Form 12509 December Statement of Disagreement Purpose of Form You Can Use This Form to Explain Why You Disagree with the Interna

Understanding the Form 12509 December Statement of Disagreement

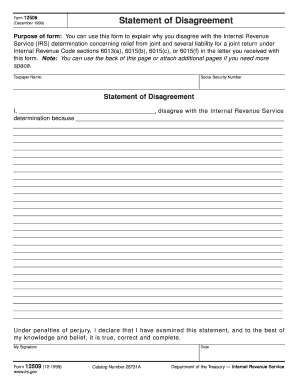

The Form 12509, known as the December Statement of Disagreement, is a crucial document for taxpayers who wish to contest a determination made by the Internal Revenue Service (IRS) regarding relief from joint and several liability. This form allows individuals to articulate their reasons for disagreeing with the IRS's findings, particularly in cases where they believe they should not be held responsible for tax liabilities incurred by a spouse or former spouse. It is specifically designed for situations where joint tax returns were filed, and one party seeks relief from the shared responsibility for tax debts.

How to Complete the Form 12509

Filling out the Form 12509 requires careful attention to detail. Taxpayers should begin by clearly stating their disagreement with the IRS determination. This involves providing specific reasons and any supporting documentation that substantiates their claim. It is important to include personal information such as name, address, and taxpayer identification number. Additionally, taxpayers should ensure that they sign and date the form before submission to validate their request.

Obtaining the Form 12509

The Form 12509 can be obtained directly from the IRS website or by contacting the IRS for a physical copy. It is advisable to ensure that you are using the most current version of the form to avoid any issues with your submission. Taxpayers can also visit local IRS offices to request the form in person if needed.

Key Elements of the Form 12509

Several key elements must be included in the Form 12509 to ensure it is processed correctly. These include:

- Taxpayer Information: Full name, address, and taxpayer identification number.

- IRS Determination Details: Reference to the specific IRS determination being contested.

- Reasons for Disagreement: A clear and concise explanation of why the taxpayer disagrees with the IRS's findings.

- Supporting Documentation: Any relevant documents that support the taxpayer's position.

- Signature and Date: The taxpayer's signature and the date of submission.

Filing Deadlines for the Form 12509

It is essential to be aware of the filing deadlines associated with the Form 12509. Taxpayers typically have a limited time frame to submit their disagreement after receiving the IRS determination. Generally, the form must be filed within thirty days of the date on the IRS notice. Missing this deadline can result in the inability to contest the IRS's decision, making timely submission critical.

Submission Methods for the Form 12509

The Form 12509 can be submitted to the IRS through various methods. Taxpayers have the option to mail the completed form to the address specified in the IRS notice. Alternatively, if applicable, some taxpayers may be able to submit the form electronically, depending on their specific situation and IRS guidelines. It is important to verify the submission method that applies to your case to ensure proper processing.

Quick guide on how to complete form 12509 december statement of disagreement purpose of form you can use this form to explain why you disagree with the

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device using the airSlate SignNow apps available for Android or iOS and simplify any document-related tasks today.

How to Alter and eSign [SKS] With Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to store your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 12509 December Statement Of Disagreement Purpose Of Form You Can Use This Form To Explain Why You Disagree With The Interna

Create this form in 5 minutes!

How to create an eSignature for the form 12509 december statement of disagreement purpose of form you can use this form to explain why you disagree with the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 12509 December Statement Of Disagreement?

The Form 12509 December Statement Of Disagreement is designed for individuals to explain their disagreement with the IRS's determination concerning relief from joint and several liabilities. You can use this form to articulate your concerns and provide the necessary justification to the IRS, ensuring that your voice is heard in the matter.

-

Who should use the Form 12509?

The Form 12509 is intended for taxpayers who do not agree with the IRS's decision regarding their liability for taxes owed jointly with another individual. By using the Form 12509 December Statement Of Disagreement, you can explain your specific reasons for disputing the IRS determination and seek relief accordingly.

-

How much does it cost to file the Form 12509?

Filing the Form 12509 December Statement Of Disagreement itself does not have a specific fee, but it's essential to check for any applicable IRS fees or costs related to legal assistance if needed. Utilizing airSlate SignNow may incur standard eSignature costs, simplifying your filing process efficiently and affordably.

-

What features does airSlate SignNow offer for filing the Form 12509?

airSlate SignNow provides a user-friendly platform allowing you to fill out, sign, and send the Form 12509 December Statement Of Disagreement with ease. Key features include automated reminders, advanced security measures, and cloud storage, so you can manage your document efficiently without any hassle.

-

How can airSlate SignNow help with the IRS process?

Using airSlate SignNow to prepare and submit the Form 12509 December Statement Of Disagreement can streamline your communication with the IRS. With electronic signatures and document tracking, you can ensure that your disagreement is submitted properly and is traceable, enhancing the overall efficiency of your request.

-

Is there any technical support for airSlate SignNow users filing the Form 12509?

Yes, airSlate SignNow offers excellent customer support for users filing the Form 12509 December Statement Of Disagreement. Whether you need help navigating the platform or have questions about the form itself, the support team is readily available to assist you promptly.

-

Can I integrate airSlate SignNow with other applications for my tax process?

Absolutely! airSlate SignNow offers robust integrations with various applications, allowing you to seamlessly incorporate the Form 12509 December Statement Of Disagreement into your existing workflow. This capability ensures that all your documents and data remain connected and easily accessible during the filing process.

Get more for Form 12509 December Statement Of Disagreement Purpose Of Form You Can Use This Form To Explain Why You Disagree With The Interna

- Certification renewal form

- Vermont eee iep form with examples education vermont

- Kisumu county bursary form kisumu county bursary form a3c bestbooks

- Vsf z 08 03 abs 1 form

- Eviction notice oregon form

- Cms signature log template 421242136 form

- Quartz prior authorization list form

- 16 rental form for scuba diving equipment divers training

Find out other Form 12509 December Statement Of Disagreement Purpose Of Form You Can Use This Form To Explain Why You Disagree With The Interna

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template