Form 8849 Rev January

What is the Form 8849 Rev January

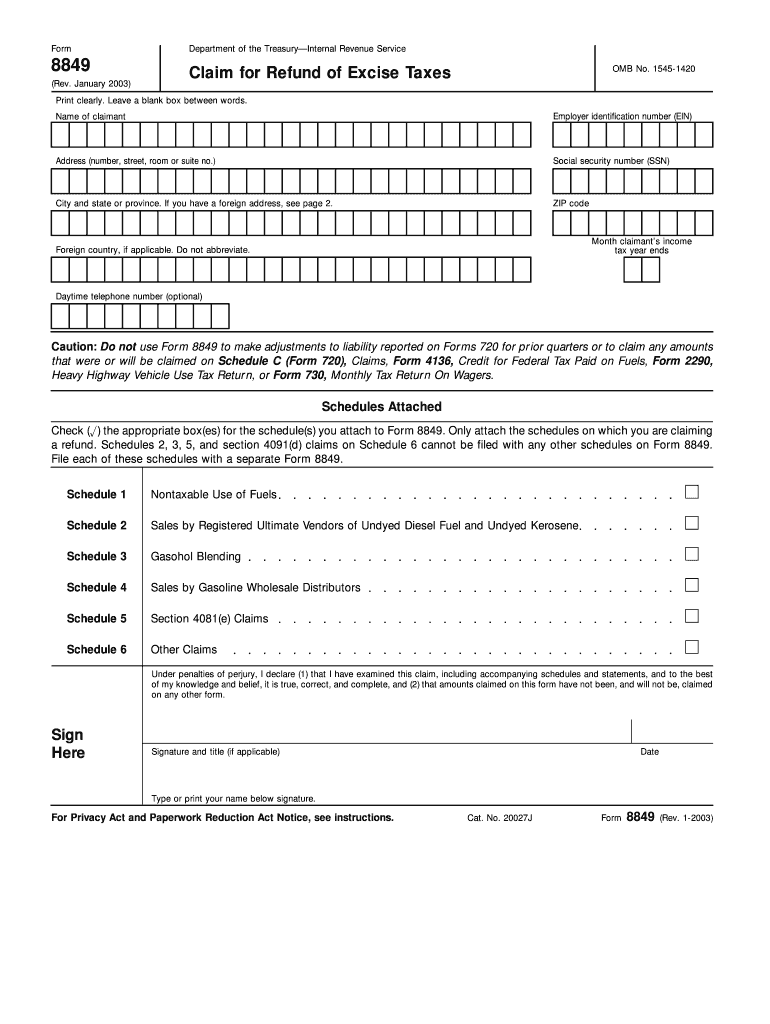

The Form 8849 Rev January is a tax form used by businesses and individuals in the United States to claim refunds for certain excise taxes. This form is specifically designed for filing claims related to fuel taxes, including those for gasoline, diesel, and kerosene. It allows taxpayers to report overpayments and seek reimbursement from the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for ensuring compliance with tax regulations and maximizing potential refunds.

How to use the Form 8849 Rev January

Using the Form 8849 Rev January involves several steps to ensure accurate completion and submission. Taxpayers must first gather all relevant documentation, including records of fuel purchases and any previous excise tax payments. After filling out the form with the required information, including details about the fuel types and amounts, the next step is to review the entries for accuracy. Once verified, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Form 8849 Rev January

Completing the Form 8849 Rev January requires careful attention to detail. Begin by entering your name, address, and taxpayer identification number at the top of the form. Next, specify the type of claim you are filing by selecting the appropriate box. Fill in the details of your fuel purchases, including the quantity and type of fuel, as well as the total excise tax paid. Ensure that all calculations are accurate, as errors can delay processing. Finally, sign and date the form before submitting it to the IRS.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 8849 Rev January. Generally, claims for refunds must be filed within three years from the date of the overpayment. This timeframe ensures that taxpayers do not miss out on potential refunds due to late submissions. Keeping track of these dates is essential for maintaining compliance and securing any eligible refunds.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8849 Rev January. These guidelines include instructions on which types of claims are eligible, how to calculate the refund amounts, and the required documentation to support the claim. It is important to refer to the IRS website or the form instructions directly to ensure that all requirements are met and that the form is completed correctly.

Key elements of the Form 8849 Rev January

The Form 8849 Rev January includes several key elements that taxpayers must be aware of. These elements consist of the identification section, where personal and business information is provided, and the claim section, which details the specific fuel types and amounts being claimed for refund. Additionally, taxpayers must include any supporting documentation, such as receipts or invoices, to substantiate their claims. Understanding these elements is vital for a successful filing process.

Examples of using the Form 8849 Rev January

There are various scenarios in which the Form 8849 Rev January can be utilized. For instance, a business that purchases fuel for its vehicles may find that it has overpaid excise taxes due to changes in fuel prices. By filing this form, the business can reclaim those excess payments. Similarly, individuals who use fuel for agricultural purposes may also be eligible for refunds by submitting the appropriate claims on this form. These examples illustrate the practical applications of the Form 8849 in seeking tax refunds.

Quick guide on how to complete form 8849 rev january

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without hindrances. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The simplest method to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8849 Rev January

Create this form in 5 minutes!

How to create an eSignature for the form 8849 rev january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8849 Rev January?

Form 8849 Rev January is an IRS tax form used to claim a refund of certain excise taxes. Businesses often need this form to submit claims for refunds on fuel taxes and other related expenses. Using airSlate SignNow, you can easily create, edit, and eSign your Form 8849 Rev January for efficient processing.

-

How can airSlate SignNow help with Form 8849 Rev January?

airSlate SignNow provides an intuitive platform for businesses to efficiently manage Form 8849 Rev January. You can fill out the necessary fields, make required edits, and securely sign the document all in one place. This simplifies the process and ensures compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for Form 8849 Rev January?

airSlate SignNow offers various pricing plans to suit different business needs, including options for teams and enterprises. Each plan provides access to essential features for managing documents like Form 8849 Rev January. Check our website for detailed pricing information and choose the plan that best fits your requirements.

-

What features does airSlate SignNow provide for handling Form 8849 Rev January?

AirSlate SignNow includes features such as easy document creation, eSignature capabilities, and secure cloud storage for Form 8849 Rev January. Additionally, you can automate workflows, track document statuses, and ensure compliance, which enhances efficiency for your business operations.

-

Can I integrate airSlate SignNow with other software for Form 8849 Rev January?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easier to work with Form 8849 Rev January. You can connect with popular tools like CRM systems, accounting software, and cloud storage solutions. This ensures that all your documents and data are organized and accessible.

-

How secure is airSlate SignNow when handling Form 8849 Rev January?

AirSlate SignNow employs top-notch security protocols to protect your data while managing Form 8849 Rev January. Features like encryption, secure access, and compliant eSignature processes help safeguard sensitive information. You can trust that your documents are handled securely on our platform.

-

What are the benefits of using airSlate SignNow for Form 8849 Rev January?

Using airSlate SignNow for Form 8849 Rev January streamlines your document handling process, saving you time and reducing errors. The easy-to-use interface allows for quick completion and eSigning of forms, while automation features help in tracking and managing document flows efficiently. It ultimately leads to enhanced productivity for your business.

Get more for Form 8849 Rev January

Find out other Form 8849 Rev January

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself