the gross proceeds from the sale, the date of the transaction, and the parties involved. Understanding the instructions for completing this form is crucial for compliance and accurate reporting.

Steps to Complete Form 1099-S

Completing Form 1099-S involves several key steps:

- Gather necessary information, including the seller's and buyer's names, addresses, and taxpayer identification numbers (TIN).

- Determine the gross proceeds from the real estate transaction, which typically includes the total sale price.

- Fill out the form, ensuring that all information is accurate and complete. Pay particular attention to the sections that require details about the transaction date and property description.

- Review the completed form for any errors before submission.

Legal Use of Form 1099-S

Form 1099-S is legally required for reporting real estate transactions where the gross proceeds exceed a specific threshold. The IRS mandates that the form be filed for sales of real estate, including residential properties, commercial properties, and land. Failure to file this form when required can result in penalties for both the seller and the buyer. It is important to understand the legal implications of this form and to ensure compliance with IRS regulations.

Filing Deadlines for Form 1099-S

Timely filing of Form 1099-S is essential to avoid penalties. The form must be submitted to the IRS by a specified deadline, typically January 31 of the year following the transaction. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Additionally, copies of the form must be provided to the seller by the same deadline to ensure they have the necessary information for their tax returns.

Required Documents for Form 1099-S

When preparing to file Form 1099-S, certain documents are essential. These may include:

- The sales contract or agreement outlining the terms of the transaction.

- Closing statements that detail the final sale price and any adjustments.

- Identification documents for both parties, including TINs.

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with IRS requirements.

IRS Guidelines for Form 1099-S

The IRS provides specific guidelines for completing Form 1099-S, which include instructions on how to report various types of transactions and what information is necessary. These guidelines emphasize the importance of accuracy and completeness in reporting. Taxpayers should familiarize themselves with these guidelines to ensure they meet all requirements and avoid potential issues with the IRS.

Quick guide on how to complete instructions for form 1099 s instructions for form 1099 s proceeds from real estate transactions

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular amongst organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark essential sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to share your completed form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1099 s instructions for form 1099 s proceeds from real estate transactions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing Form 1099 S?

airSlate SignNow provides a user-friendly platform for effectively managing Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions. Key features include customizable templates, secure eSigning, and automatic reminders, all designed to streamline your documentation process and ensure compliance.

-

How does airSlate SignNow help simplify the process of filling out Form 1099 S?

With airSlate SignNow, users can easily navigate the Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions. The platform offers guided workflows, making it easier to input the necessary information, ensuring that all required fields are completed accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans aimed at providing value for businesses of all sizes. Each plan includes access to features that assist with Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions, ensuring that you have the right tools without overspending.

-

Can I integrate airSlate SignNow with other software for processing Form 1099 S?

Yes, airSlate SignNow seamlessly integrates with various popular software solutions. This allows you to enhance your workflow when dealing with Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions, enabling smoother data transfer and improved efficiency.

-

What benefits does airSlate SignNow provide for businesses handling real estate transactions?

Using airSlate SignNow simplifies the process of handling real estate transactions, particularly when managing Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions. Benefits include reduced paperwork, faster turnaround times, and improved compliance and tracking capabilities.

-

Is airSlate SignNow compliant with legal and regulatory standards for Form 1099 S?

Absolutely! airSlate SignNow is committed to compliance with all relevant legal and regulatory standards concerning Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions. Our platform ensures that all eSigned documents meet federal and state guidelines.

-

How secure is the airSlate SignNow platform for sensitive transaction documents?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption protocols to protect your sensitive documents, including those related to Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions, ensuring that your data remains safe throughout the signing process.

Get more for Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions

Find out other Instructions For Form 1099 S Instructions For Form 1099 S, Proceeds From Real Estate Transactions

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney