Form 706GST Rev January Generation Skipping Transfer Tax Return for Terminations

What is the Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations

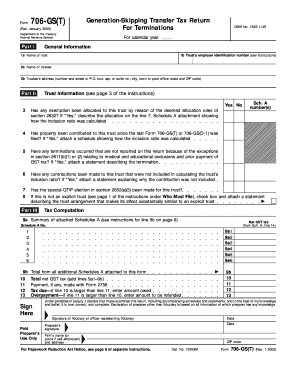

The Form 706GST Rev January is a tax document used in the United States to report Generation Skipping Transfer (GST) taxes. This form is specifically designed for terminations, allowing taxpayers to disclose transfers that skip generations, such as gifts or bequests to grandchildren or unrelated individuals. The IRS requires this form to ensure proper taxation on these transfers, which can have significant tax implications. Understanding the purpose and requirements of this form is essential for compliance with federal tax laws.

How to use the Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations

Using the Form 706GST Rev January involves several steps to ensure accurate reporting. First, gather all necessary information about the transfer, including the value of the assets and the identities of the beneficiaries. Next, fill out the form by providing details about the transferor, the recipients, and the nature of the transfers. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form must be submitted to the IRS by the specified deadline to ensure compliance and avoid any late fees.

Steps to complete the Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations

Completing the Form 706GST Rev January involves a systematic approach:

- Gather all relevant documentation regarding the transfer, including appraisals and previous tax returns.

- Fill in the transferor's information, including name, address, and taxpayer identification number.

- Detail the recipients' information, ensuring accurate identification of each beneficiary.

- Provide a comprehensive description of the assets being transferred, including their fair market value.

- Calculate the GST tax owed based on the current tax rates and applicable exemptions.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706GST Rev January are critical to avoid penalties. Typically, the form must be filed within nine months of the transfer date. Extensions may be available, but they require proper documentation and submission of Form 4868. It is essential to stay informed about any changes in deadlines or requirements announced by the IRS to ensure timely compliance.

Penalties for Non-Compliance

Failure to file the Form 706GST Rev January or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to audits or further scrutiny of the taxpayer's financial activities. Understanding these potential penalties emphasizes the importance of accurate and timely filing.

Eligibility Criteria

Eligibility to use the Form 706GST Rev January is generally determined by the nature of the transfer. Taxpayers who make transfers that skip generations, such as gifts to grandchildren or unrelated parties, must file this form if the total value exceeds the annual exclusion limit. Additionally, understanding the specific exemptions and thresholds set by the IRS is essential for determining whether filing is necessary.

Quick guide on how to complete form 706gst rev january generation skipping transfer tax return for terminations

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can obtain the precise format and securely store it on the internet. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without interruptions. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or obscure sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your document, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, time-consuming document searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations

Create this form in 5 minutes!

How to create an eSignature for the form 706gst rev january generation skipping transfer tax return for terminations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations is a tax return used to report generation-skipping transfers and calculate any taxes owed. This form is essential for estate planning and ensuring compliance with IRS regulations, especially in the context of trusts and estates.

-

How can airSlate SignNow help with Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

airSlate SignNow simplifies the process of completing and eSigning Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations. With features such as templates, automatic reminders, and secure storage, users can efficiently manage their tax documentation without hassle.

-

Is airSlate SignNow cost-effective for filing Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations. With transparent pricing plans, you can choose the best option that fits your needs without overspending on unnecessary features.

-

Can I integrate airSlate SignNow with other software for filing my Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing your workflow when handling Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations. This integration allows for easy access to your documents and data in one central location.

-

What features does airSlate SignNow provide for managing Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

airSlate SignNow includes features like document templates, custom workflows, eSigning capabilities, and secure cloud storage specifically designed to streamline the handling of Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations. These features ensure your documents are processed quickly and securely.

-

What are the benefits of using airSlate SignNow for Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

Using airSlate SignNow for Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations provides benefits such as reduced processing time, enhanced security, and user-friendly interfaces. These advantages aid in ensuring compliance while minimizing errors in your tax filings.

-

How does airSlate SignNow ensure the security of my Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations?

airSlate SignNow employs advanced encryption protocols and compliance measures to protect your information when filing Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations. This commitment to security helps safeguard sensitive financial data against unauthorized access.

Get more for Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations

Find out other Form 706GST Rev January Generation Skipping Transfer Tax Return For Terminations

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online