Form 990 Schedule a Fill in Version

What is the Form 990 Schedule A Fill In Version

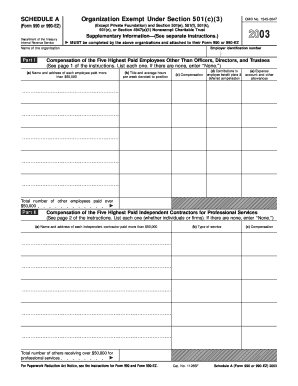

The Form 990 Schedule A Fill In Version is a supplemental form used by tax-exempt organizations to provide information about their public charity status and to report their public support. This form is essential for organizations that seek to demonstrate their compliance with IRS regulations regarding public charities. It helps the IRS determine whether an organization meets the criteria for public charity status, which can affect its tax-exempt status and eligibility for certain funding opportunities.

How to use the Form 990 Schedule A Fill In Version

Using the Form 990 Schedule A Fill In Version involves several steps. First, organizations must gather relevant financial information, including revenue sources and contributions. Next, they need to accurately complete each section of the form, ensuring that all information is consistent with their financial records. After filling out the form, organizations should review it for accuracy before submission. This form is typically filed alongside the main Form 990, and it is essential to follow IRS guidelines to avoid any compliance issues.

Steps to complete the Form 990 Schedule A Fill In Version

Completing the Form 990 Schedule A Fill In Version requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and donation records.

- Identify the appropriate sections of Schedule A that apply to your organization.

- Fill in the form with accurate data regarding public support and revenue sources.

- Double-check all entries for accuracy and consistency with your financial records.

- Submit the completed Schedule A along with your Form 990 by the due date.

Legal use of the Form 990 Schedule A Fill In Version

The Form 990 Schedule A Fill In Version is legally required for certain tax-exempt organizations to maintain their status. Organizations must ensure that they comply with IRS regulations when completing and submitting this form. Failure to provide accurate information can result in penalties, including the potential loss of tax-exempt status. It is crucial for organizations to understand the legal implications of the information reported on this form.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 Schedule A Fill In Version. These guidelines outline the information required in each section, the definitions of public support, and the criteria for public charity status. Organizations should refer to the IRS instructions for Schedule A to ensure they meet all requirements. Adhering to these guidelines helps organizations maintain compliance and avoid issues during audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Schedule A Fill In Version align with the main Form 990 submission dates. Generally, organizations must file their forms by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. It is important to stay informed about any changes to deadlines, as late submissions can result in penalties.

Quick guide on how to complete form 990 schedule a fill in version

Complete [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] while ensuring excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Schedule A Fill In Version

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule a fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 Schedule A Fill In Version?

The Form 990 Schedule A Fill In Version is a component of the IRS Form 990, used by tax-exempt organizations to provide detailed information about their public charity status. This fillable version allows organizations to complete and submit the form electronically, ensuring accuracy and compliance. Utilizing the Form 990 Schedule A Fill In Version can streamline the reporting process and help organizations maintain their tax-exempt status.

-

How can airSlate SignNow assist with the Form 990 Schedule A Fill In Version?

airSlate SignNow provides an easy-to-use platform that allows businesses to fill out, sign, and send the Form 990 Schedule A Fill In Version electronically. With our solution, you can save time and reduce errors in your filings. The platform's features ensure that you can effortlessly manage your documents, making compliance a breeze.

-

What features does airSlate SignNow offer for the Form 990 Schedule A Fill In Version?

The airSlate SignNow platform includes features such as customizable templates, eSignature capabilities, and automated workflows for the Form 990 Schedule A Fill In Version. These features streamline the document preparation and submission process, helping organizations maintain efficiency while completing their IRS obligations. Additionally, real-time tracking allows users to monitor the status of their submissions.

-

Is airSlate SignNow cost-effective for organizations using the Form 990 Schedule A Fill In Version?

Yes, airSlate SignNow offers a cost-effective solution for organizations needing to complete the Form 990 Schedule A Fill In Version. With flexible pricing plans, you can choose the option that best meets your needs without sacrificing quality or functionality. This affordability makes it ideal for small to medium-sized non-profits looking to manage their documentation efficiently.

-

Can I integrate airSlate SignNow with other software for managing the Form 990 Schedule A Fill In Version?

Absolutely! airSlate SignNow seamlessly integrates with various software platforms, allowing you to streamline your workflow when managing the Form 990 Schedule A Fill In Version. By connecting with accounting systems and project management tools, you can enhance your productivity and keep all your related documents organized in one place.

-

What are the benefits of using the Form 990 Schedule A Fill In Version with airSlate SignNow?

Using the Form 990 Schedule A Fill In Version with airSlate SignNow offers numerous benefits, including increased accuracy, improved efficiency, and enhanced document security. The fillable version reduces the risk of errors, while our user-friendly interface simplifies the entire process. Additionally, eSignatures provide an extra layer of authentication for your documentation.

-

Is training provided for using airSlate SignNow with the Form 990 Schedule A Fill In Version?

Yes, airSlate SignNow offers training and resources to help users effectively utilize the Form 990 Schedule A Fill In Version. Our user guides, tutorials, and customer support ensure that you have the tools needed to navigate the platform confidently. Whether you are a new or experienced user, assistance is always available to enhance your experience.

Get more for Form 990 Schedule A Fill In Version

Find out other Form 990 Schedule A Fill In Version

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast