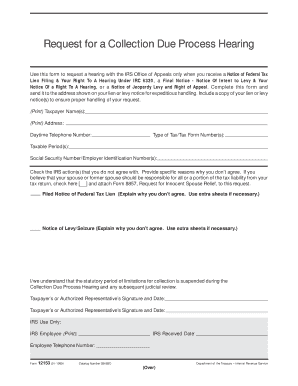

Form 12153 Rev January Request for a Collection Due Process Hearing

Understanding Form 12153: Request for a Collection Due Process Hearing

The Form 12153, officially known as the Request for a Collection Due Process Hearing, is a crucial document for taxpayers facing collection actions by the Internal Revenue Service (IRS). This form allows individuals to request a hearing to challenge the IRS's collection actions, such as levies or liens. It is essential for taxpayers to understand their rights and the implications of requesting this hearing, as it can significantly affect their financial situation and compliance with tax obligations.

Steps to Complete Form 12153

Completing Form 12153 requires careful attention to detail to ensure that all necessary information is accurately provided. Follow these steps:

- Gather Information: Collect all relevant documents, including notices from the IRS regarding the collection action.

- Fill Out Personal Information: Enter your name, address, and taxpayer identification number at the top of the form.

- Describe the Issue: Clearly explain why you are requesting a hearing. Include details about the IRS actions you wish to contest.

- Sign and Date: Ensure you sign and date the form to validate your request.

Review the completed form for accuracy before submission to avoid delays in processing.

Obtaining Form 12153

Form 12153 can be easily obtained through various channels. Taxpayers can download the form directly from the IRS website or request a physical copy by contacting the IRS. It is important to ensure you are using the most current version of the form, as updates may occur periodically. Always verify that you have the latest revision to avoid complications with your request.

Legal Use of Form 12153

The legal framework surrounding Form 12153 is rooted in taxpayer rights. This form is a formal request for a hearing under the Internal Revenue Code, specifically designed to protect taxpayers from unfair collection practices. Understanding the legal implications of submitting this form is essential, as it provides taxpayers with an opportunity to present their case before an impartial judge within the IRS. Proper use of this form can lead to favorable outcomes, such as the reversal of collection actions or negotiated payment plans.

Filing Deadlines for Form 12153

Timeliness is critical when submitting Form 12153. Taxpayers must file the form within thirty days of receiving a notice of intent to levy or a notice of federal tax lien. Failing to meet this deadline may result in the loss of the right to contest the IRS's actions. It is advisable to send the form as soon as possible to ensure compliance with the deadline and to protect your rights as a taxpayer.

Key Elements of Form 12153

Form 12153 includes several key elements that must be addressed for a successful submission. These elements include:

- Taxpayer Information: Accurate personal details such as name, address, and Social Security number.

- Reason for Request: A detailed explanation of the grounds for contesting the IRS action.

- Signature: The taxpayer's signature is required to validate the request.

Ensuring all these elements are correctly filled out is vital for the form's acceptance and processing by the IRS.

Quick guide on how to complete form 12153

Prepare form 12153 effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without complications. Manage form 12153 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The optimal way to modify and eSign form 12153 without hassle

- Locate form 12153 and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign form 12153 and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 12153

Create this form in 5 minutes!

How to create an eSignature for the form 12153

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 12153

-

What is form 12153 and how can airSlate SignNow help?

Form 12153 is a request for a collection due process hearing with the IRS. Using airSlate SignNow, you can easily prepare, sign, and send your form 12153 electronically, streamlining communication with the IRS and expediting your request process.

-

Is there a cost associated with using airSlate SignNow for form 12153?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that suits your requirements for handling form 12153 and other document management tasks, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for managing form 12153?

airSlate SignNow provides features such as template creation, electronic signatures, and document tracking, specifically for managing form 12153. These features help ease the process of preparing and submitting your form efficiently.

-

Can I integrate airSlate SignNow with other platforms for handling form 12153?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive and Salesforce. This enhances your capability to manage form 12153 alongside other essential business processes seamlessly.

-

How secure is the submission of form 12153 through airSlate SignNow?

Security is a top priority for airSlate SignNow. When you submit form 12153 using our platform, it is protected with bank-level encryption and secure data protocols to ensure your information remains confidential and safe.

-

Can multiple users collaborate on form 12153 using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on form 12153 through shared access to documents. This feature ensures that your team can work together efficiently and make necessary edits or approvals in real time.

-

What benefits does airSlate SignNow offer when filing form 12153?

Using airSlate SignNow to file form 12153 offers numerous benefits including reduced paperwork, faster processing times, and the convenience of e-signature capabilities. This makes handling tax-related documents less stressful and more efficient for businesses.

Get more for form 12153

- Forms for arkids

- Application for employment palm beach county form

- Knox county application form

- Where do i mail my application for reginal reduce fare permit for sound transit form

- Personal history form

- E quickpay form

- Printable geography word search form

- Review of the south amp central pacific regional tourism form

Find out other form 12153

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter