Form 1041 N Rev February Fill in Version U S Income Tax Return for Electing Alaska Native Settlement Trusts

What is the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

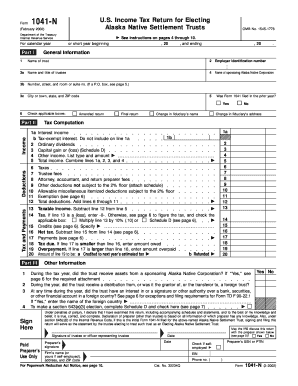

The Form 1041 N Rev February is a specific tax return designed for electing Alaska Native Settlement Trusts. This form allows these trusts to report their income, deductions, and other relevant tax information to the Internal Revenue Service (IRS). It is essential for ensuring compliance with U.S. tax laws while providing a means for these trusts to manage their financial responsibilities effectively. The form is tailored to meet the unique needs of Alaska Native Settlement Trusts, reflecting their distinct legal and tax status.

How to use the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

Using the Form 1041 N Rev February involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records related to the trust. Next, fill out the form by entering the required information in the designated fields, such as trust income, deductions, and credits. It is crucial to review the form for accuracy before submission. Once completed, the form can be filed electronically or mailed to the appropriate IRS address, depending on the trust's preferences and requirements.

Steps to complete the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

Completing the Form 1041 N Rev February involves a systematic approach:

- Gather all necessary financial documents, including income and expense records.

- Begin filling out the form, starting with the trust's identifying information.

- Report all sources of income, including dividends, interest, and capital gains.

- Detail any deductions the trust is eligible for, such as administrative expenses.

- Calculate the total taxable income and any applicable tax credits.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail to the IRS.

Key elements of the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

The Form 1041 N Rev February contains several key elements that are critical for accurate reporting:

- Trust Identification: This section requires the name, address, and taxpayer identification number of the trust.

- Income Reporting: All income sources must be documented, including dividends and rental income.

- Deductions: Eligible deductions, such as administrative costs, must be clearly outlined.

- Tax Calculation: The form includes sections for calculating the trust's tax liability based on reported income.

- Signature: A designated trustee must sign the form, certifying the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 N Rev February are crucial to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the deadline is April 15. If additional time is needed, a six-month extension can be requested, but it is important to note that this does not extend the time to pay any taxes owed.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1041 N Rev February. These guidelines include instructions on eligibility, required documentation, and filing methods. Trusts must adhere to these guidelines to ensure compliance with federal tax laws. Detailed instructions are often included with the form itself, and it is advisable to consult these resources during the completion process to avoid common mistakes.

Quick guide on how to complete form 1041 n rev february fill in version u s income tax return for electing alaska native settlement trusts

Complete [SKS] effortlessly on any device

Online document management has gained immense traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and select Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet-ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev february fill in version u s income tax return for electing alaska native settlement trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

The Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts is a tax return specifically designed for Alaska Native Settlement Trusts. It helps trustees report income, deductions, and other tax-related information in compliance with U.S. tax laws. This form is crucial for ensuring that the trust fulfills its tax obligations effectively.

-

How can airSlate SignNow help with filling out Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow simplifies the process of completing the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts by providing customizable templates. Users can easily fill in the required fields, eSign documents, and store them securely. This enhances accuracy and ensures compliance with tax requirements.

-

Is there a cost associated with using airSlate SignNow for Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when using it for the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts. These plans are cost-effective and designed to provide excellent value, making it easier for users to manage their tax documentation efficiently.

-

What features does airSlate SignNow provide for managing Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow offers a range of features such as document editing, eSignature capabilities, workflow automation, and secure cloud storage. These features ensure that users can manage the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts easily and securely. Additionally, the platform allows for collaboration among team members, streamlining the filing process.

-

What are the benefits of using airSlate SignNow for Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Using airSlate SignNow for the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts provides several benefits, such as improved efficiency, reduced paperwork, and enhanced compliance. By digitizing the process, users can save time and avoid potential errors when filing their tax returns. Secure eSigning further adds to the process's reliability.

-

Can I integrate airSlate SignNow with other applications for handling Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, making it convenient for users managing the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts. Users can connect with CRM systems, cloud storage platforms, and more to enhance their workflow. This integration capability streamlines the overall documentation process.

-

Is airSlate SignNow user-friendly for completing Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those who may not be tech-savvy. It provides intuitive interfaces and step-by-step guidance to assist users in completing the Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts without complications, ensuring accessibility for everyone.

Get more for Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

- 208 add math module 08 indices and logarithms form

- Personal self assessment of anti bias behavior form

- Navres 1570 2 form

- Example of completed pip 2 form

- Oppenheimer funds withdrawal form

- City of fort worth temporary power letter form

- A 0520 bf in english form

- Disposal or change of address for watercraft sc department of dnr sc form

Find out other Form 1041 N Rev February Fill in Version U S Income Tax Return For Electing Alaska Native Settlement Trusts

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now