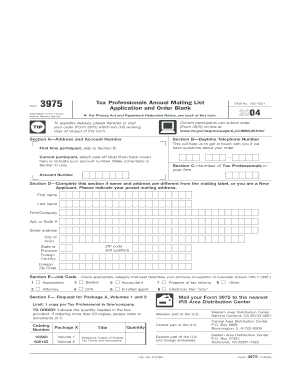

Form 3975 Tax Professionals Annual Mailing List Application and Order Blank

What is the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank

The Form 3975 Tax Professionals Annual Mailing List Application And Order Blank is a document used by tax professionals in the United States to request inclusion in the IRS mailing list. This form allows tax preparers to receive important updates, publications, and other materials from the IRS that are essential for their practice. By completing this form, tax professionals ensure they stay informed about changes in tax laws, regulations, and procedures that could affect their clients.

How to use the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank

To use the Form 3975, tax professionals must first obtain the form from the IRS website or through authorized channels. Once the form is in hand, it should be filled out with accurate information, including the preparer's name, business address, and contact details. After completing the form, it can be submitted either by mail or electronically, depending on the IRS guidelines. Proper submission ensures that tax professionals receive timely information and updates relevant to their practice.

Steps to complete the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank

Completing the Form 3975 involves several straightforward steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in the required fields, including your name, business name, address, and contact information.

- Review the form for accuracy to prevent any issues with processing.

- Choose your preferred method of receiving materials (mail or electronic).

- Submit the completed form to the IRS through the designated submission method.

Key elements of the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank

The key elements of the Form 3975 include:

- Contact Information: Accurate details about the tax professional, including name, address, and phone number.

- Business Information: Name of the business or firm, if applicable.

- Delivery Preference: Indication of whether the professional prefers to receive materials by mail or electronically.

- Signature: A signature to verify the authenticity of the request.

Who Issues the Form

The Form 3975 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides this form to facilitate communication with tax professionals and ensure they have access to the latest information necessary for their work.

Application Process & Approval Time

The application process for the Form 3975 involves filling out the form and submitting it to the IRS. Once submitted, the processing time can vary. Generally, tax professionals can expect to receive confirmation of their application within a few weeks. However, factors such as the volume of applications and IRS processing capabilities may affect the timeline. It is advisable to submit the form well in advance of any critical deadlines to ensure timely receipt of materials.

Quick guide on how to complete form 3975 tax professionals annual mailing list application and order blank

Complete [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to adjust and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] and ensure superb communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3975 tax professionals annual mailing list application and order blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank?

The Form 3975 Tax Professionals Annual Mailing List Application And Order Blank is a document used by tax professionals to request access to the annual mailing list of taxpayers. This list is crucial for ensuring that tax professionals can signNow their clients effectively and stay informed about updates from the IRS.

-

How can I obtain the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank?

You can obtain the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank directly from the IRS website or through your professional tax software. Completing this form is essential for maintaining communication with your clients, so make sure to fill it out accurately.

-

What are the benefits of using the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank?

Using the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank allows tax professionals to stay connected with their clients and access important tax-related information. This can enhance your ability to offer more tailored services and improve client satisfaction.

-

Is there a cost associated with the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank?

There is no cost to submit the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank. However, you should be aware of any potential fees associated with privacy regulations or handling data from the list.

-

Are there any specific features of the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank?

The Form 3975 Tax Professionals Annual Mailing List Application And Order Blank includes fields for tax professional information, contact details, and confirmation of qualifications. This ensures that the information provided is accurate and that professionals receive the correct mailing list for their needs.

-

How does the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank integrate with my existing tax software?

Many tax software programs allow you to directly integrate the information from the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank. This integration helps streamline your client management and ensures you can efficiently access the annual mailing list data.

-

How often do I need to submit the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank?

You typically need to submit the Form 3975 Tax Professionals Annual Mailing List Application And Order Blank on an annual basis. This annual submission helps ensure that your client information is up-to-date and that you remain on the mailing list for important tax notifications.

Get more for Form 3975 Tax Professionals Annual Mailing List Application And Order Blank

- Vgh floor directory form

- Baseball liability waiver form

- Ricoh aficio mp c2051 service manual pdf form

- Hoa architectural review request form

- Partition form 34289884

- Strategic business letters and e mail form

- Out of plan reimbursement form instructions connecticare

- Service learning form sunrise middle school

Find out other Form 3975 Tax Professionals Annual Mailing List Application And Order Blank

- eSign West Virginia Sports Lease Agreement Template Computer

- eSign Wisconsin Sports LLC Operating Agreement Later

- eSign Wisconsin Sports LLC Operating Agreement Myself

- eSign Wisconsin Sports LLC Operating Agreement Free

- eSign West Virginia Sports Lease Agreement Template Mobile

- eSign Wisconsin Sports LLC Operating Agreement Secure

- eSign Wisconsin Sports LLC Operating Agreement Fast

- eSign Wisconsin Sports LLC Operating Agreement Simple

- eSign West Virginia Sports Lease Agreement Template Now

- eSign Wisconsin Sports LLC Operating Agreement Easy

- eSign Virginia Police Lease Agreement Online

- eSign Virginia Police Lease Agreement Computer

- eSign Wisconsin Sports LLC Operating Agreement Safe

- eSign West Virginia Sports Lease Agreement Template Later

- How To eSign West Virginia Sports Lease Agreement Template

- How Do I eSign West Virginia Sports Lease Agreement Template

- eSign Virginia Police Lease Agreement Mobile

- eSign West Virginia Sports Lease Agreement Template Myself

- Help Me With eSign West Virginia Sports Lease Agreement Template

- How Can I eSign West Virginia Sports Lease Agreement Template