Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al Form

What is the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

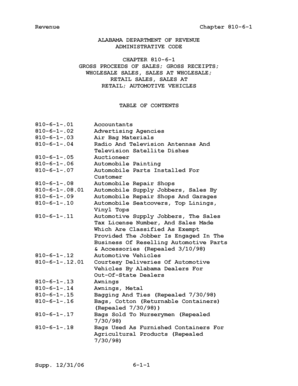

The Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al is a regulatory framework that outlines specific tax obligations and compliance requirements for businesses operating within Alabama. This chapter serves as a guide for understanding various revenue-related processes, including tax assessment, collection, and enforcement. It is essential for businesses to familiarize themselves with this code to ensure compliance with state regulations and avoid penalties.

How to use the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

Using the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al involves understanding the specific provisions that apply to your business. This includes identifying applicable tax rates, deadlines for filing, and any required documentation. Businesses should carefully review the chapter to determine their obligations and ensure that they maintain accurate records to support their tax filings.

Steps to complete the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

Completing the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al requires several key steps:

- Review the relevant sections of the chapter to understand your tax obligations.

- Gather necessary financial documents, including income statements and expense records.

- Calculate the appropriate tax amounts based on the guidelines provided.

- Complete any required forms accurately, ensuring all information is current and correct.

- Submit the completed forms by the specified deadlines to avoid penalties.

Legal use of the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

The legal use of the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al is crucial for ensuring that businesses operate within the law. Compliance with this chapter helps to protect businesses from legal challenges and financial penalties. It is important for businesses to stay updated on any changes to the code and to consult with legal or tax professionals when necessary to ensure adherence to all requirements.

Key elements of the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

Key elements of the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al include:

- Definitions of taxable entities and activities.

- Tax rates applicable to different types of businesses.

- Filing requirements and deadlines for tax submissions.

- Penalties for non-compliance and guidelines for appeals.

- Procedures for audits and assessments by state authorities.

State-specific rules for the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

State-specific rules within the Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al address unique aspects of Alabama's tax system. These may include local tax regulations, exemptions, and credits that are specific to the state. Understanding these rules is essential for businesses to optimize their tax liabilities and ensure compliance with state law.

Quick guide on how to complete revenue chapter 81061 supp 123106 6 alabamaadministrativecode state al

Finish [SKS] easily on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow offers you all the tools you require to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The most efficient way to edit and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenue chapter 81061 supp 123106 6 alabamaadministrativecode state al

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al?

Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al outlines specific administrative regulations regarding electronic signatures in Alabama. Understanding these regulations is essential for businesses looking to implement eSignature solutions like airSlate SignNow.

-

How can airSlate SignNow help my business comply with Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al?

airSlate SignNow offers features that ensure all electronic signatures are legally compliant with Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al. Our platform provides detailed audit trails and secure verification methods to uphold compliance.

-

What features are available with airSlate SignNow related to Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al?

With airSlate SignNow, users can access a variety of features including templates, mobile signing, and customizable workflows, all tailored to adhere to Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al. This enhances the signing experience while ensuring compliance with state regulations.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans to accommodate different business needs and sizes. Each plan incorporates the features necessary to comply with Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al while remaining cost-effective for every organization.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms. This enables businesses to enhance their workflows and remain compliant with Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al without needing to switch tools.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow allows for faster document turnaround times and higher efficiency due to its easy-to-use interface. Furthermore, it helps businesses adhere to Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al, ensuring documents are signed securely and legally.

-

Is airSlate SignNow suitable for all business sizes?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, providing scalable solutions. Whether a small startup or a large enterprise, compliance with Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al is streamlined for every user.

Get more for Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

Find out other Revenue Chapter 81061 Supp 123106 6 Alabamaadministrativecode State Al

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself