Schedule J Form 1041

What is the Schedule J Form 1041

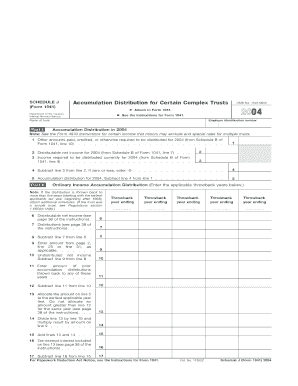

The Schedule J Form 1041 is a tax form used by estates and trusts to calculate the income distribution deduction. This form allows fiduciaries to report the income that is distributed to beneficiaries. By doing so, the income is taxed at the beneficiaries' tax rates rather than the trust or estate's higher rates. This form is essential for ensuring that the income is accurately reported and that the appropriate deductions are claimed.

How to use the Schedule J Form 1041

To effectively use the Schedule J Form 1041, fiduciaries must first gather all relevant financial information related to the estate or trust. This includes income earned, distributions made to beneficiaries, and any deductions that may apply. Once the necessary information is collected, the fiduciary can complete the form by entering the total income, distributions, and deductions. It is important to ensure that the information is accurate to avoid penalties or issues with the IRS.

Steps to complete the Schedule J Form 1041

Completing the Schedule J Form 1041 involves several key steps:

- Gather all financial documents related to the estate or trust.

- Calculate the total income earned during the tax year.

- Determine the amount of income distributed to beneficiaries.

- Identify any deductions that can be claimed.

- Fill out the Schedule J Form 1041 with the calculated figures.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The Schedule J Form 1041 must be filed along with the Form 1041 by the due date of the estate or trust's tax return. Generally, this deadline is the fifteenth day of the fourth month following the end of the tax year. For estates and trusts that operate on a calendar year, the due date is April fifteenth. It is crucial to be aware of these deadlines to avoid late filing penalties.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule J Form 1041. These guidelines include instructions on how to report income, deductions, and distributions accurately. Fiduciaries should refer to the IRS instructions for Form 1041 and Schedule J to ensure compliance with all regulations. Following these guidelines helps in maintaining proper tax records and avoiding potential audits.

Key elements of the Schedule J Form 1041

Key elements of the Schedule J Form 1041 include:

- Total income earned by the estate or trust.

- Distributions made to beneficiaries.

- Income distribution deduction claimed.

- Signature of the fiduciary or authorized representative.

Each of these elements plays a critical role in determining the tax liability of the estate or trust and ensuring that beneficiaries are taxed appropriately.

Quick guide on how to complete schedule j form 1041

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to alter and eSign [SKS] with ease

- Find [SKS] and click on Get Form to commence.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule J Form 1041

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule J Form 1041 and why is it important?

The Schedule J Form 1041 is used to compute the income distribution deduction for estates and trusts that distribute income to beneficiaries. It's important because it helps ensure that the correct amount of income is taxed at the beneficiary level rather than at the estate or trust level. Understanding how to accurately fill out this form can streamline the tax process for estates and trusts.

-

How can airSlate SignNow help with filling out the Schedule J Form 1041?

airSlate SignNow provides an easy-to-use platform that enables users to create, fill out, and eSign documents like the Schedule J Form 1041 efficiently. With its user-friendly interface, you can quickly upload your tax documents, fill in the necessary fields, and seamlessly share them with your tax advisor for review. This reduces the hassle associated with paper forms and enhances document security.

-

What features does airSlate SignNow offer for eSigning the Schedule J Form 1041?

With airSlate SignNow, you can eSign your Schedule J Form 1041 easily from any device, at any time. The platform supports multiple signature options, including drawing, typing, or uploading images of your signature. Additionally, you can track the signing status in real-time, ensuring that all parties are engaged in the process.

-

Is airSlate SignNow cost-effective for handling Schedule J Form 1041?

Yes, airSlate SignNow offers cost-effective plans designed to fit various budget needs while providing robust features for eSigning documents like the Schedule J Form 1041. The platform’s subscription model allows you to choose a plan that suits your volume of document needs, reducing the overall cost associated with traditional signing methods.

-

Can I integrate airSlate SignNow with other software to manage my Schedule J Form 1041?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including accounting and tax software that can help you manage your Schedule J Form 1041. This integration allows for automatic population of your form with relevant data, saving you time and minimizing errors in the process.

-

What are the benefits of using airSlate SignNow for the Schedule J Form 1041?

Using airSlate SignNow for the Schedule J Form 1041 simplifies the entire signing process, making it quick and efficient. Benefits include enhanced security for your sensitive tax documents, easy accessibility from any device, and the ability to track the document's status. These features contribute to a smoother experience for both you and your beneficiaries.

-

How secure is my data when using airSlate SignNow for Schedule J Form 1041?

airSlate SignNow prioritizes your data security, employing advanced encryption methods to protect your information while filling out and eSigning the Schedule J Form 1041. The platform complies with industry standards and regulations, ensuring that your personal and financial data is safe from unauthorized access.

Get more for Schedule J Form 1041

Find out other Schedule J Form 1041

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract