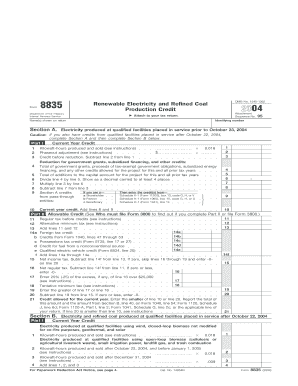

Form 8835 Renewable Electricity and Refined Coal Production Credit Attach to Your Tax Return

What is the Form 8835 Renewable Electricity And Refined Coal Production Credit?

The Form 8835 is used by businesses to claim the Renewable Electricity and Refined Coal Production Credit. This tax credit is designed to encourage the production of renewable energy and refined coal, providing financial incentives for companies that engage in these environmentally friendly practices. By completing this form, eligible businesses can reduce their tax liability based on the amount of renewable electricity or refined coal they produce during the tax year.

Steps to Complete the Form 8835

Completing the Form 8835 involves several key steps:

- Gather necessary information, including production quantities and related financial data.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the credit amount based on the production figures provided.

- Attach the completed form to your tax return when filing.

It is important to double-check all entries for accuracy to avoid delays or issues with your tax return.

Eligibility Criteria for Form 8835

To qualify for the Renewable Electricity and Refined Coal Production Credit, businesses must meet specific eligibility criteria. These include:

- Producing renewable electricity or refined coal during the tax year.

- Meeting the required production thresholds set by the IRS.

- Complying with any applicable federal and state regulations regarding renewable energy production.

Understanding these criteria is crucial for businesses seeking to benefit from this tax credit.

IRS Guidelines for Form 8835

The IRS provides comprehensive guidelines for completing and submitting Form 8835. These guidelines outline the necessary documentation, calculation methods for the credit, and specific instructions for different types of producers. It is essential for businesses to familiarize themselves with these guidelines to ensure compliance and maximize their potential tax benefits.

Filing Deadlines for Form 8835

Timely filing of Form 8835 is critical to avoid penalties. The form must be submitted along with your annual tax return. Typically, the deadline for filing individual tax returns is April 15, while corporate returns may have different deadlines. It is advisable to check the IRS website for any updates or changes to these deadlines, especially in light of potential extensions or changes in tax policy.

How to Obtain the Form 8835

Businesses can obtain Form 8835 directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as updates may occur annually. Additionally, consulting with a tax professional can provide guidance on obtaining and completing the form correctly.

Quick guide on how to complete form 8835

Complete form 8835 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents rapidly without delays. Manage form 8835 on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign form 8835 with ease

- Locate form 8835 and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign form 8835 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8835

Create this form in 5 minutes!

How to create an eSignature for the form 8835

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8835

-

What is form 8835 and why do I need it?

Form 8835 is used to claim the credit for renewable energy expenditures, specifically for businesses engaging in alternative energy projects. Completing this form ensures you receive the appropriate tax benefits, helping your business save on costs associated with energy improvements.

-

How can airSlate SignNow assist me in completing form 8835?

With airSlate SignNow, you can easily create, edit, and eSign form 8835 digitally, making the process more efficient and less stressful. Our platform provides templates and step-by-step guidance, ensuring you don’t miss any critical details while filling out the form.

-

What are the pricing options for using airSlate SignNow for form 8835?

airSlate SignNow offers several pricing tiers to accommodate different business needs, ensuring affordability regardless of your budget. Each tier includes access to features that streamline the preparation and submission of form 8835, allowing you to choose the plan that best fits your requirements.

-

Are there any integrations available with airSlate SignNow for form 8835 submissions?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easy to pull in necessary information for form 8835 from your existing tools. This integration simplifies the data entry process, helping you focus on accurately completing your forms.

-

What features does airSlate SignNow provide for managing form 8835?

airSlate SignNow offers features like document templates, automated workflows, and secure eSigning for managing form 8835. These tools enhance productivity and accuracy, ensuring your submissions are timely and compliant with the latest tax regulations.

-

Is it safe to use airSlate SignNow for my form 8835 submissions?

Absolutely! airSlate SignNow prioritizes security and compliance, utilizing advanced encryption methods to safeguard your sensitive information when submitting form 8835. You can trust our platform to keep your documents secure during the entire eSigning process.

-

Can airSlate SignNow help me track the status of my form 8835?

Yes, airSlate SignNow allows you to track the status of your form 8835 submissions in real-time. You will receive notifications when your document is viewed and signed, giving you peace of mind as you manage your important tax forms.

Get more for form 8835

Find out other form 8835

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe